Satoshitalks

No content yet

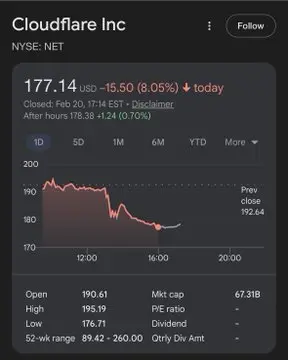

🚨 One tweet. Billions erased.

After Anthropic announcement, cybersecurity names sold off within minutes:

$CRWD

$NET

$PANW

$ZS

AI disruption is hitting faster than expected.

After Anthropic announcement, cybersecurity names sold off within minutes:

$CRWD

$NET

$PANW

$ZS

AI disruption is hitting faster than expected.

- Reward

- 1

- Comment

- Repost

- Share

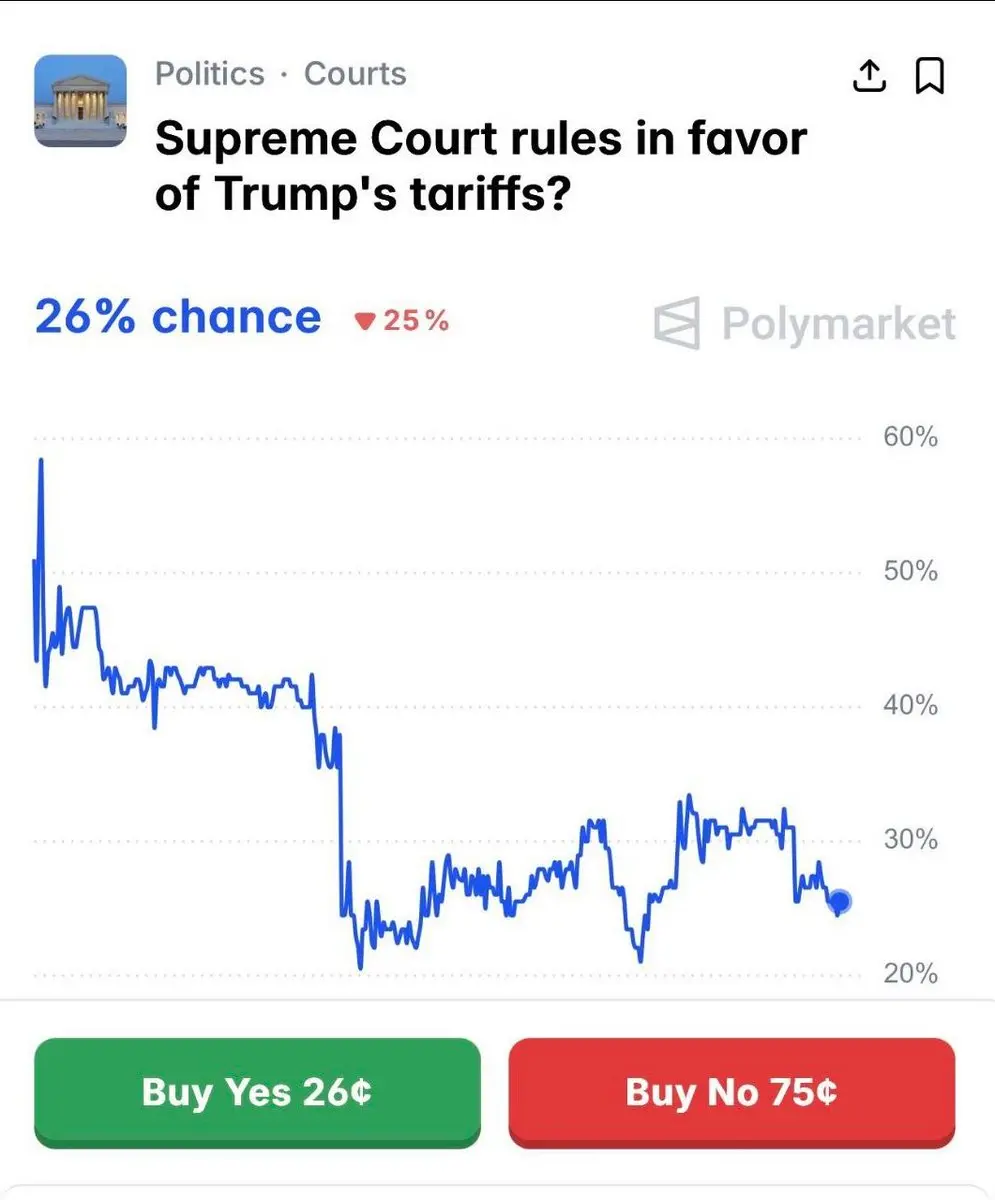

🚨 JUST IN: Polymarket traders now price a 40% chance the Supreme Court forces Trump to refund $175B in tariff revenue.

What’s at stake:

Massive fiscal reversal

Trade policy reset

Market volatility risk

Prediction markets are watching closely.

What’s at stake:

Massive fiscal reversal

Trade policy reset

Market volatility risk

Prediction markets are watching closely.

- Reward

- 2

- Comment

- Repost

- Share

🚨 UPDATE: The U.S. has reportedly launched its largest force deployment to the Middle East since 2003.

What this could mean:

Heightened regional tensions

Oil & gold volatility risk

Risk-off pressure across markets

Markets will be watching closely.

What this could mean:

Heightened regional tensions

Oil & gold volatility risk

Risk-off pressure across markets

Markets will be watching closely.

- Reward

- 1

- Comment

- Repost

- Share

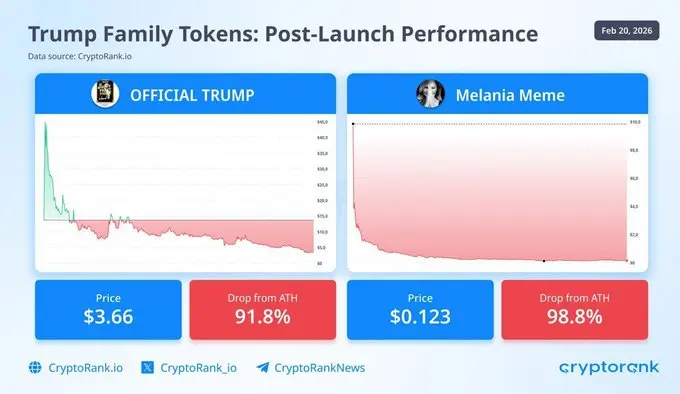

These memecoins are being publicly shared and promoted by members of the U.S. presidential family:

Politics meets crypto — and markets are paying attention.

Politics meets crypto — and markets are paying attention.

- Reward

- 1

- Comment

- Repost

- Share

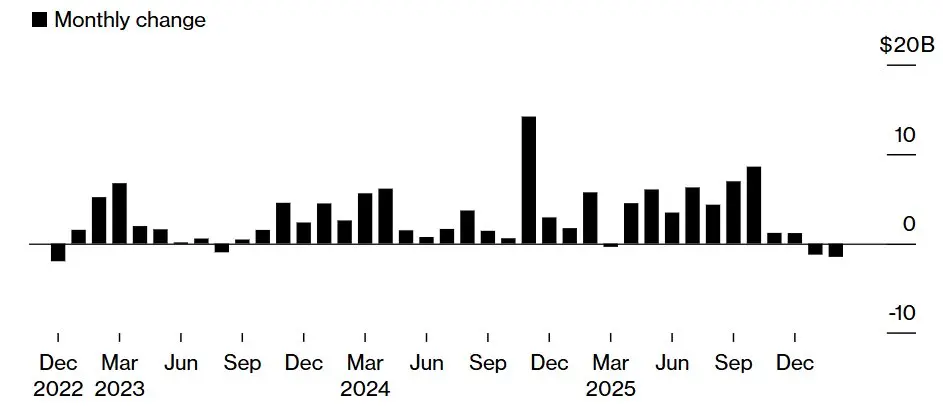

Tether’s USDT supply is on track for its sharpest monthly decline in 3 years.

$USDT supply is shrinking fast.

−$1.5B in February (so far)

−$1.2B in January

Sharpest monthly contraction in 3 years

Liquidity is tightening — and that matters for risk assets.

$USDT supply is shrinking fast.

−$1.5B in February (so far)

−$1.2B in January

Sharpest monthly contraction in 3 years

Liquidity is tightening — and that matters for risk assets.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

ImprovedTweet

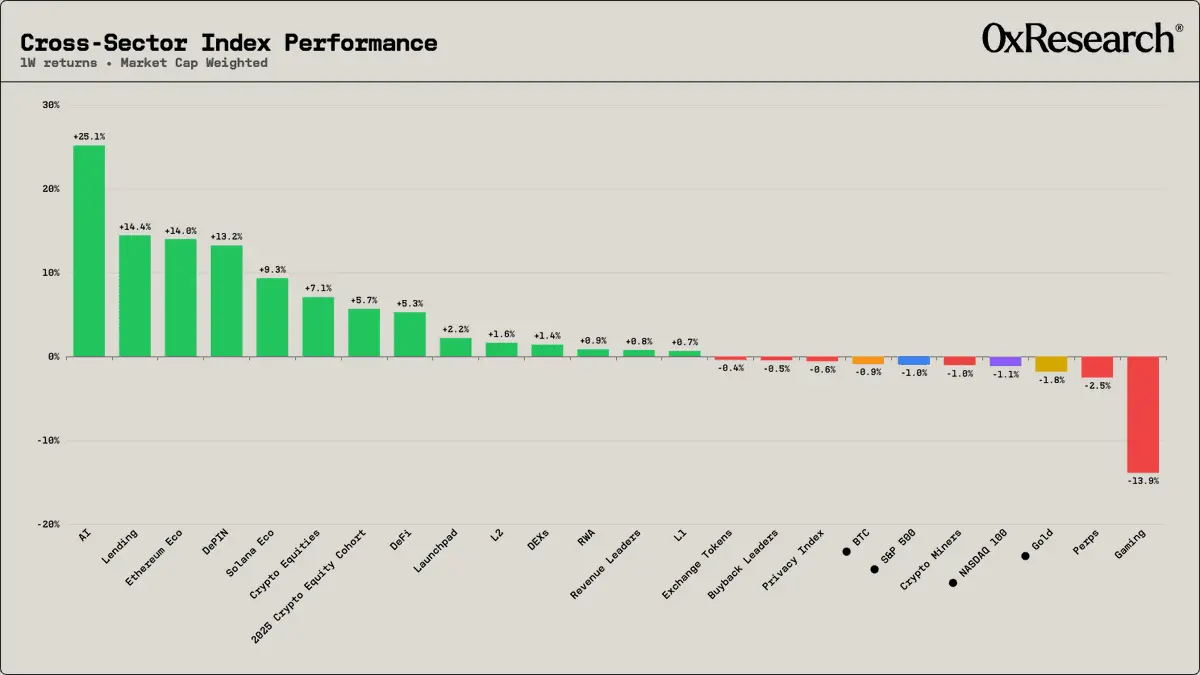

📊 1W Sector Performance Snapshot:

Leaders:

1. AI +25.1%

2. Lending +14.4%

3. Ethereum Eco +14.0%

4. DePIN +13.2%

Laggards:

• Gaming −13.9%

• Perps −2.5%

• Gold −1.8%

Rotation is underway.

📊 1W Sector Performance Snapshot:

Leaders:

1. AI +25.1%

2. Lending +14.4%

3. Ethereum Eco +14.0%

4. DePIN +13.2%

Laggards:

• Gaming −13.9%

• Perps −2.5%

• Gold −1.8%

Rotation is underway.

ETH0,61%

- Reward

- like

- Comment

- Repost

- Share

🚨 JUST IN: Odds of the Supreme Court backing Trump tariffs drop to 26%.

What this signals:

Legal headwinds building

Trade policy uncertainty rising

Markets may need to reprice expectations

Policy risk just shifted.

What this signals:

Legal headwinds building

Trade policy uncertainty rising

Markets may need to reprice expectations

Policy risk just shifted.

- Reward

- 2

- Comment

- Repost

- Share

Dario left OpenAI for a reason.

This photo proves he still hasn't forgotten it.

This photo proves he still hasn't forgotten it.

- Reward

- 2

- Comment

- Repost

- Share

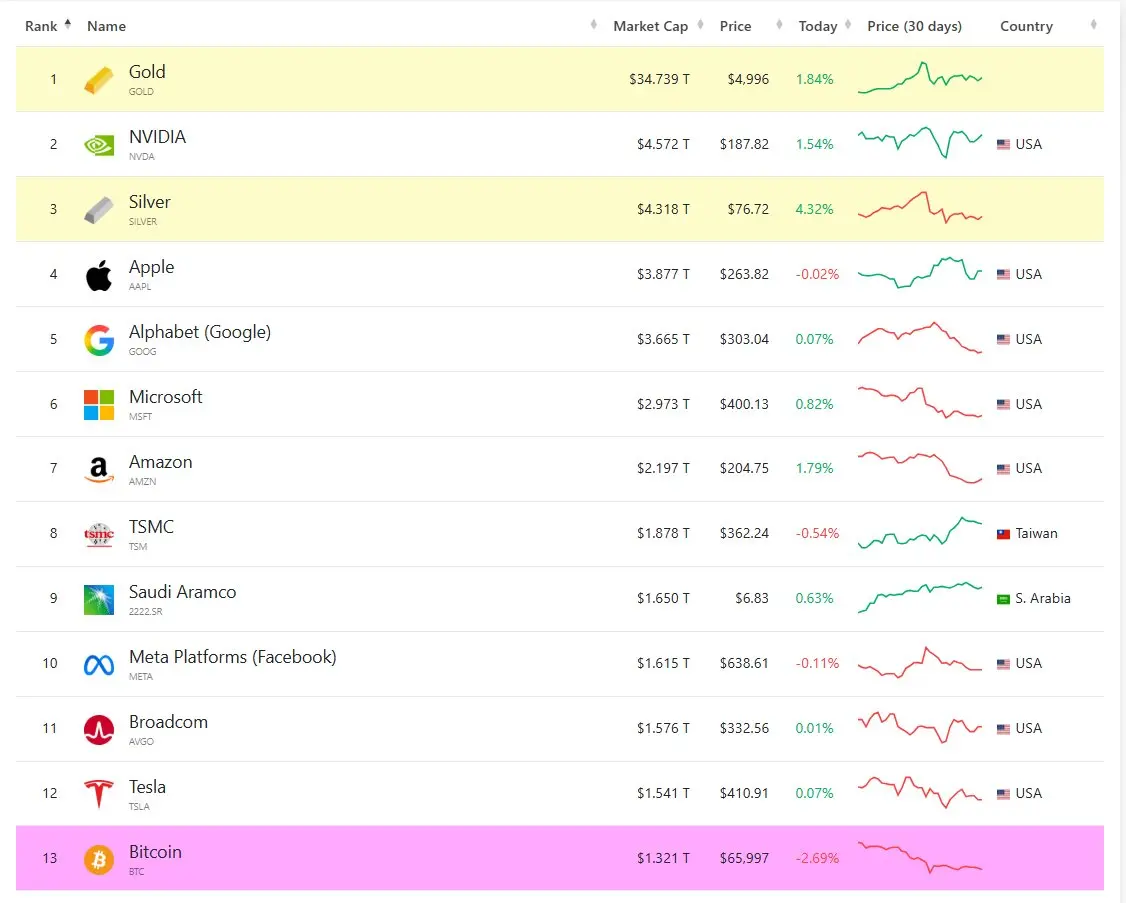

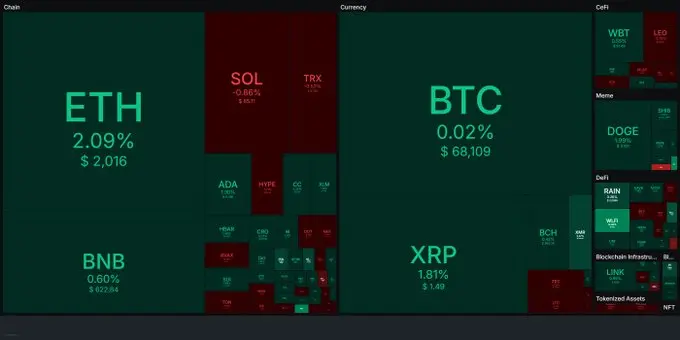

Happy Thursday.

Crypto is red across the board 🔴

BTC slipping.

Alts bleeding.

Sentiment cooling.

Dip… or deeper move loading? 👇

👇

Crypto is red across the board 🔴

BTC slipping.

Alts bleeding.

Sentiment cooling.

Dip… or deeper move loading? 👇

👇

BTC0,15%

- Reward

- 1

- Comment

- Repost

- Share

🚨 Tesla’s robotaxi update:

• 5 new crashes in Dec–Jan

• 14 total since the Austin launch

• ~800,000 paid miles logged

That’s ~1 crash every 57,000 miles — reportedly ~4x more frequent than human drivers, per Electr.

Are robotaxis actually safer than humans yet?

• 5 new crashes in Dec–Jan

• 14 total since the Austin launch

• ~800,000 paid miles logged

That’s ~1 crash every 57,000 miles — reportedly ~4x more frequent than human drivers, per Electr.

Are robotaxis actually safer than humans yet?

- Reward

- 3

- Comment

- Repost

- Share

🚨 Goldman Sachs CEO says he holds “a very small amount” of Bitcoin and is closely watching its development.

Context:

• Net worth estimated at $130M+

• Personal BTC exposure: minimal

Even TradFi leaders are paying attention.

Small allocation… or first step?

Context:

• Net worth estimated at $130M+

• Personal BTC exposure: minimal

Even TradFi leaders are paying attention.

Small allocation… or first step?

BTC0,15%

- Reward

- 1

- Comment

- Repost

- Share

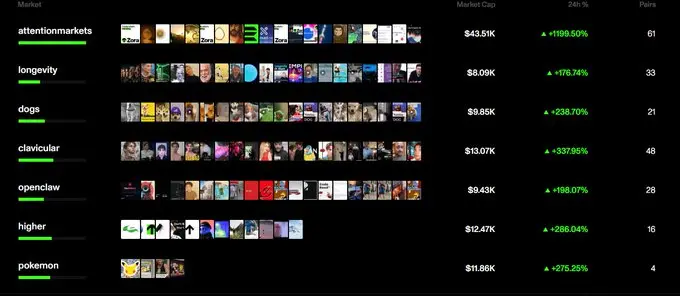

I tried Zora. Here’s my honest take.

Zora has raised ~$70M.

Yet its value has dropped ~34% in the past 3 months and now sits near $90M.

This week they launched “Attention Markets” on Solana — a way to trade what’s trending on social media.

In theory: interesting.

In reality: barely any traction.

The largest market has only ~$43K in liquidity.

Everything else is even smaller.

It doesn’t feel like Polymarket (news-driven).

It feels more like hype trading.

Could it work? Maybe — but only if they shift focus away from pure speculation.

Right now? I’m skeptical.

What am I missing?

Zora has raised ~$70M.

Yet its value has dropped ~34% in the past 3 months and now sits near $90M.

This week they launched “Attention Markets” on Solana — a way to trade what’s trending on social media.

In theory: interesting.

In reality: barely any traction.

The largest market has only ~$43K in liquidity.

Everything else is even smaller.

It doesn’t feel like Polymarket (news-driven).

It feels more like hype trading.

Could it work? Maybe — but only if they shift focus away from pure speculation.

Right now? I’m skeptical.

What am I missing?

ZORA-0,19%

- Reward

- 1

- Comment

- Repost

- Share

📊 Crypto Market Update:

• BTC: $67.9K–$68.9K

→ Rejected again at $70K

→ ~28% down in February

• ETH: $2,015–$2,030

→ +1.5% today

→ Still far from 2025 highs

• XRP: ~$1.41 (+~1%)

• BNB: ~$627 (+~1–2%)

Selective strength in alts while majors struggle.

Is this consolidation… or distribution?

• BTC: $67.9K–$68.9K

→ Rejected again at $70K

→ ~28% down in February

• ETH: $2,015–$2,030

→ +1.5% today

→ Still far from 2025 highs

• XRP: ~$1.41 (+~1%)

• BNB: ~$627 (+~1–2%)

Selective strength in alts while majors struggle.

Is this consolidation… or distribution?

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

thnxx for sharing information about crypto