# CryptoMarkets

6.67K

Korean_Girl

#TopCoinsRisingAgainsttheTrend Even as broader crypto markets face pullbacks, tightening liquidity, and rising uncertainty, a select group of top coins continues to display strength and upward momentum. This divergence is a powerful signal of a maturing ecosystem — one where assets no longer move in perfect correlation and where capital is becoming more selective.

From a technical standpoint, these leading tokens are holding key support zones and forming higher lows despite overall weakness. Volume patterns, moving average alignment, and relative strength metrics indicate sustained accumulatio

From a technical standpoint, these leading tokens are holding key support zones and forming higher lows despite overall weakness. Volume patterns, moving average alignment, and relative strength metrics indicate sustained accumulatio

- Reward

- 2

- 1

- Repost

- Share

HeavenSlayerSupporter :

:

Hold on tight, we're about to take off 🛫#WhenWillBTCRebound? | Patience Before the Next Move

Bitcoin is once again testing investor conviction as price action remains volatile and range-bound. After a powerful rally earlier in the cycle, BTC has entered a consolidation phase that feels uncomfortable—but historically, these periods often lay the groundwork for the strongest rebounds. The key question now is not if Bitcoin will rebound, but what conditions will trigger it.

From a macro perspective, liquidity remains the primary driver. Bitcoin continues to respond closely to interest rate expectations, dollar strength, and broader fin

Bitcoin is once again testing investor conviction as price action remains volatile and range-bound. After a powerful rally earlier in the cycle, BTC has entered a consolidation phase that feels uncomfortable—but historically, these periods often lay the groundwork for the strongest rebounds. The key question now is not if Bitcoin will rebound, but what conditions will trigger it.

From a macro perspective, liquidity remains the primary driver. Bitcoin continues to respond closely to interest rate expectations, dollar strength, and broader fin

BTC3,22%

- Reward

- like

- Comment

- Repost

- Share

#WhenWillBTCRebound? | Patience Before the Next Move

Bitcoin is once again testing investor conviction as price action remains volatile and range-bound. After a powerful rally earlier in the cycle, BTC has entered a consolidation phase that feels uncomfortable—but historically, these periods often lay the groundwork for the strongest rebounds. The key question now is not if Bitcoin will rebound, but what conditions will trigger it.

From a macro perspective, liquidity remains the primary driver. Bitcoin continues to respond closely to interest rate expectations, dollar strength, and broader fin

Bitcoin is once again testing investor conviction as price action remains volatile and range-bound. After a powerful rally earlier in the cycle, BTC has entered a consolidation phase that feels uncomfortable—but historically, these periods often lay the groundwork for the strongest rebounds. The key question now is not if Bitcoin will rebound, but what conditions will trigger it.

From a macro perspective, liquidity remains the primary driver. Bitcoin continues to respond closely to interest rate expectations, dollar strength, and broader fin

BTC3,22%

- Reward

- 5

- 14

- Repost

- Share

NovaCryptoGirl :

:

Ape In 🚀View More

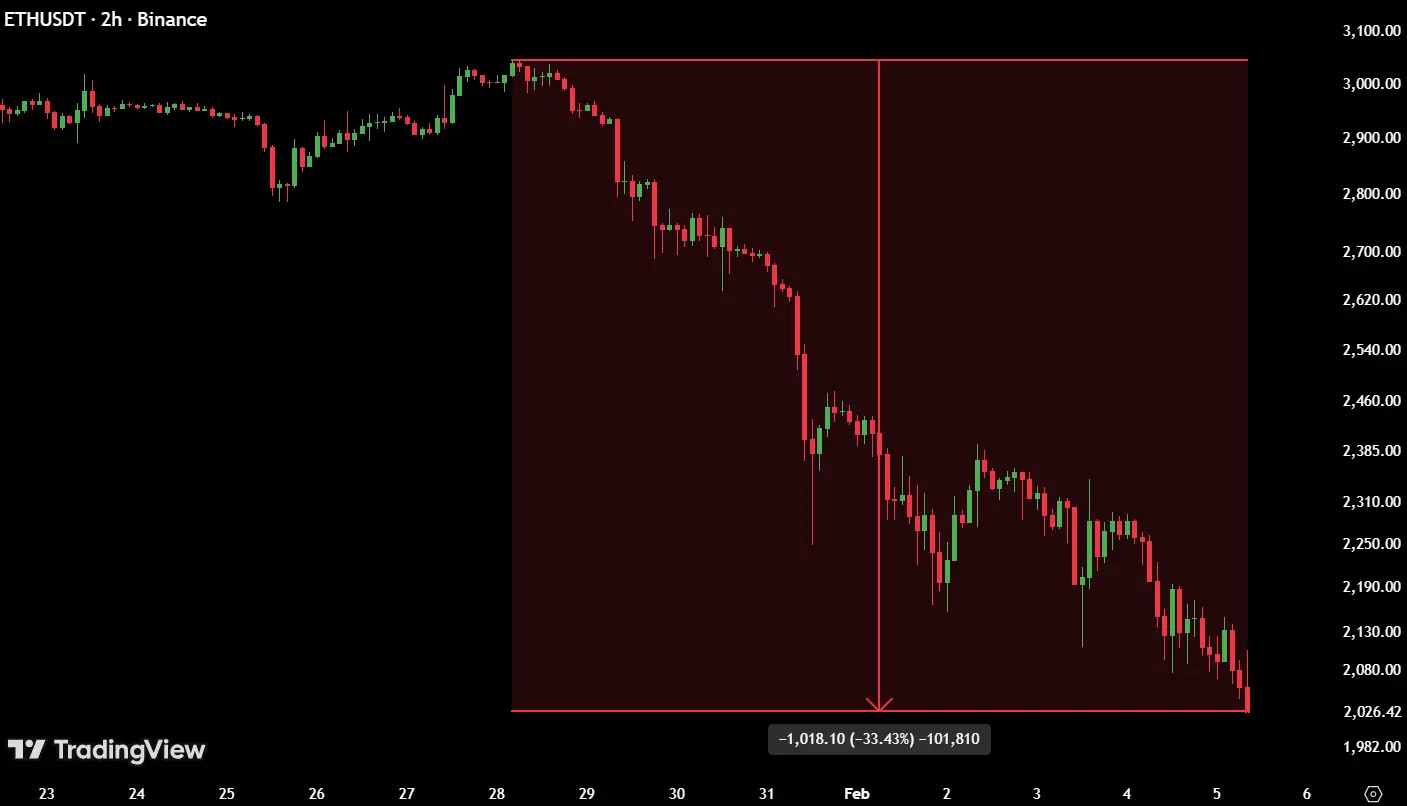

$ETH is down ~$1,000 in just 8 days.

At this pace, ETH hits zero in 16 days…

according to panic math, not reality.

Volatility shakes weak hands.

Markets reward patience.

#ETH #CryptoMarkets #Volatility #TradingPsychology

At this pace, ETH hits zero in 16 days…

according to panic math, not reality.

Volatility shakes weak hands.

Markets reward patience.

#ETH #CryptoMarkets #Volatility #TradingPsychology

ETH2,42%

- Reward

- like

- Comment

- Repost

- Share

#InstitutionalHoldingsDebate #InstitutionalHoldingsDebate 🏦📊

Institutions aren’t just holding crypto — they’re shaping market psychology.

Key questions right now:

• Are big players stabilizing or destabilizing markets?

• Does their accumulation signal confidence or risk?

• How much influence do traditional funds have compared to retail traders?

📉 Short-term swings can fool sentiment

📈 Long-term trends are built by smart money

Your take:

▫️ Bullish — institutions = market backbone

▫️ Cautious — retail still moves emotion

▫️ Watching — waiting for clearer signals

Let’s discuss 👇

#CryptoMark

Institutions aren’t just holding crypto — they’re shaping market psychology.

Key questions right now:

• Are big players stabilizing or destabilizing markets?

• Does their accumulation signal confidence or risk?

• How much influence do traditional funds have compared to retail traders?

📉 Short-term swings can fool sentiment

📈 Long-term trends are built by smart money

Your take:

▫️ Bullish — institutions = market backbone

▫️ Cautious — retail still moves emotion

▫️ Watching — waiting for clearer signals

Let’s discuss 👇

#CryptoMark

- Reward

- 2

- 2

- Repost

- Share

BeautifulDay :

:

Happy New Year! 🤑View More

#SEConTokenizedSecurities 💥 Bitcoin vs Gold Ratio Alert

Bitcoin’s BTC/Gold ratio has dropped about 559% from its peak and just slipped below the 200-week moving average — a level many traders watch closely.

📈 What it means:

Potential dip-buying opportunity for BTC

Historically, dips near the 200-week MA have offered high risk-reward

Core BTC exposure + gradual stacking is key — not all-in

⚡ Your move: Are you buying the dip or waiting for confirmation?

#Bitcoin #BTC #CryptoMarkets #DipBuying

Bitcoin’s BTC/Gold ratio has dropped about 559% from its peak and just slipped below the 200-week moving average — a level many traders watch closely.

📈 What it means:

Potential dip-buying opportunity for BTC

Historically, dips near the 200-week MA have offered high risk-reward

Core BTC exposure + gradual stacking is key — not all-in

⚡ Your move: Are you buying the dip or waiting for confirmation?

#Bitcoin #BTC #CryptoMarkets #DipBuying

BTC3,22%

MC:$3.18KHolders:8

0.00%

- Reward

- 2

- Comment

- Repost

- Share

#TrumpWithdrawsEUTariffThreats Global markets reacted sharply to renewed tariff threats and rising geopolitical tension from the United States, triggering volatility across both traditional and digital assets. Bitcoin fell from above 95,000 toward the 86,000–90,000 range, while gold surged beyond 5,000 to new record highs. This divergence reflects a classic risk-off rotation, with capital moving away from high-beta assets and into defensive stores of value. Macro policy headlines once again proved capable of overpowering short-term fundamentals in crypto markets.

Bitcoin’s decline aligned clos

Bitcoin’s decline aligned clos

BTC3,22%

- Reward

- 4

- 1

- Repost

- Share

Yajing :

:

2026 GOGOGO 👊#TrumpWithdrawsEUTariffThreats Bitcoin Slides, Gold Soars Amid Macro Tensions

Global markets have reacted sharply to renewed tariff threats and geopolitical tensions emanating from the U.S., sending shockwaves through both traditional and digital assets. Bitcoin (BTC) dropped from above $95,000 to lows near $86,000–$90,000, while gold surged past $5,000, hitting record highs. This divergence highlights a classic risk-off rotation: investors are moving capital from high-beta assets into defensive stores of value. The move underscores how macro policy headlines can temporarily overshadow fundame

Global markets have reacted sharply to renewed tariff threats and geopolitical tensions emanating from the U.S., sending shockwaves through both traditional and digital assets. Bitcoin (BTC) dropped from above $95,000 to lows near $86,000–$90,000, while gold surged past $5,000, hitting record highs. This divergence highlights a classic risk-off rotation: investors are moving capital from high-beta assets into defensive stores of value. The move underscores how macro policy headlines can temporarily overshadow fundame

BTC3,22%

- Reward

- 15

- 13

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

🚀📈 #DUSKJumps53.6% | Market Movers Spotlight

DUSK recorded a sharp 53.6% surge, capturing strong attention from traders as momentum and volume accelerated across the market. Such moves highlight renewed interest in select altcoins amid shifting market conditions. 👀💥

🔍 What Traders Are Watching:

⚡ Increased trading activity and liquidity

📊 Momentum-driven price action

🧠 Short-term opportunities alongside volatility management

💡 Stay alert during high-momentum moves and use Gate.io’s advanced charts, indicators, and real-time data to make informed trading decisions.

📌 Volatility creates

DUSK recorded a sharp 53.6% surge, capturing strong attention from traders as momentum and volume accelerated across the market. Such moves highlight renewed interest in select altcoins amid shifting market conditions. 👀💥

🔍 What Traders Are Watching:

⚡ Increased trading activity and liquidity

📊 Momentum-driven price action

🧠 Short-term opportunities alongside volatility management

💡 Stay alert during high-momentum moves and use Gate.io’s advanced charts, indicators, and real-time data to make informed trading decisions.

📌 Volatility creates

- Reward

- 1

- Comment

- Repost

- Share

#WeekendMarketAnalysis 📊 Market Prediction | When One Sentence Moves Global Markets

A single remark from Trump was enough to shift market expectations — and suddenly, Kevin Warsh is being priced in as the frontrunner for the next Fed Chair.

This isn’t about politics alone. It’s about how markets trade probability, not announcements.

Warsh is widely seen as more disciplined on monetary policy, less tolerant of prolonged easing, and more focused on financial stability. That changes everything — from bond yields and the US dollar to equities and crypto.

For crypto traders, this matters deeply. H

A single remark from Trump was enough to shift market expectations — and suddenly, Kevin Warsh is being priced in as the frontrunner for the next Fed Chair.

This isn’t about politics alone. It’s about how markets trade probability, not announcements.

Warsh is widely seen as more disciplined on monetary policy, less tolerant of prolonged easing, and more focused on financial stability. That changes everything — from bond yields and the US dollar to equities and crypto.

For crypto traders, this matters deeply. H

BTC3,22%

- Reward

- 5

- 8

- Repost

- Share

MissCrypto :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

108.05K Popularity

19.13K Popularity

387.95K Popularity

6.72K Popularity

4.25K Popularity

4.27K Popularity

2.86K Popularity

4.48K Popularity

2.47K Popularity

3.2K Popularity

12.5K Popularity

8.23K Popularity

20.54K Popularity

28.46K Popularity

23.41K Popularity

News

View MoreBitwise: Market anxiety reaches its peak, indicating that the crypto market is approaching the bottom

10 m

Brother Ma Ji opens a Bitcoin long position again, but the position is only 6 BTC

19 m

Data: BTC breaks through $69,000 as it reaches new all-time highs, signaling strong bullish momentum in the cryptocurrency market. Investors are optimistic about further gains, and analysts suggest monitoring key resistance levels for potential breakout confirmation.

26 m

BTC Breaks Through 69,000 USDT

27 m

Yi Lihua: A 10-Year Summary of the Crypto World - "Profits Come from Bull Markets, Drawdowns Come from Bear Markets"

31 m

Pin