🔍 Why BTC Is Continuing Down (Short Is Running)

Bearish Macro Sentiment:

Risk assets are under pressure as capital rotates toward safer assets (e.g., gold and premium bonds). Weak market sentiment in the U.S. has added selling pressure on Bitcoin.

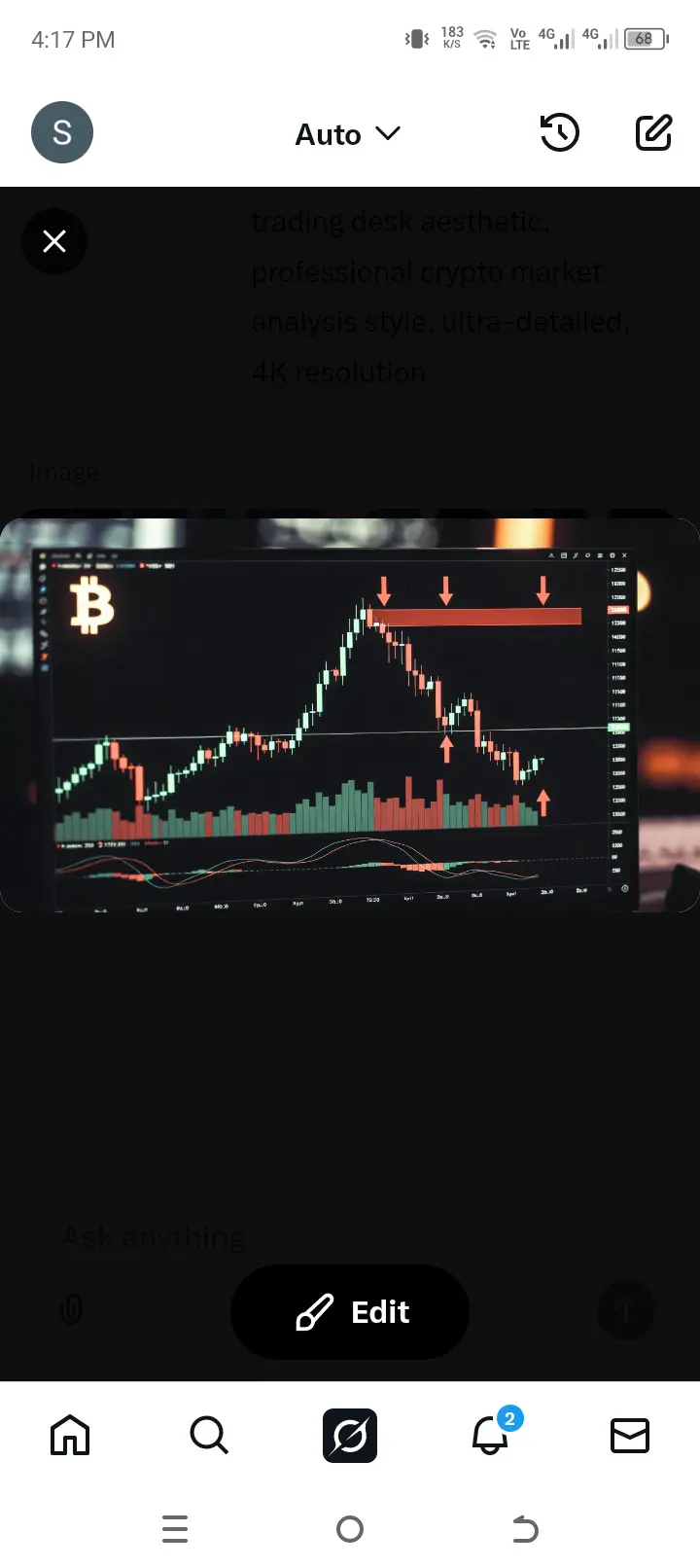

Loss of Key Support Levels:

Bitcoin briefly dipped to levels last seen in late 2024, breaking short-term support zones such as $78,000–$76,000. These levels have flipped from support into resistance, fueling continued short activity.

Technical Downtrend Structure:

Technical indicators and regression models suggest BTC is below its “fair value” lines — a sign bears are still in control until a trend reversal signal appears.

Institutional Pressure:

Major BTC holders like Strategy (formerly MicroStrategy) saw their holdings trade below cost, increasing selling risk if markets remain weak.

📊 Where BTC Could Stop — Key Support Zones

These levels are crucial: if BTC breaks below one, shorts could extend further.

✅ 1) $75,000–$76,000 Zone (Short-Term Support)

This zone has already acted as initial support but is fragile — a break here can accelerate drops.

🔻 2) $69,500–$70,000 Range (Second Major Support)

On-chain clusters and technical models show this region as a high-volume supply zone where traders historically defend prices.

🔻 3) $66,000–$63,000 Stronger Support Floor

If BTC cannot hold above ~$70,000, the next major bottom target sits in this broader structural support range — where previous buyers have accumulated.

🚨 Extreme Case: Some models even target $40,000–$50,000 if sentiment collapses severely and capitulation occurs — but that’s lower-probability and long-range.

📌 Resistance Levels — Where Up Moves Could Stop BTC Rally

Before short pressures fade, BTC must clear these obstacles:

🔹 $79,000–$80,000 — Immediate resistance zone. Failure here keeps bears dominant.

🔹 $85,000–$88,000 — Mid-term resistance where volume congestion forms.

🔹 $90,000+ — Key technical breakout level. Until BTC clears this, shorts are incentivized.

📈 Summary — Market Structure in Simple Terms

✔ Short trend running because:

• Market sentiment weak

• Breakdown of support zones

• Technical bearish structure

✔ Possible bottoms if trend continues:

👣 $75K → $70K → $66–63K

✔ Bullish reversal only if BTC breaks above:

🔺 $79K → $85K → $90K

#Bitcoin #BTC #CryptoAnalysis #BearMarket #SupportResistance

Bearish Macro Sentiment:

Risk assets are under pressure as capital rotates toward safer assets (e.g., gold and premium bonds). Weak market sentiment in the U.S. has added selling pressure on Bitcoin.

Loss of Key Support Levels:

Bitcoin briefly dipped to levels last seen in late 2024, breaking short-term support zones such as $78,000–$76,000. These levels have flipped from support into resistance, fueling continued short activity.

Technical Downtrend Structure:

Technical indicators and regression models suggest BTC is below its “fair value” lines — a sign bears are still in control until a trend reversal signal appears.

Institutional Pressure:

Major BTC holders like Strategy (formerly MicroStrategy) saw their holdings trade below cost, increasing selling risk if markets remain weak.

📊 Where BTC Could Stop — Key Support Zones

These levels are crucial: if BTC breaks below one, shorts could extend further.

✅ 1) $75,000–$76,000 Zone (Short-Term Support)

This zone has already acted as initial support but is fragile — a break here can accelerate drops.

🔻 2) $69,500–$70,000 Range (Second Major Support)

On-chain clusters and technical models show this region as a high-volume supply zone where traders historically defend prices.

🔻 3) $66,000–$63,000 Stronger Support Floor

If BTC cannot hold above ~$70,000, the next major bottom target sits in this broader structural support range — where previous buyers have accumulated.

🚨 Extreme Case: Some models even target $40,000–$50,000 if sentiment collapses severely and capitulation occurs — but that’s lower-probability and long-range.

📌 Resistance Levels — Where Up Moves Could Stop BTC Rally

Before short pressures fade, BTC must clear these obstacles:

🔹 $79,000–$80,000 — Immediate resistance zone. Failure here keeps bears dominant.

🔹 $85,000–$88,000 — Mid-term resistance where volume congestion forms.

🔹 $90,000+ — Key technical breakout level. Until BTC clears this, shorts are incentivized.

📈 Summary — Market Structure in Simple Terms

✔ Short trend running because:

• Market sentiment weak

• Breakdown of support zones

• Technical bearish structure

✔ Possible bottoms if trend continues:

👣 $75K → $70K → $66–63K

✔ Bullish reversal only if BTC breaks above:

🔺 $79K → $85K → $90K

#Bitcoin #BTC #CryptoAnalysis #BearMarket #SupportResistance