When the US dollar drops by 10%... will Bitcoin once again usher in a "bull market"?

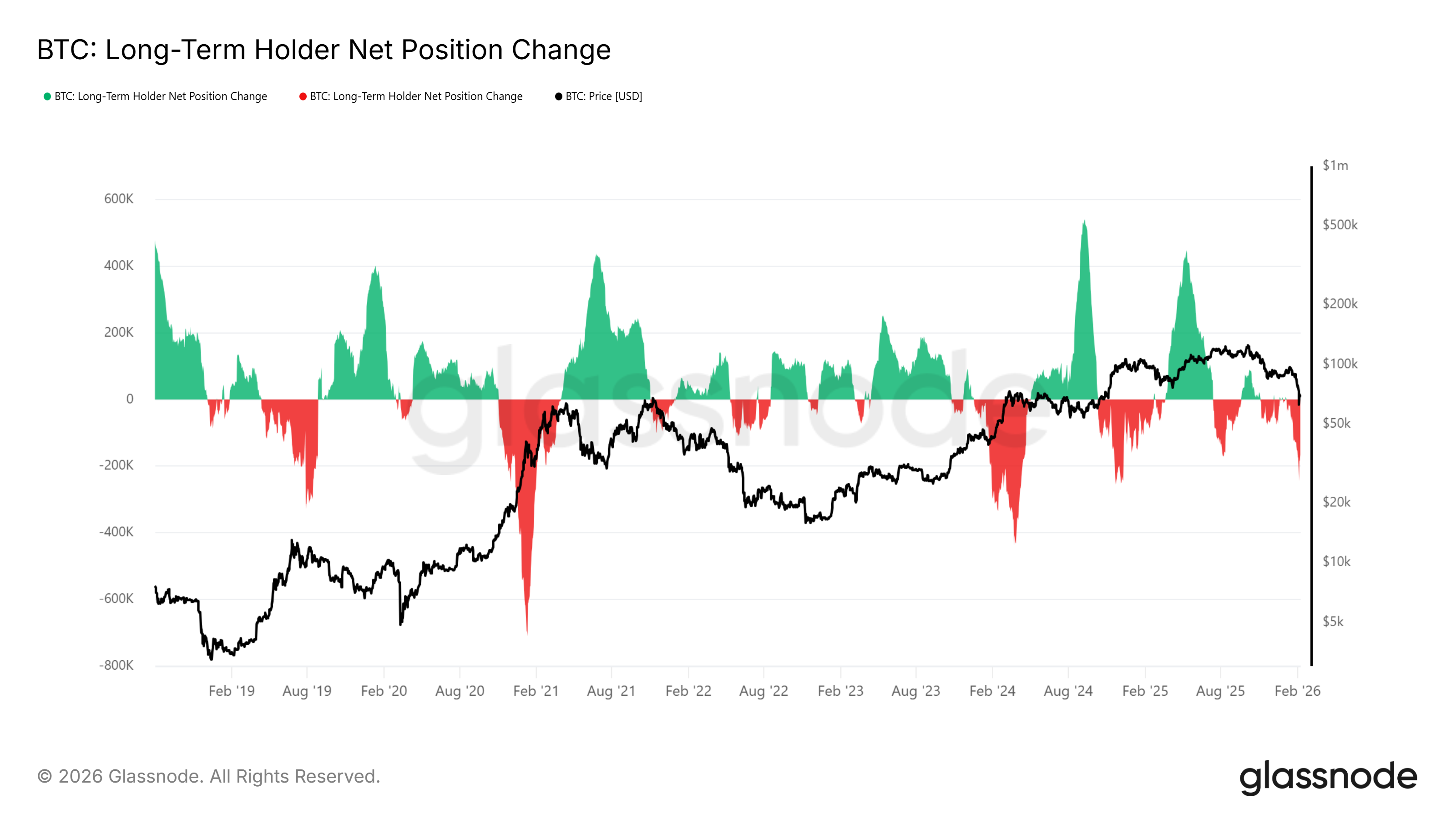

If the Federal Reserve cuts interest rates early, the US dollar could decline by 10%, which would benefit digital assets like Bitcoin. Analysts believe that a weakening dollar is inversely correlated with Bitcoin prices, but caution is advised when analyzing investment risks and market changes.

TechubNews·17m ago