# FedRateDecisionApproaches

10.33K

No rate cut is expected, but the Fed’s tone—hawkish or dovish—could still move Bitcoin. What’s your read on this meeting? Will Powell stay tough or soften his stance?

Luna_Star

#FedRateDecisionApproaches

Today the world’s financial spotlight is firmly pointed at the U.S. Federal Reserve as with markets, traders, investors, and policymakers all bracing for one of the most consequential policy decisions of the year. After a series of aggressive interest rate cuts through late 2025 intended to support economic activity, the Federal Open Market Committee (FOMC) is set to announce its first major policy action of 2026 in the coming hours and the mood across global markets is tense, packed with speculation, strategic hedging, and major asset rotation plays. This isn’t ju

Today the world’s financial spotlight is firmly pointed at the U.S. Federal Reserve as with markets, traders, investors, and policymakers all bracing for one of the most consequential policy decisions of the year. After a series of aggressive interest rate cuts through late 2025 intended to support economic activity, the Federal Open Market Committee (FOMC) is set to announce its first major policy action of 2026 in the coming hours and the mood across global markets is tense, packed with speculation, strategic hedging, and major asset rotation plays. This isn’t ju

- Reward

- 4

- 9

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#FedRateDecisionApproaches the Federal Reserve’s upcoming decision may act less as a conclusion and more as a directional signal that shapes market behavior well into the next quarter. Even if rates remain unchanged, the framing around inflation progress, economic resilience, and policy flexibility will influence how capital allocates across risk and defensive assets. Markets are increasingly forward-looking, meaning reactions will be driven by what the Fed implies about the next move rather than the present one. This creates an environment where expectations, not certainty, dominate price di

- Reward

- 4

- 13

- Repost

- Share

Yunna :

:

buy to earnView More

#FedRateDecisionApproaches

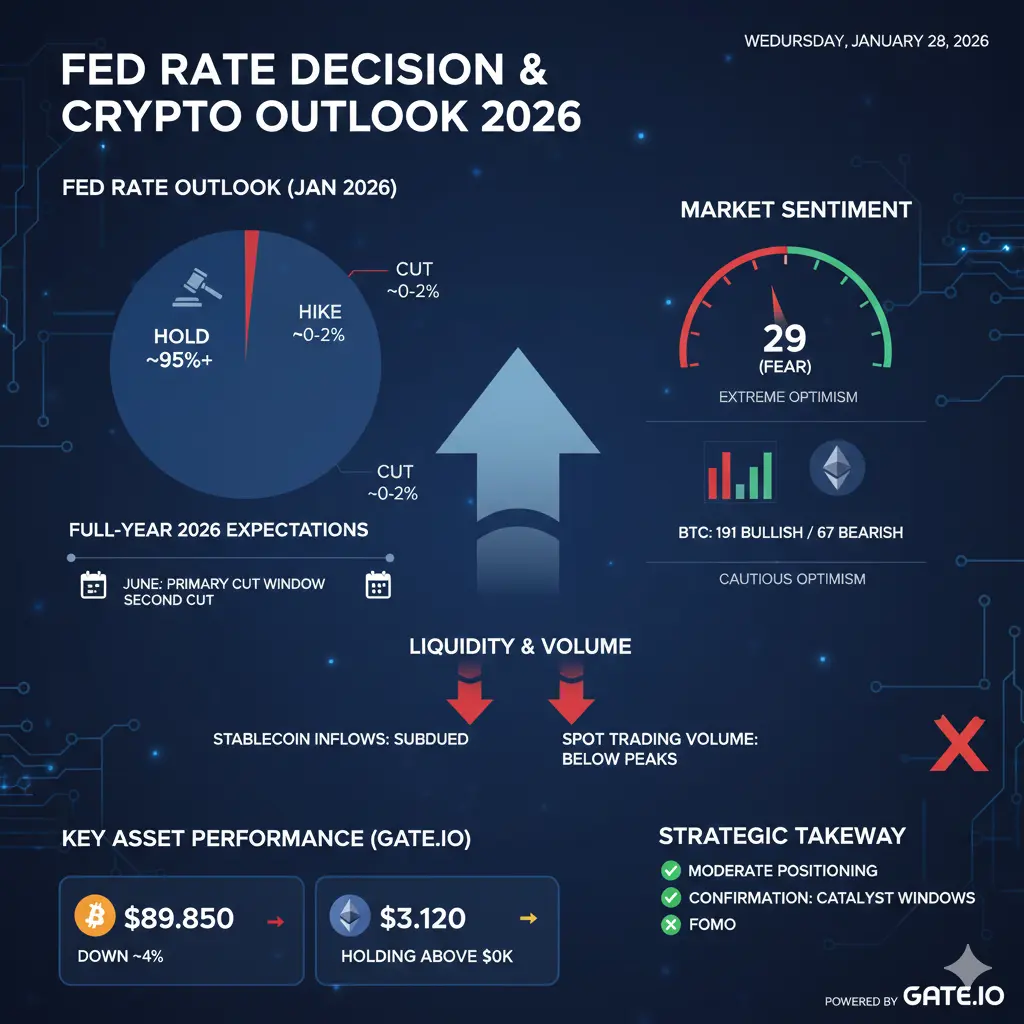

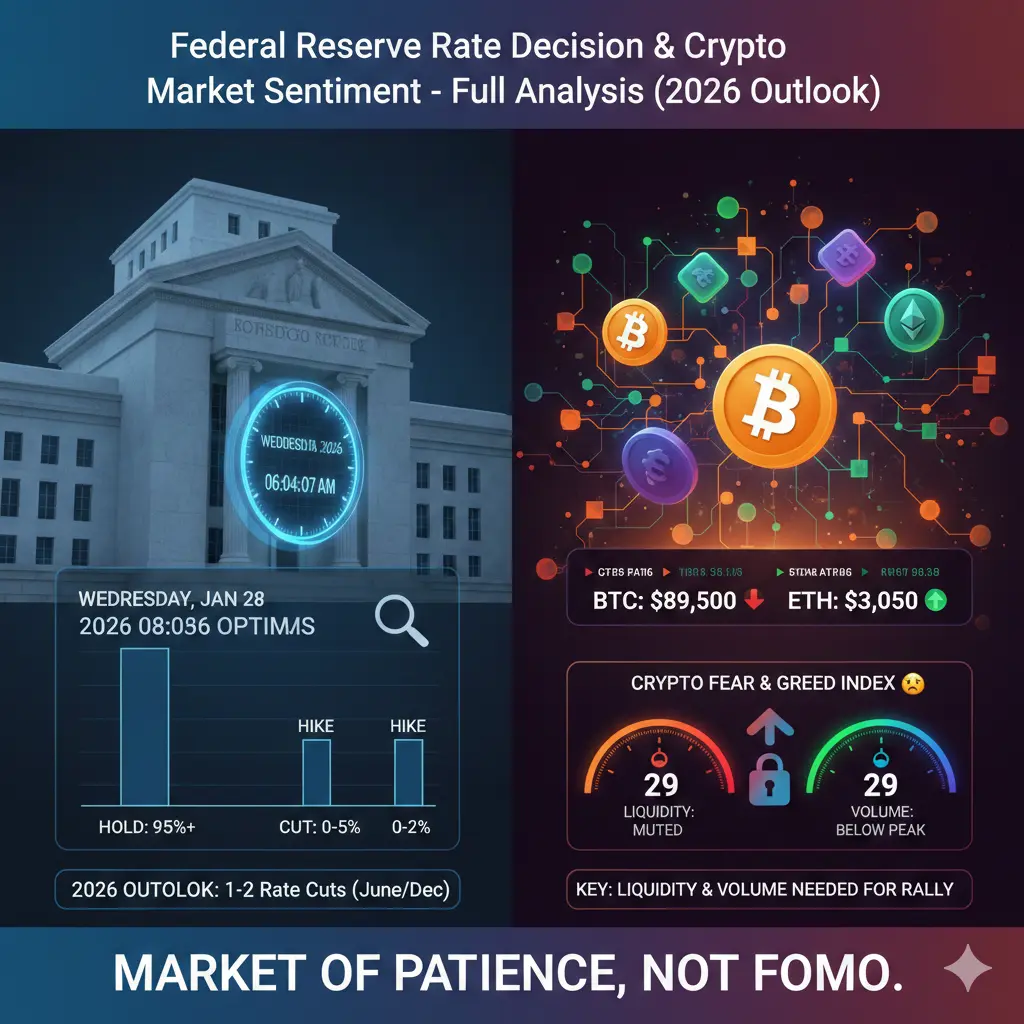

The upcoming Federal Reserve interest rate decision this Wednesday is widely expected to result in no rate change, with financial markets assigning near-zero probability to a surprise rate hike or immediate rate cut.

After three rate cuts at the end of 2025, the current benchmark interest rate sits around 3.50%–3.75%, and policymakers remain cautious as they evaluate inflation stability and labor market strength.

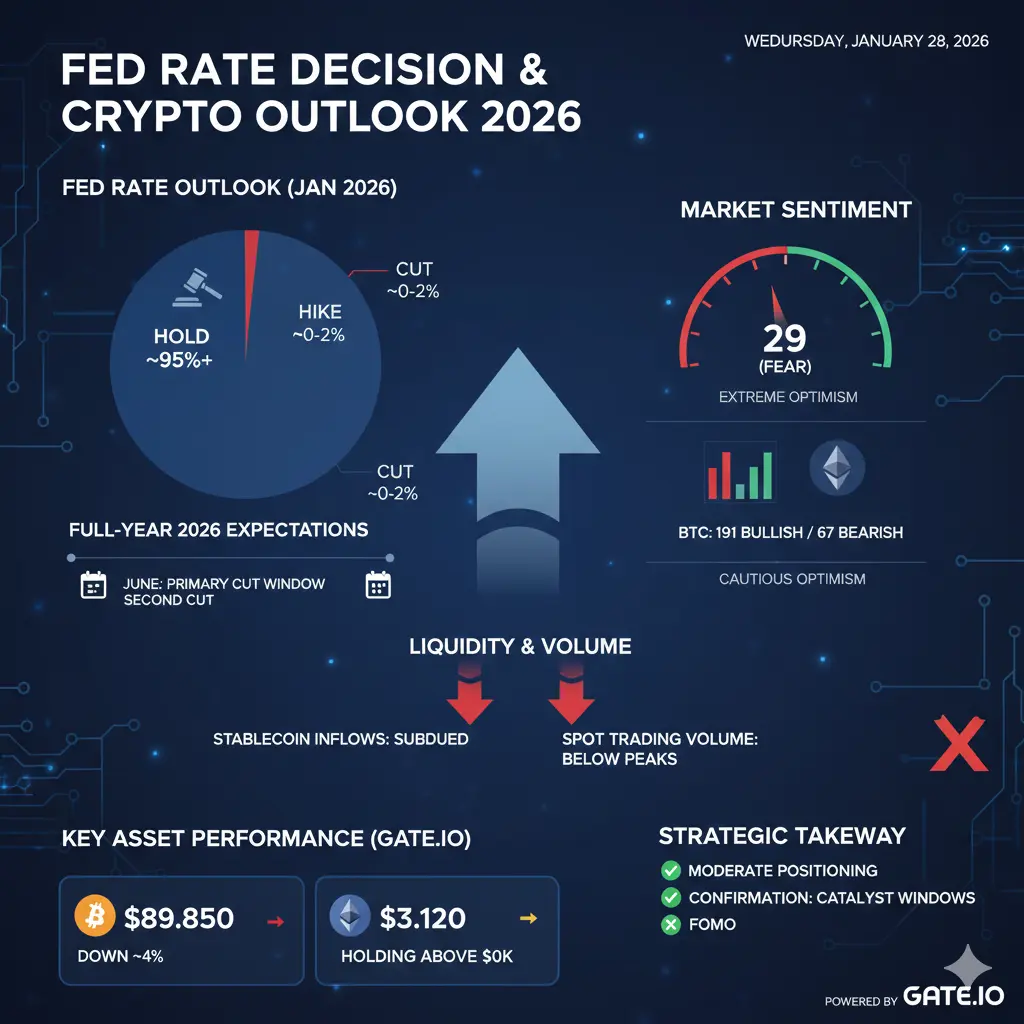

🏦 Fed Rate Outlook & Rate Cut Probabilities (2026)

Short-Term Outlook (This Meeting):

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Hold probab

The upcoming Federal Reserve interest rate decision this Wednesday is widely expected to result in no rate change, with financial markets assigning near-zero probability to a surprise rate hike or immediate rate cut.

After three rate cuts at the end of 2025, the current benchmark interest rate sits around 3.50%–3.75%, and policymakers remain cautious as they evaluate inflation stability and labor market strength.

🏦 Fed Rate Outlook & Rate Cut Probabilities (2026)

Short-Term Outlook (This Meeting):

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Hold probab

- Reward

- 6

- 4

- Repost

- Share

AYATTAC :

:

Buy To Earn 💎View More

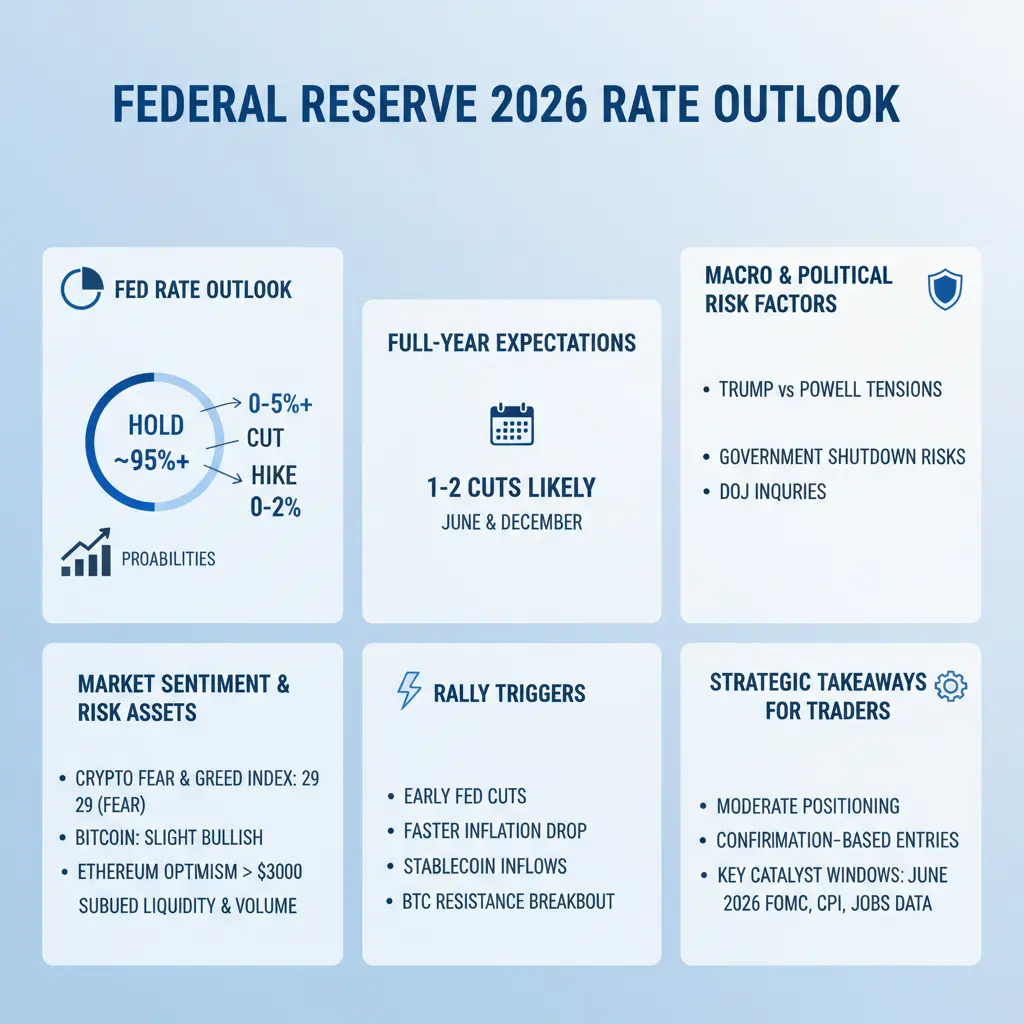

#FedRateDecisionApproaches 🚨

The Federal Reserve’s interest rate decision this Wednesday is widely expected to remain on hold, with markets assigning near-zero probability to an immediate hike or cut.

After three cuts at the end of 2025, the benchmark rate sits at 3.50%–3.75%, and policymakers are cautious as they monitor inflation stability and labor market strength.

📊 Fed Rate Outlook (2026)

This Meeting:

Hold probability: ~95%+

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Full-Year Expectations: 1–2 rate cuts likely, primarily in June 2026, with a possible second cut in Decemb

The Federal Reserve’s interest rate decision this Wednesday is widely expected to remain on hold, with markets assigning near-zero probability to an immediate hike or cut.

After three cuts at the end of 2025, the benchmark rate sits at 3.50%–3.75%, and policymakers are cautious as they monitor inflation stability and labor market strength.

📊 Fed Rate Outlook (2026)

This Meeting:

Hold probability: ~95%+

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Full-Year Expectations: 1–2 rate cuts likely, primarily in June 2026, with a possible second cut in Decemb

- Reward

- 5

- 8

- Repost

- Share

CryptoChampion :

:

DYOR 🤓View More

#FedRateDecisionApproaches

As the Federal Reserve’s interest rate decision approaches, global financial markets are entering a cautious and highly sensitive phase. Investors across equities, commodities, and crypto are closely monitoring economic signals, as the outcome of this decision will influence liquidity, risk appetite, and capital flows worldwide.

Below is a detailed, point-by-point explanation of why this event matters and what markets are watching.

1️⃣ Markets Shift Into Wait-and-See Mode

Ahead of the Fed’s decision, volatility often compresses as traders reduce large positions. Thi

As the Federal Reserve’s interest rate decision approaches, global financial markets are entering a cautious and highly sensitive phase. Investors across equities, commodities, and crypto are closely monitoring economic signals, as the outcome of this decision will influence liquidity, risk appetite, and capital flows worldwide.

Below is a detailed, point-by-point explanation of why this event matters and what markets are watching.

1️⃣ Markets Shift Into Wait-and-See Mode

Ahead of the Fed’s decision, volatility often compresses as traders reduce large positions. Thi

BOND-2,57%

- Reward

- 2

- 3

- Repost

- Share

EagleEye :

:

thanks for sharing thisn informationView More

🧭 Gold Breaks $5,000 as Geopolitical Risk Spikes — Is This the Moment to Hedge or Hunt a BTC Dip?

Escalating U.S.–Iran tensions have flipped global markets into risk-off mode. Capital is rotating fast — and the divergence between gold and Bitcoin is getting louder.

🥇 Gold: Fear Trade in Full Control

Gold pushing above the $5,000 level is not a normal technical breakout — it’s a macro statement.

What’s driving it right now:

Heightened geopolitical risk → classic safe-haven demand

Weak confidence in fiat stability during conflict escalation

Central banks & institutions prioritizing capital pre

Escalating U.S.–Iran tensions have flipped global markets into risk-off mode. Capital is rotating fast — and the divergence between gold and Bitcoin is getting louder.

🥇 Gold: Fear Trade in Full Control

Gold pushing above the $5,000 level is not a normal technical breakout — it’s a macro statement.

What’s driving it right now:

Heightened geopolitical risk → classic safe-haven demand

Weak confidence in fiat stability during conflict escalation

Central banks & institutions prioritizing capital pre

BTC2,54%

- Reward

- 13

- 7

- Repost

- Share

EagleEye :

:

thanks for sharing thisn informationView More

#FedRateDecisionApproaches

The upcoming Federal Reserve interest rate decision this Wednesday is widely expected to result in no rate change, with financial markets assigning near-zero probability to a surprise rate hike or immediate rate cut.

After three rate cuts at the end of 2025, the current benchmark interest rate sits around 3.50%–3.75%, and policymakers remain cautious as they evaluate inflation stability and labor market strength.

🏦 Fed Rate Outlook & Rate Cut Probabilities (2026)

Short-Term Outlook (This Meeting):

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Hold probab

The upcoming Federal Reserve interest rate decision this Wednesday is widely expected to result in no rate change, with financial markets assigning near-zero probability to a surprise rate hike or immediate rate cut.

After three rate cuts at the end of 2025, the current benchmark interest rate sits around 3.50%–3.75%, and policymakers remain cautious as they evaluate inflation stability and labor market strength.

🏦 Fed Rate Outlook & Rate Cut Probabilities (2026)

Short-Term Outlook (This Meeting):

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Hold probab

BLESS1,46%

- Reward

- 16

- 14

- Repost

- Share

GateUser-68291371 :

:

Vibe at 1000x 🤑View More

#FedRateDecisionApproaches As the Federal Reserve’s interest rate decision draws closer, global financial markets are entering a period of heightened sensitivity and recalibration. This event remains one of the most powerful macroeconomic catalysts, capable of influencing capital flows across equities, cryptocurrencies, commodities, bonds, and currency markets simultaneously. In the days leading up to the decision, positioning often becomes as important as the outcome itself.

The Federal Reserve’s policy direction directly affects borrowing costs, liquidity availability, and overall economic m

The Federal Reserve’s policy direction directly affects borrowing costs, liquidity availability, and overall economic m

- Reward

- 14

- 9

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#FedRateDecisionApproaches

No rate cut expected, but the real move will come from Powell’s tone.

Hawkish words can pressure BTC even without policy change.

Dovish hints could quickly flip risk appetite back on.

I’m watching DXY, yields, and BTC reaction during the speech — not the headline.

Sometimes the market moves more on language than decisions.

Do you expect Powell to stay tough, or signal a softer path ahead?

No rate cut expected, but the real move will come from Powell’s tone.

Hawkish words can pressure BTC even without policy change.

Dovish hints could quickly flip risk appetite back on.

I’m watching DXY, yields, and BTC reaction during the speech — not the headline.

Sometimes the market moves more on language than decisions.

Do you expect Powell to stay tough, or signal a softer path ahead?

BTC2,54%

- Reward

- 16

- 24

- Repost

- Share

MissCrypto :

:

Buy To Earn 💎View More

#FedRateDecisionApproaches

As the Federal Reserve’s interest rate decision approaches, global financial markets are entering a cautious and highly sensitive phase. Investors across equities, commodities, and crypto are closely monitoring economic signals, as the outcome of this decision will influence liquidity, risk appetite, and capital flows worldwide.

Below is a detailed, point-by-point explanation of why this event matters and what markets are watching.

1️⃣ Markets Shift Into Wait-and-See Mode

Ahead of the Fed’s decision, volatility often compresses as traders reduce large positions. Thi

As the Federal Reserve’s interest rate decision approaches, global financial markets are entering a cautious and highly sensitive phase. Investors across equities, commodities, and crypto are closely monitoring economic signals, as the outcome of this decision will influence liquidity, risk appetite, and capital flows worldwide.

Below is a detailed, point-by-point explanation of why this event matters and what markets are watching.

1️⃣ Markets Shift Into Wait-and-See Mode

Ahead of the Fed’s decision, volatility often compresses as traders reduce large positions. Thi

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

11.36K Popularity

73.76K Popularity

28.98K Popularity

10.21K Popularity

10.33K Popularity

9.04K Popularity

8.33K Popularity

7.92K Popularity

74.31K Popularity

21.44K Popularity

82.44K Popularity

23.42K Popularity

50.12K Popularity

43.67K Popularity

179.17K Popularity

News

View MoreUSDC Treasury在以太坊销毁9515万枚USDC

4 m

Data: 151.58 BTC transferred out from multiple anonymous addresses, worth approximately $13.67 million

20 m

Opinion: Trump may announce the new Federal Reserve Chair tonight

20 m

Uniswap: Token auction feature will be launched on the web version on February 2nd

23 m

Fidelity will launch the stablecoin FIDD on Ethereum

37 m

Pin