# WarshNominationBullorBear?

8.38K

MissCrypto

#WarshNominationBullOrBear? Short-Term Fear, Long-Term Discipline

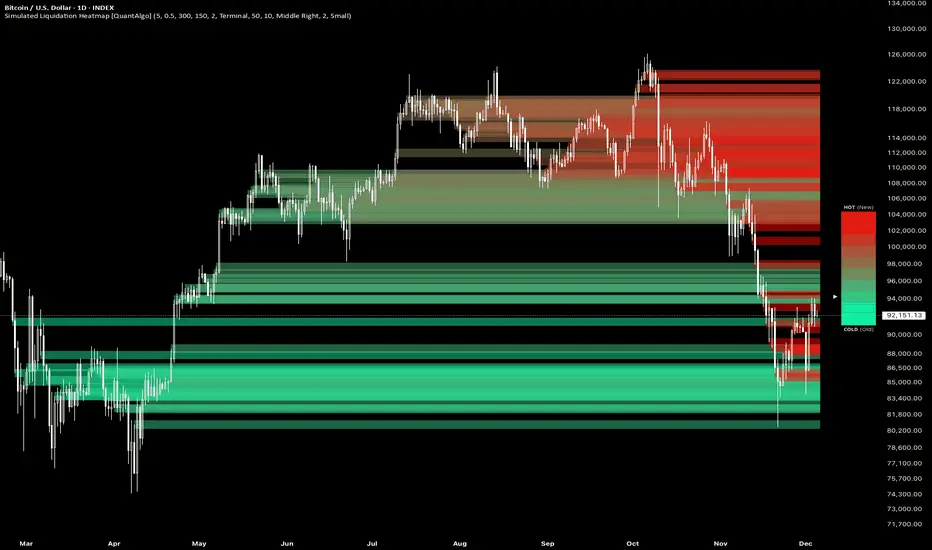

Kevin Warsh’s nomination for Federal Reserve Chair has shaken both traditional and crypto markets. Known as an inflation hawk, Warsh signals tighter monetary policy—balance sheet reduction (QT), higher real interest rates, and disciplined macro oversight. While initial reactions sparked fear, especially in Bitcoin and risk assets, the long-term implications could reinforce market stability.

🔹 Immediate Market Reaction

Bitcoin: dipped to ~$75–78k

Gold & Silver: sold off sharply

U.S. Dollar: strengthened

The so-called “Warsh Shoc

Kevin Warsh’s nomination for Federal Reserve Chair has shaken both traditional and crypto markets. Known as an inflation hawk, Warsh signals tighter monetary policy—balance sheet reduction (QT), higher real interest rates, and disciplined macro oversight. While initial reactions sparked fear, especially in Bitcoin and risk assets, the long-term implications could reinforce market stability.

🔹 Immediate Market Reaction

Bitcoin: dipped to ~$75–78k

Gold & Silver: sold off sharply

U.S. Dollar: strengthened

The so-called “Warsh Shoc

BTC-8,4%

- Reward

- 4

- 10

- Repost

- Share

NovaCryptoGirl :

:

HODL Tight 💪View More

#WarshNominationBullorBear? Short-Term Fear, Long-Term Discipline?

Kevin Warsh’s nomination for Federal Reserve Chair has sent ripples through financial and crypto markets. Known as an inflation hawk, Warsh is widely associated with tighter monetary policy—balance sheet reduction (QT), higher real interest rates, and disciplined macro oversight. Many market participants immediately interpreted the news as bearish for risk assets, including Bitcoin. Yet, the reality is more nuanced, with potential implications for both short-term volatility and long-term market structure.

🔹 Who Is Kevin Warsh?

Kevin Warsh’s nomination for Federal Reserve Chair has sent ripples through financial and crypto markets. Known as an inflation hawk, Warsh is widely associated with tighter monetary policy—balance sheet reduction (QT), higher real interest rates, and disciplined macro oversight. Many market participants immediately interpreted the news as bearish for risk assets, including Bitcoin. Yet, the reality is more nuanced, with potential implications for both short-term volatility and long-term market structure.

🔹 Who Is Kevin Warsh?

BTC-8,4%

- Reward

- 4

- 4

- Repost

- Share

YingYue :

:

1000x VIbes 🤑View More

#WarshNominationBullorBear? Short-Term Fear, Long-Term Discipline?

Kevin Warsh’s nomination for Federal Reserve Chair has sent ripples through financial and crypto markets. Known as an inflation hawk, Warsh is widely associated with tighter monetary policy—balance sheet reduction (QT), higher real interest rates, and disciplined macro oversight. Many market participants immediately interpreted the news as bearish for risk assets, including Bitcoin. Yet, the reality is more nuanced, with potential implications for both short-term volatility and long-term market structure.

🔹 Who Is Kevin Warsh?

Kevin Warsh’s nomination for Federal Reserve Chair has sent ripples through financial and crypto markets. Known as an inflation hawk, Warsh is widely associated with tighter monetary policy—balance sheet reduction (QT), higher real interest rates, and disciplined macro oversight. Many market participants immediately interpreted the news as bearish for risk assets, including Bitcoin. Yet, the reality is more nuanced, with potential implications for both short-term volatility and long-term market structure.

🔹 Who Is Kevin Warsh?

BTC-8,4%

- Reward

- like

- Comment

- Repost

- Share

#WarshNominationBullorBear? Short-Term Fear, Long-Term Discipline?

Kevin Warsh’s nomination for Federal Reserve Chair has sent ripples through financial and crypto markets. Known as an inflation hawk, Warsh is widely associated with tighter monetary policy—balance sheet reduction (QT), higher real interest rates, and disciplined macro oversight. Many market participants immediately interpreted the news as bearish for risk assets, including Bitcoin. Yet, the reality is more nuanced, with potential implications for both short-term volatility and long-term market structure.

🔹 Who Is Kevin Warsh?

Kevin Warsh’s nomination for Federal Reserve Chair has sent ripples through financial and crypto markets. Known as an inflation hawk, Warsh is widely associated with tighter monetary policy—balance sheet reduction (QT), higher real interest rates, and disciplined macro oversight. Many market participants immediately interpreted the news as bearish for risk assets, including Bitcoin. Yet, the reality is more nuanced, with potential implications for both short-term volatility and long-term market structure.

🔹 Who Is Kevin Warsh?

BTC-8,4%

- Reward

- 15

- 30

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#WarshNominationBullorBear? WarshNominationBullorBear? Short-Term Fear, Long-Term Discipline?

Kevin Warsh’s nomination for Federal Reserve Chair has sent ripples through financial and crypto markets. Known as an inflation hawk, Warsh is associated with tighter monetary policy—balance sheet reduction, higher real interest rates, and disciplined macro oversight. Many interpreted the news as bearish for risk assets, including Bitcoin, but implications are nuanced, affecting short-term volatility and long-term market structure.

🔹 Who Is Kevin Warsh?

Warsh served as Fed Governor from 2006–2011 and

Kevin Warsh’s nomination for Federal Reserve Chair has sent ripples through financial and crypto markets. Known as an inflation hawk, Warsh is associated with tighter monetary policy—balance sheet reduction, higher real interest rates, and disciplined macro oversight. Many interpreted the news as bearish for risk assets, including Bitcoin, but implications are nuanced, affecting short-term volatility and long-term market structure.

🔹 Who Is Kevin Warsh?

Warsh served as Fed Governor from 2006–2011 and

BTC-8,4%

- Reward

- 3

- 3

- Repost

- Share

Yunna :

:

BUY TO EARNView More

#WarshNominationBullorBear? | Markets Decode the Policy Signal

Speculation around a potential nomination of Kevin Warsh to a top Federal Reserve role has reignited an old debate in financial markets: would this be a bullish or bearish development for risk assets? While no nomination is official, even the discussion itself has been enough to move sentiment, highlighting how sensitive markets remain to shifts in monetary leadership expectations

.

Kevin Warsh is widely known as a policy hawk with deep institutional experience. As a former Federal Reserve governor, he has consistently emphasized p

Speculation around a potential nomination of Kevin Warsh to a top Federal Reserve role has reignited an old debate in financial markets: would this be a bullish or bearish development for risk assets? While no nomination is official, even the discussion itself has been enough to move sentiment, highlighting how sensitive markets remain to shifts in monetary leadership expectations

.

Kevin Warsh is widely known as a policy hawk with deep institutional experience. As a former Federal Reserve governor, he has consistently emphasized p

BTC-8,4%

- Reward

- 2

- 3

- Repost

- Share

HighAmbition :

:

new year Wealth ExplosionView More

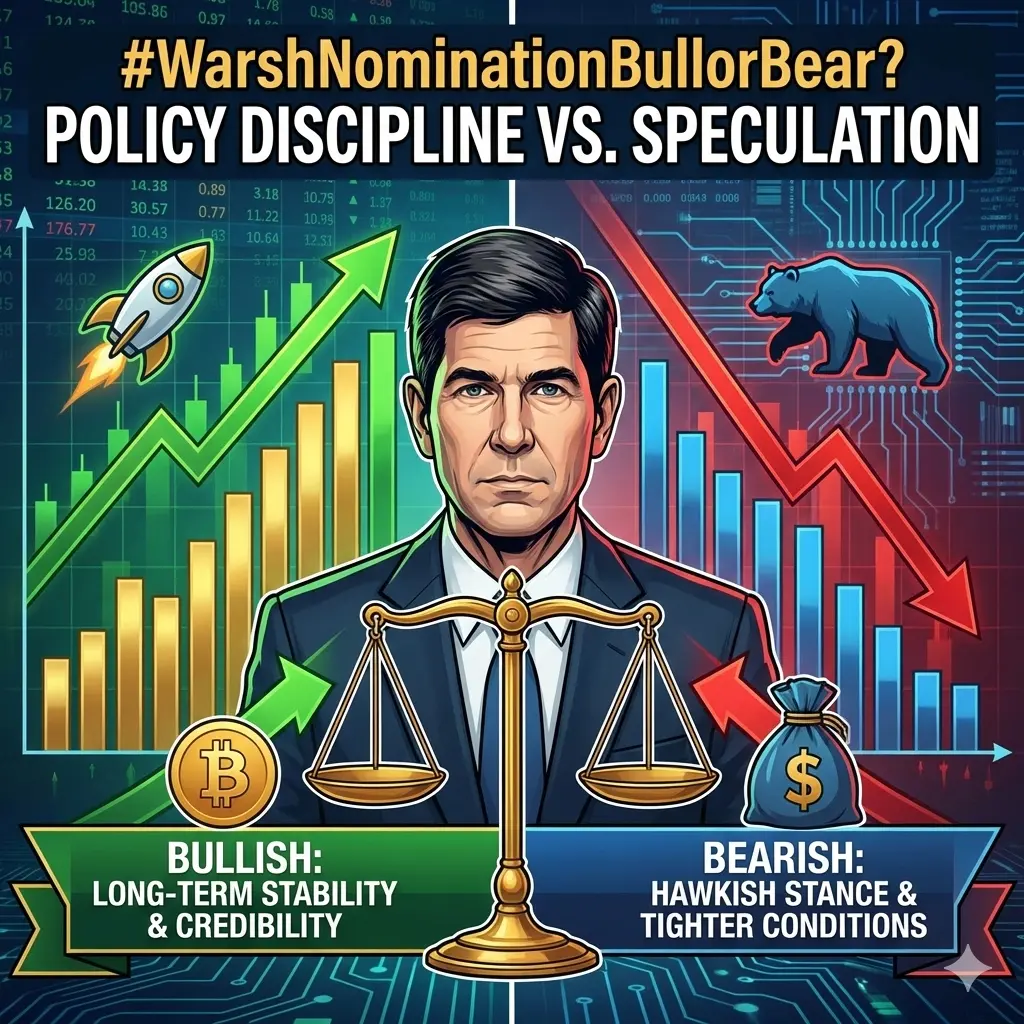

#WarshNominationBullorBear?

Market Impact Analysis — Bullish or Bearish?

The potential nomination of Kevin Warsh (former Federal Reserve Governor) is being closely watched by markets because it directly touches monetary policy expectations, Fed credibility, and liquidity outlook.

Short answer: Structurally bearish for risk assets in the short term, neutral-to-bullish long term if credibility improves.

Here’s the clean breakdown 👇

🔹 1. Who Is Kevin Warsh (Market Lens)

Known as hawkish-leaning

Strong advocate of:

Central bank credibility

Inflation control

Limiting excessive monetary easing

📌

Market Impact Analysis — Bullish or Bearish?

The potential nomination of Kevin Warsh (former Federal Reserve Governor) is being closely watched by markets because it directly touches monetary policy expectations, Fed credibility, and liquidity outlook.

Short answer: Structurally bearish for risk assets in the short term, neutral-to-bullish long term if credibility improves.

Here’s the clean breakdown 👇

🔹 1. Who Is Kevin Warsh (Market Lens)

Known as hawkish-leaning

Strong advocate of:

Central bank credibility

Inflation control

Limiting excessive monetary easing

📌

BTC-8,4%

- Reward

- 7

- 4

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#WarshNominationBullorBear?

Kevin Warsh's Fed Chair Nomination: Short-Term Fear in Crypto, Long-Term Discipline?

Kevin Warsh's nomination for Federal Reserve Chair has sparked intense debate across markets—especially in the crypto space. Many immediately labeled it as bearish, given Warsh's reputation as an inflation hawk who favors tighter policies like balance sheet reduction (QT) and higher real interest rates. But the reality is more nuanced. From my perspective, this nomination might create short-term unease, yet it could lay the groundwork for a more disciplined, healthier environment f

Kevin Warsh's Fed Chair Nomination: Short-Term Fear in Crypto, Long-Term Discipline?

Kevin Warsh's nomination for Federal Reserve Chair has sparked intense debate across markets—especially in the crypto space. Many immediately labeled it as bearish, given Warsh's reputation as an inflation hawk who favors tighter policies like balance sheet reduction (QT) and higher real interest rates. But the reality is more nuanced. From my perspective, this nomination might create short-term unease, yet it could lay the groundwork for a more disciplined, healthier environment f

BTC-8,4%

- Reward

- 40

- 29

- Repost

- Share

Moonchart :

:

Happy New Year! 🤑View More

#WarshNominationBullorBear?

The potential nomination of Kevin Warsh to a key Federal Reserve leadership role has ignited a fresh debate across financial markets: is this development bullish or bearish for risk assets, particularly equities and crypto? As investors try to price in policy direction before it becomes reality, Warsh’s reputation and historical stance are now under the microscope.

Kevin Warsh is widely viewed as a monetary policy hawk. During his time as a Federal Reserve Governor, he consistently emphasized price stability, discipline in monetary expansion, and the long-term risk

The potential nomination of Kevin Warsh to a key Federal Reserve leadership role has ignited a fresh debate across financial markets: is this development bullish or bearish for risk assets, particularly equities and crypto? As investors try to price in policy direction before it becomes reality, Warsh’s reputation and historical stance are now under the microscope.

Kevin Warsh is widely viewed as a monetary policy hawk. During his time as a Federal Reserve Governor, he consistently emphasized price stability, discipline in monetary expansion, and the long-term risk

BTC-8,4%

- Reward

- 5

- 11

- Repost

- Share

ybaser :

:

Hold on tight, we're about to take off 🛫View More

🔴 ETH5S (ETH 5x Short Token)

Overview & Use Case

ETH5S is a leveraged short product, designed to gain when Ethereum falls. High risk, high volatility.

Current Price: ~$0.0307

Trend: Strong bullish (ETH weakness play)

🔍 Technical Analysis

Support:

$0.0298

$0.0279

Resistance:

$0.0316

$0.0322

Indicators

RSI: Elevated but not extreme

MACD: Bullish momentum intact

MA: Price above all key MAs

Pattern:

📈 Higher highs & higher lows

🎯 Trading Plan

Entry (Aggressive): $0.0298 – $0.0305

Targets:

TP1: $0.0316

TP2: $0.0330

Stop Loss: $0.0289

Risk–Reward: ~1:2+

⚠️ Note: Leveraged tokens are short-term t

Overview & Use Case

ETH5S is a leveraged short product, designed to gain when Ethereum falls. High risk, high volatility.

Current Price: ~$0.0307

Trend: Strong bullish (ETH weakness play)

🔍 Technical Analysis

Support:

$0.0298

$0.0279

Resistance:

$0.0316

$0.0322

Indicators

RSI: Elevated but not extreme

MACD: Bullish momentum intact

MA: Price above all key MAs

Pattern:

📈 Higher highs & higher lows

🎯 Trading Plan

Entry (Aggressive): $0.0298 – $0.0305

Targets:

TP1: $0.0316

TP2: $0.0330

Stop Loss: $0.0289

Risk–Reward: ~1:2+

⚠️ Note: Leveraged tokens are short-term t

ETH5S42,54%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

99.14K Popularity

15.14K Popularity

386.58K Popularity

3.16K Popularity

1.5K Popularity

1.15K Popularity

442 Popularity

1.45K Popularity

572 Popularity

3.16K Popularity

11.28K Popularity

7.36K Popularity

19.29K Popularity

27.33K Popularity

22.86K Popularity

News

View MoreData: 243.15 BTC transferred out from Cumberland DRW, valued at approximately $2,467,700.

10 m

CLARITY Act Accelerates! Scott Bessent Firmly States: Disagree? You Can Move to El Salvador

11 m

F2Pool Co-founder Wang Chun mentions the warning of "Silver Thursday": If CZ restricts buying, curious about the market reaction

14 m

Insider Trump shorted cryptocurrencies for $150 million? On-chain data reveals the truth, market panic stems from rumors

16 m

Cardano Founder Refuses to Cash Out! Charles Hoskinson Reveals Crypto Losses Exceeding $3 Billion, Still Optimistic About ADA's Future

20 m

Pin