# ETHEREUM

608.63K

CryptoSat

🚨 STABLECOIN SUPPLY ON ETHEREUM DROPS $1.4B IN 7 DAYS

Liquidity just quietly left the room.

Over the past week, stablecoin supply on #Ethereum has fallen by $1.4 BILLION.

When stablecoins flow onto $ETH → traders are preparing to deploy capital.

When they flow out → either profits are taken, risk is reduced, or funds rotate elsewhere.

Liquidity just quietly left the room.

Over the past week, stablecoin supply on #Ethereum has fallen by $1.4 BILLION.

When stablecoins flow onto $ETH → traders are preparing to deploy capital.

When they flow out → either profits are taken, risk is reduced, or funds rotate elsewhere.

ETH1,52%

- Reward

- like

- 2

- Repost

- Share

IncreasinglyBetterBy2026The :

:

Wishing you great wealth in the Year of the Horse 🐴View More

🚀 Crypto Market Surge — What’s Driving the Pump?

On Feb 14 during the Asia session:

✅ Bitcoin broke above $69,000

✅ Ethereum crossed $2,050

✅ The entire crypto market moved upward

So what triggered this sudden rally?

🏛️ Regulation Optimism

U.S. Treasury Secretary Janet Yellen urged Congress to pass the Digital Asset Market Clarity Act. Clear rules = stronger investor confidence.

📈 Institutional Momentum

Major firms like BlackRock continue integrating crypto into investment strategies.

💧 Liquidity & Macro Support

Falling interest rates and improving liquidity conditions are strengthening ma

On Feb 14 during the Asia session:

✅ Bitcoin broke above $69,000

✅ Ethereum crossed $2,050

✅ The entire crypto market moved upward

So what triggered this sudden rally?

🏛️ Regulation Optimism

U.S. Treasury Secretary Janet Yellen urged Congress to pass the Digital Asset Market Clarity Act. Clear rules = stronger investor confidence.

📈 Institutional Momentum

Major firms like BlackRock continue integrating crypto into investment strategies.

💧 Liquidity & Macro Support

Falling interest rates and improving liquidity conditions are strengthening ma

- Reward

- 6

- 4

- Repost

- Share

Luna_Star :

:

LFG 🔥View More

Ethereum is evolving. Are you ready for 10,000 TPS? 💎

With the Hegota upgrade approaching, $ETH is transitioning from “digital bond” to high-performance infrastructure.

Parallel transaction processing could transform the Layer 2 ecosystem.

Short-term volatility ≠ long-term weakness.

#Ethereum #ETH #L2 #BlockchainTech

$ETH #GateSquare$50KRedPacketGiveaway

With the Hegota upgrade approaching, $ETH is transitioning from “digital bond” to high-performance infrastructure.

Parallel transaction processing could transform the Layer 2 ecosystem.

Short-term volatility ≠ long-term weakness.

#Ethereum #ETH #L2 #BlockchainTech

$ETH #GateSquare$50KRedPacketGiveaway

ETH1,52%

- Reward

- like

- Comment

- Repost

- Share

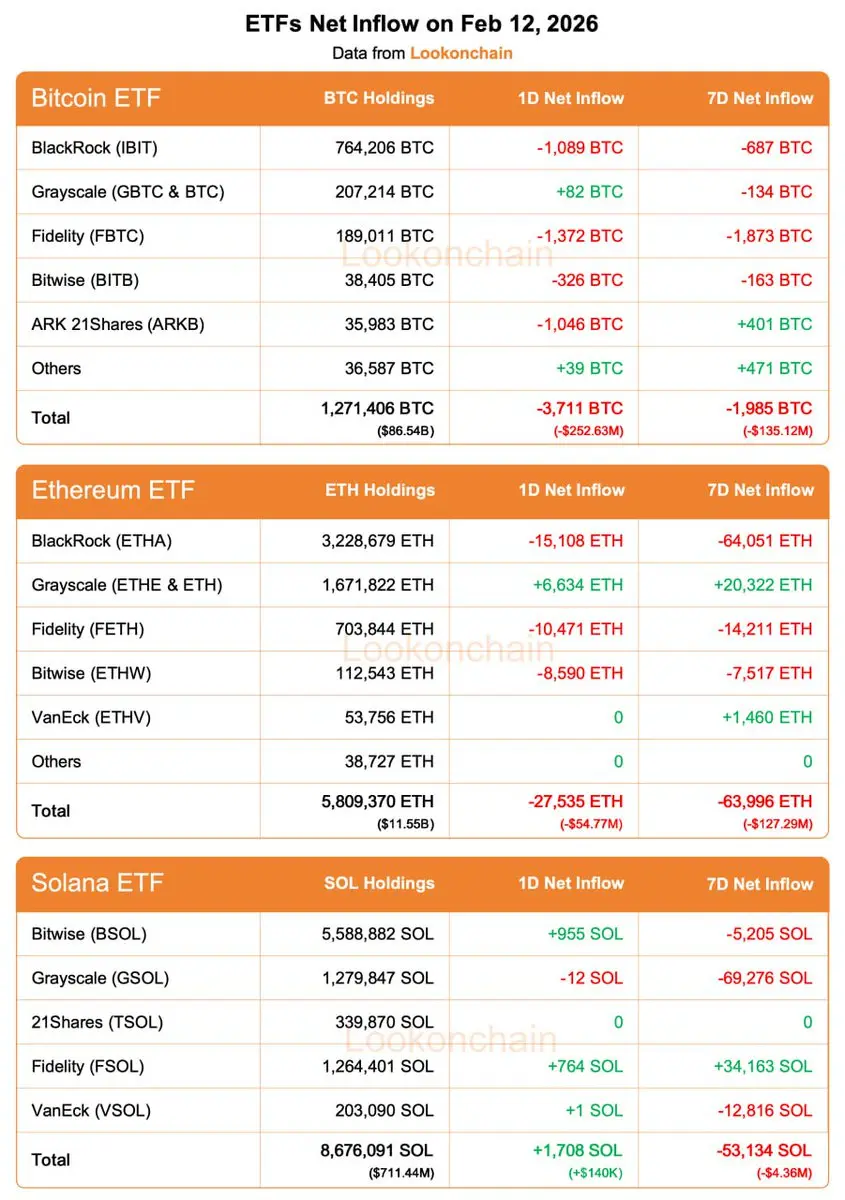

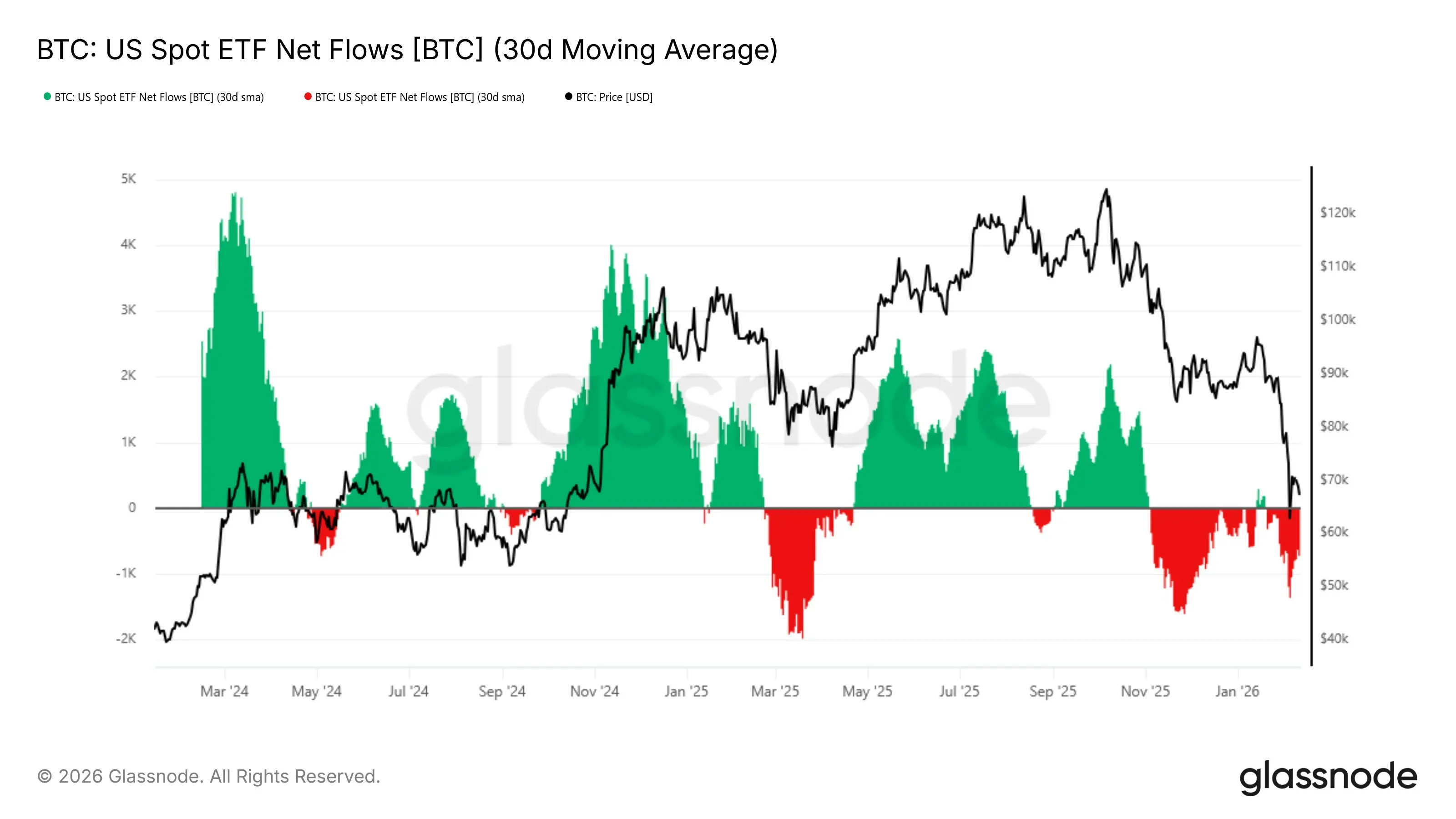

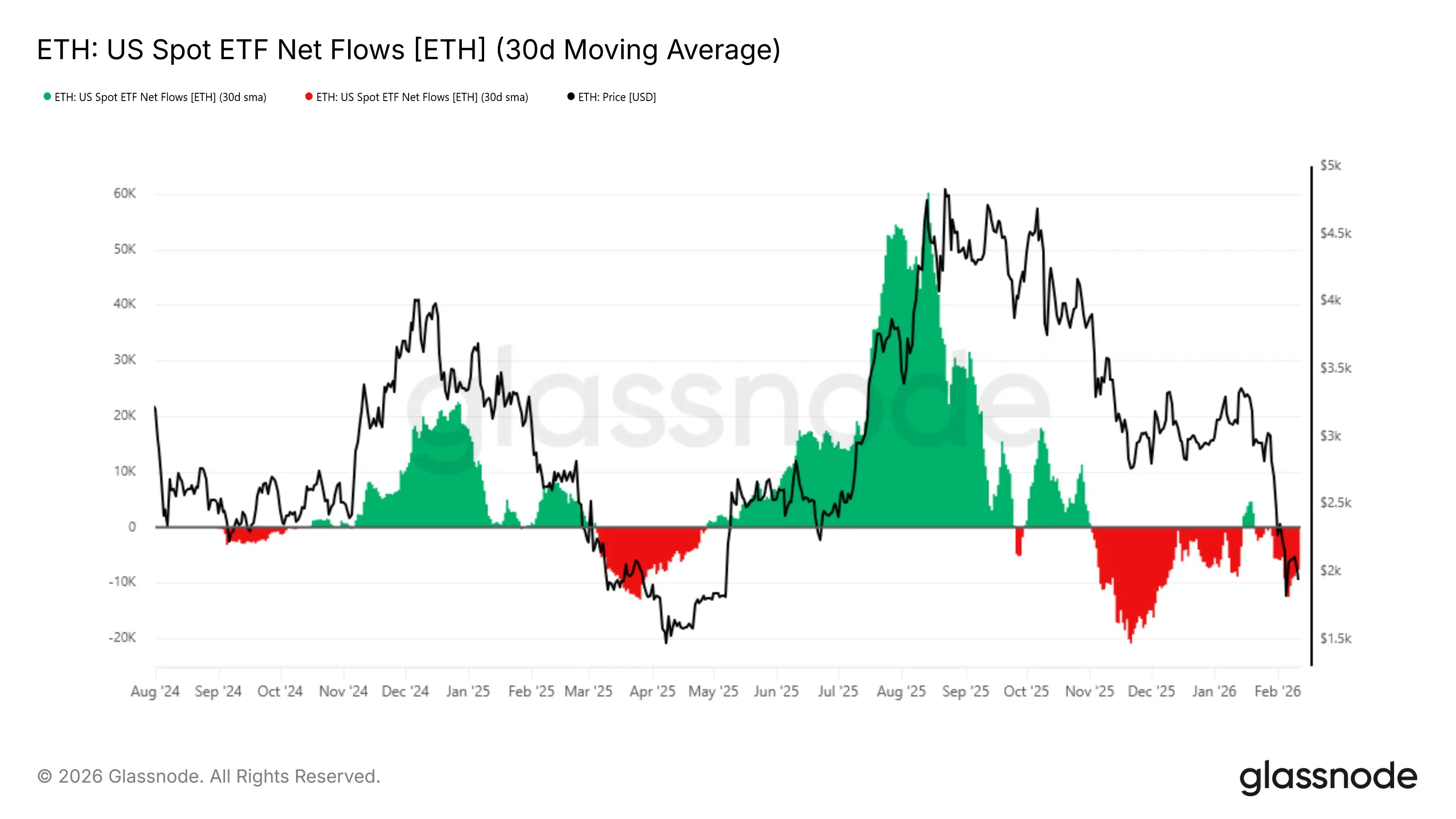

ETF Outflows Reshape Institutional Demand Dynamics

Recent on-chain data tracking the 30-day moving average of US Spot ETF net flows highlights a clear deterioration in institutional demand across both $BTC and $ETH , signaling a shift in the macro liquidity backdrop supporting crypto markets.

For #Bitcoin, ETF inflows that previously sustained the 2024–2025 expansion have faded, with flows now turning persistently negative. This reversal coincides with BTC retracement from the $100k+ region, suggesting that institutional capital is no longer providing the same absorptive buy-side pressure. Hi

Recent on-chain data tracking the 30-day moving average of US Spot ETF net flows highlights a clear deterioration in institutional demand across both $BTC and $ETH , signaling a shift in the macro liquidity backdrop supporting crypto markets.

For #Bitcoin, ETF inflows that previously sustained the 2024–2025 expansion have faded, with flows now turning persistently negative. This reversal coincides with BTC retracement from the $100k+ region, suggesting that institutional capital is no longer providing the same absorptive buy-side pressure. Hi

- Reward

- 1

- 2

- Repost

- Share

CryptoZeno :

:

good luck everyone View More

- Reward

- 1

- Comment

- Repost

- Share

**⚠️ $ETH AT CRITICAL SUPPORT: This Level Decides Everything 🎯**

Current Price: **$1,960.65** (-13.54%)

And we're sitting on a **multi-year trendline.**

.

**📊 THE SITUATION:**

ETH is testing the **ascending channel support** (2W timeframe).

This trendline? Held since **2017.** 🔥

**Three major bounces:**

• 2020 low

• 2022 bear market bottom

• Right now (2025)

.

**🎯 WHAT HAPPENS NEXT:**

**If Support Holds ($1,900-$2,000):**

✅ Continuation of multi-year bull structure

✅ Target: Channel top (~$3,600+)

**If Support Breaks:**

❌ Breakdown = serious downside pressure

❌ Next stop: $

Current Price: **$1,960.65** (-13.54%)

And we're sitting on a **multi-year trendline.**

.

**📊 THE SITUATION:**

ETH is testing the **ascending channel support** (2W timeframe).

This trendline? Held since **2017.** 🔥

**Three major bounces:**

• 2020 low

• 2022 bear market bottom

• Right now (2025)

.

**🎯 WHAT HAPPENS NEXT:**

**If Support Holds ($1,900-$2,000):**

✅ Continuation of multi-year bull structure

✅ Target: Channel top (~$3,600+)

**If Support Breaks:**

❌ Breakdown = serious downside pressure

❌ Next stop: $

- Reward

- 2

- 5

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

2026 Go Go Go 👊View More

🚨🐋 #BitMineBuys40KETH

Big move in the market — BitMine has reportedly acquired 40,000 ETH 🔥

That’s a massive accumulation signal and the market is watching closely.

🔎 Why This Matters:

• Large ETH purchases often signal long-term confidence

• Whale activity can impact short-term price volatility

• Institutional accumulation strengthens market sentiment

At current price levels, 40K ETH represents serious capital commitment — not a small bet.

📊 Traders should monitor:

• ETH key resistance levels

• Volume spikes

• Broader market liquidity

Whales don’t move without a reason.

Is this a bullish

Big move in the market — BitMine has reportedly acquired 40,000 ETH 🔥

That’s a massive accumulation signal and the market is watching closely.

🔎 Why This Matters:

• Large ETH purchases often signal long-term confidence

• Whale activity can impact short-term price volatility

• Institutional accumulation strengthens market sentiment

At current price levels, 40K ETH represents serious capital commitment — not a small bet.

📊 Traders should monitor:

• ETH key resistance levels

• Volume spikes

• Broader market liquidity

Whales don’t move without a reason.

Is this a bullish

ETH1,52%

- Reward

- 9

- 9

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🌱 “Growth mindset activated! Learning so much from these posts.”View More

🚀🔥 #MegaETHMainnetIsLive 🔥🚀

A major milestone for the Ethereum ecosystem — MegaETH Mainnet has officially gone live!

This launch opens the door to:

⚡ Quicker transaction speeds

💸 Reduced network costs

🔗 Improved scalability

🌍 Greater potential for real-world use cases

Mainnet launches aren’t just technical events — they reflect ecosystem maturity, developer trust, and a long-term growth roadmap.

The key question now 👀

👉 Will user adoption and trading volume follow?

Smart traders should keep an eye on:

📊 Incoming liquidity

📊 New ecosystem collaborations

📊 Market and price behavior a

A major milestone for the Ethereum ecosystem — MegaETH Mainnet has officially gone live!

This launch opens the door to:

⚡ Quicker transaction speeds

💸 Reduced network costs

🔗 Improved scalability

🌍 Greater potential for real-world use cases

Mainnet launches aren’t just technical events — they reflect ecosystem maturity, developer trust, and a long-term growth roadmap.

The key question now 👀

👉 Will user adoption and trading volume follow?

Smart traders should keep an eye on:

📊 Incoming liquidity

📊 New ecosystem collaborations

📊 Market and price behavior a

ETH1,52%

- Reward

- 6

- 12

- Repost

- Share

repanzal :

:

Ape In 🚀View More

$ETH: The Foundation of the Programmable Economy

Ethereum continues to demonstrate why it remains the dominant force in the decentralized landscape. Currently, $ETH is navigating a critical consolidation phase, testing major support zones that have historically acted as springboards for significant upward moves. As the network transitions from a pure speculative asset to the primary settlement layer for global finance, the price action reflects a tug-of-war between short-term macro headwinds and long-term fundamental strength.

Technical Outlook:

Looking at the weekly charts, Ethereum is holdin

Ethereum continues to demonstrate why it remains the dominant force in the decentralized landscape. Currently, $ETH is navigating a critical consolidation phase, testing major support zones that have historically acted as springboards for significant upward moves. As the network transitions from a pure speculative asset to the primary settlement layer for global finance, the price action reflects a tug-of-war between short-term macro headwinds and long-term fundamental strength.

Technical Outlook:

Looking at the weekly charts, Ethereum is holdin

ETH1,52%

- Reward

- 1

- Comment

- Repost

- Share

#BitMineBuys40KETH 🚀💎

BitMine Immersion Technologies (BMNR) scooped up 40,302 ETH last

week—their biggest 2026 Ethereum buy yet—pushing total holdings past 4.3M

tokens (~3.58% of ETH supply) worth billions at current prices.

Power Moves

·

Staking Empire: 2.87M ETH

staked ($6.2B at $2,125/ETH), yielding ~$374M annually; MAVAN validator network

launches Q1 2026 for "best-in-class" returns.

·

Tom Lee's Bull Case: Chairman

predicts ETH explosion to $12K in 2026 via tokenization & adoption; recent

dips = buy opportunity amid 2.5M daily txns ATH.

·

Treasury Goals: Cash + c

BitMine Immersion Technologies (BMNR) scooped up 40,302 ETH last

week—their biggest 2026 Ethereum buy yet—pushing total holdings past 4.3M

tokens (~3.58% of ETH supply) worth billions at current prices.

Power Moves

·

Staking Empire: 2.87M ETH

staked ($6.2B at $2,125/ETH), yielding ~$374M annually; MAVAN validator network

launches Q1 2026 for "best-in-class" returns.

·

Tom Lee's Bull Case: Chairman

predicts ETH explosion to $12K in 2026 via tokenization & adoption; recent

dips = buy opportunity amid 2.5M daily txns ATH.

·

Treasury Goals: Cash + c

ETH1,52%

- Reward

- 2

- 2

- Repost

- Share

ShainingMoon :

:

Buy To Earn 💎View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

89.55K Popularity

8.41K Popularity

8.23K Popularity

55.11K Popularity

4.68K Popularity

261.77K Popularity

258.07K Popularity

17.17K Popularity

5.48K Popularity

4.02K Popularity

3.86K Popularity

4.47K Popularity

4.33K Popularity

33.05K Popularity

News

View MoreCZ: This year, some major Chinese competitors have been spending money to smear us, while other industry peers' competition remains relatively professional.

7 m

Data: If BTC drops below $66,242, the total long liquidation strength on mainstream CEXs will reach $1.117 billion.

10 m

Today, the Fear and Greed Index dropped to 8, and the market is in an "extreme fear" state.

11 m

Lighter has expanded the cross-margin mechanism to include the gold and silver markets.

17 m

Galaxy Digital Executive: The crypto market will not experience a V-shaped recovery; it will gradually rise after a period of volatility.

20 m

Pin