Mikhailovna

Below is a clean, professional, and fully detailed analysis of the ETH weekly chart you provided — in English as requested.

---

📊 Ethereum (ETH/USDT) — Weekly Timeframe Analysis

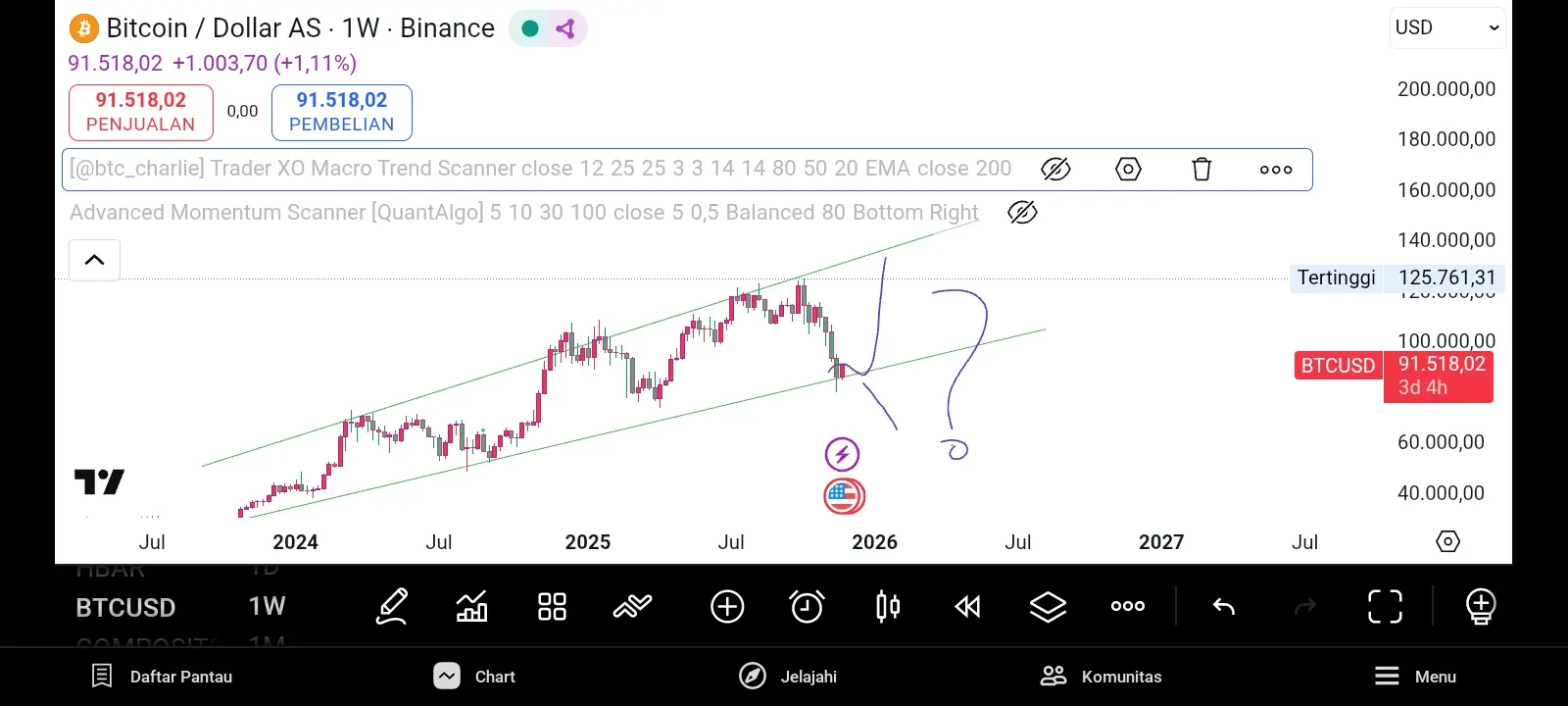

Your chart shows ETH moving inside a long-term ascending channel, respecting both:

Macro trendline support (bottom green line)

Macro trendline resistance (top green line)

ETH has once again bounced perfectly from the bottom trendline — the same area that triggered major rallies in the past.

This alone is already a strong bullish signal.

---

1️⃣ Macro Structure: ETH Repeating Its Classic Pattern

ETH appears to be formi

---

📊 Ethereum (ETH/USDT) — Weekly Timeframe Analysis

Your chart shows ETH moving inside a long-term ascending channel, respecting both:

Macro trendline support (bottom green line)

Macro trendline resistance (top green line)

ETH has once again bounced perfectly from the bottom trendline — the same area that triggered major rallies in the past.

This alone is already a strong bullish signal.

---

1️⃣ Macro Structure: ETH Repeating Its Classic Pattern

ETH appears to be formi

ETH-2.66%