Aguofthe

No content yet

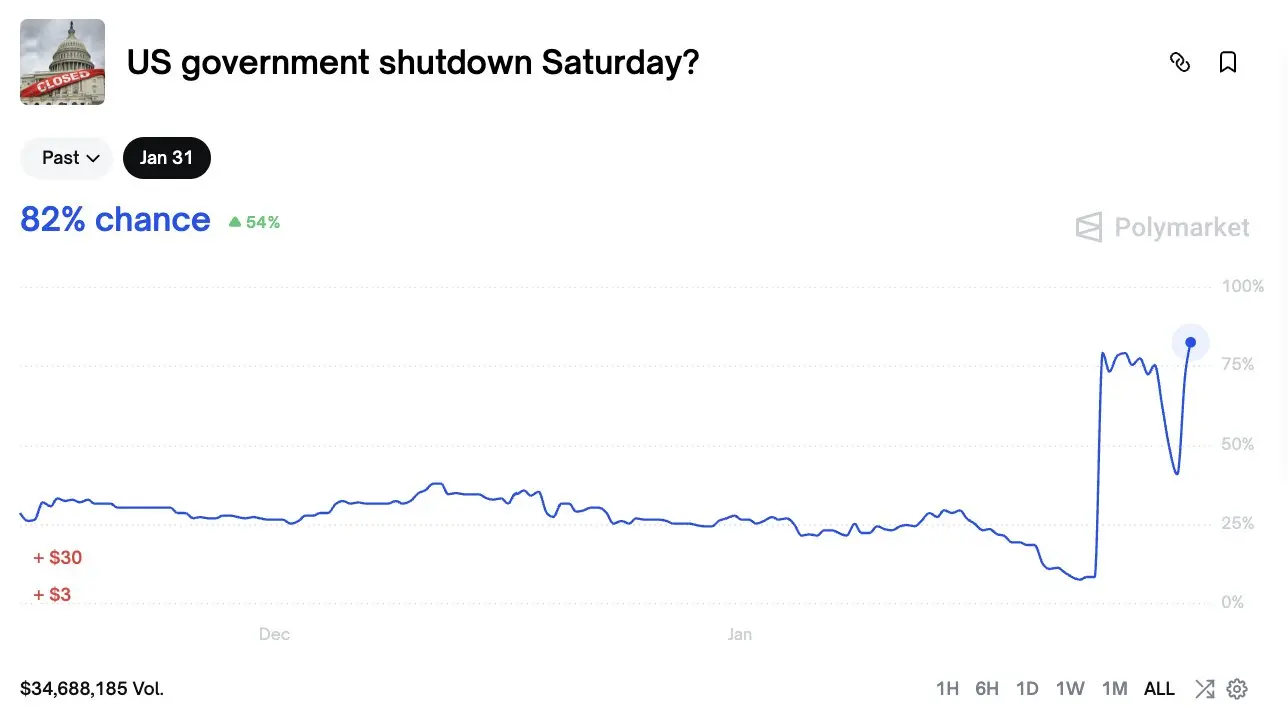

Senate officially passes bill to avoid US government shutdown.

#CryptoMarketPullback

#CryptoMarketPullback

- Reward

- like

- Comment

- Repost

- Share

#Nvidia and OpenAI's $100 Billion Investment Plan Suspended Nvidia's plan to invest up to $100 billion in the AI giant OpenAI has been halted due to strategic concerns from company management.

Nvidia CEO Jensen Huang expressed concerns about OpenAI's business strategy and its competitiveness against strong rivals like Google and Anthropic, leading to a deadlock in negotiations.

The uncertainty surrounding this massive, non-binding deal, expected to have a major impact on the technology world, could alter the course of capital flows in the sector.

$NVDAON

Nvidia CEO Jensen Huang expressed concerns about OpenAI's business strategy and its competitiveness against strong rivals like Google and Anthropic, leading to a deadlock in negotiations.

The uncertainty surrounding this massive, non-binding deal, expected to have a major impact on the technology world, could alter the course of capital flows in the sector.

$NVDAON

NVDAON0,16%

- Reward

- like

- Comment

- Repost

- Share

Polymarket odds show an 82% chance of a US government shutdown this Saturday as last-minute funding talks continue

- Reward

- like

- Comment

- Repost

- Share

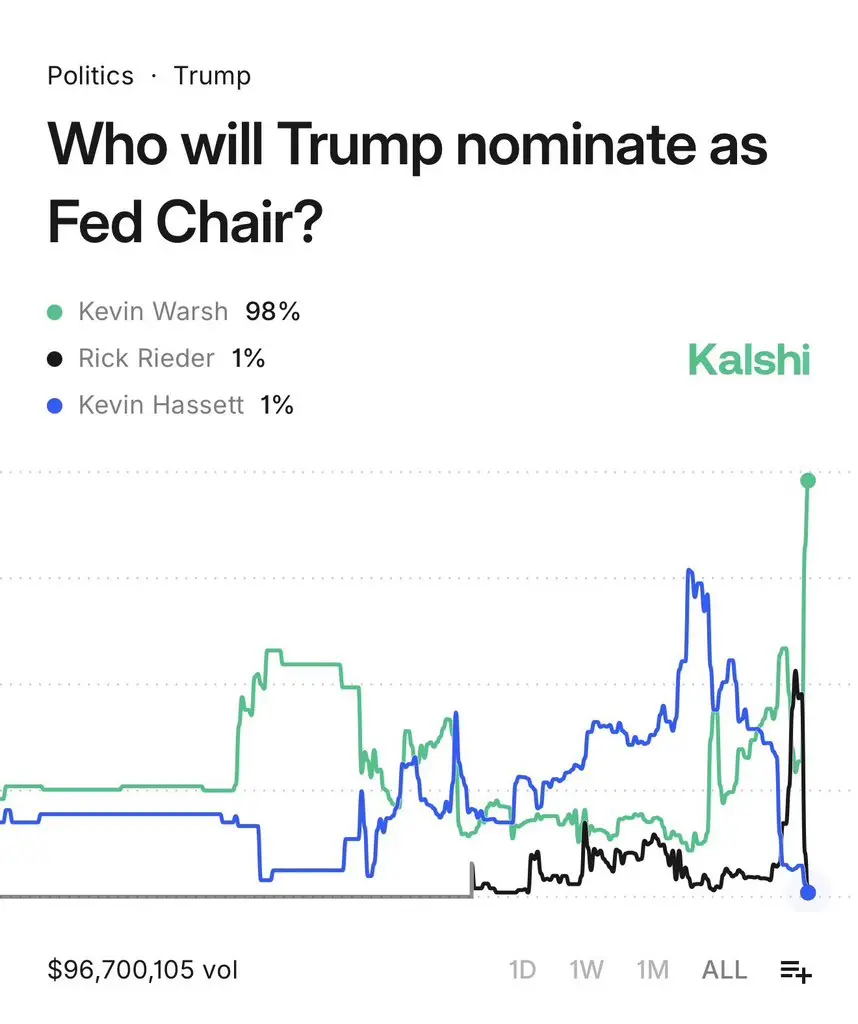

Nearly $100,000,000 was wagered on Fed Chair market, Kalshi traders priced Kevin Warsh at 75% before Trump announcement.

#FedKeepsRatesUnchanged

#FedKeepsRatesUnchanged

- Reward

- 2

- 1

- Repost

- Share

ybaser :

:

Buy To Earn 💎Trump announced Kevin Warsh as his nominee for FED Chairman.

Kevin Warsh is part of the advisory network at Electric Capital, a crypto/Web3-focused investment firm, where he provides support to Web3 founders in regulatory and financial strategy.

In 2018, he was among the investors in the algorithmic stablecoin project Basis (which later closed).

In 2021, he invested in and briefly served as an advisor to the crypto index fund company Bitwise.

Kevin Warsh is part of the advisory network at Electric Capital, a crypto/Web3-focused investment firm, where he provides support to Web3 founders in regulatory and financial strategy.

In 2018, he was among the investors in the algorithmic stablecoin project Basis (which later closed).

In 2021, he invested in and briefly served as an advisor to the crypto index fund company Bitwise.

- Reward

- like

- Comment

- Repost

- Share

US Senate blocks spending package, bringing government closer to shutdown.

#GoldBreaks$5,500

#CryptoMarketWatch

#GoldBreaks$5,500

#CryptoMarketWatch

- Reward

- like

- Comment

- Repost

- Share

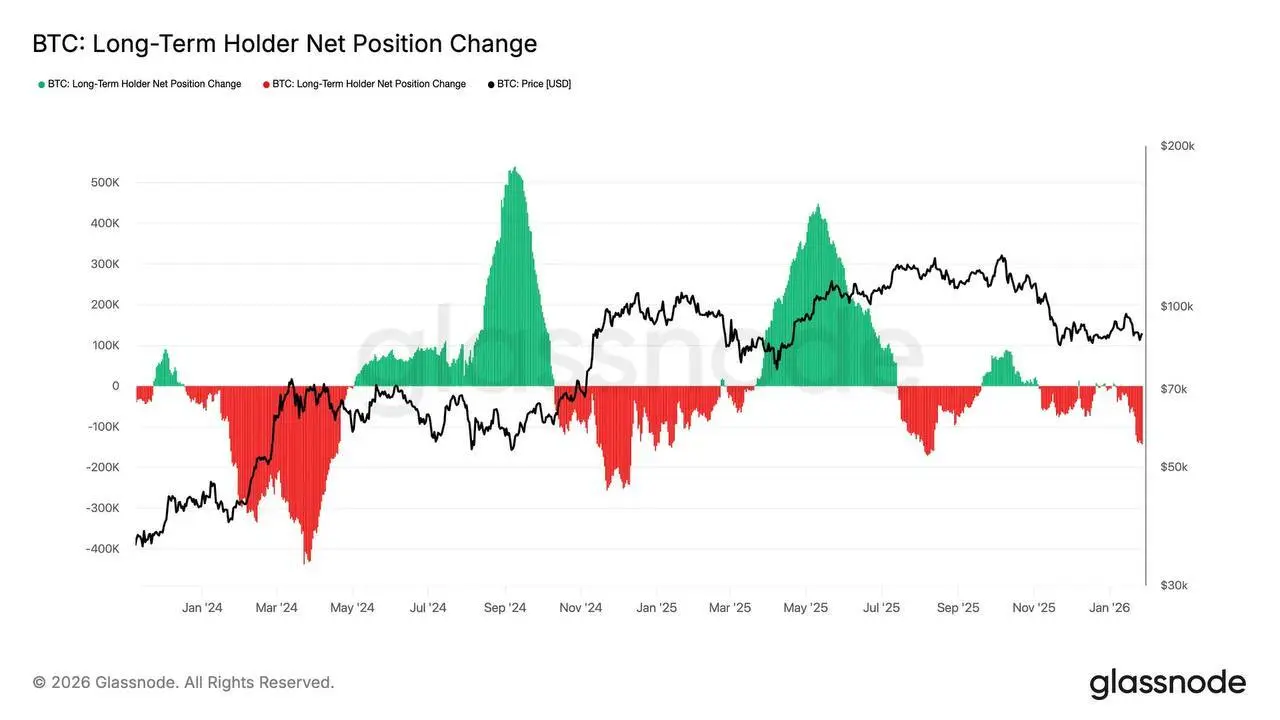

Glassnode data shows long-term Bitcoin holders sold about 143,000 $BTC in the past 30 days, the fastest pace since August.

$BTC

#BitcoinFallsBehindGold

$BTC

#BitcoinFallsBehindGold

BTC3,34%

- Reward

- like

- Comment

- Repost

- Share

FOMC will decide on interest rates today at 8pm ET, followed by Jerome Powell's speech at 8:30pm.

#FedRateDecisionApproaches

#FedRateDecisionApproaches

- Reward

- like

- Comment

- Repost

- Share

ODDS THE U.S. GOVERNMENT SHUTS DOWN THIS SATURDAY NEARS 80%

WOULD MARK THE FOURTH SHUTDOWN IN TRUMPS PRESIDENCY

WOULD MARK THE FOURTH SHUTDOWN IN TRUMPS PRESIDENCY

- Reward

- like

- Comment

- Repost

- Share

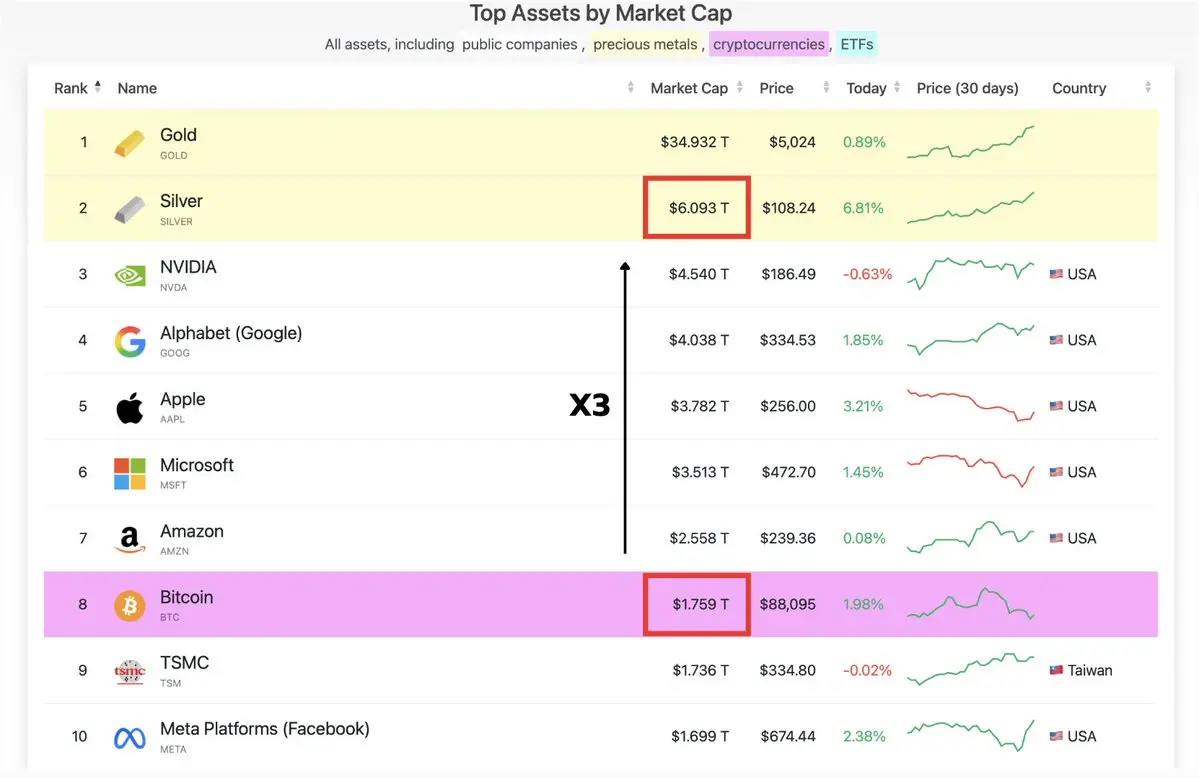

#Silver is now more than 3X the market cap of Bitcoin.

$SLVON $BTC

#GoldandSilverHitNewHighs

#BitcoinFallsBehindGold

$SLVON $BTC

#GoldandSilverHitNewHighs

#BitcoinFallsBehindGold

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

Bitmine's shareholders have approved a proposal to expand its authorized shares, giving the Ethereum treasury firm the option to issue new equity to potentially fund more $ETH purchases.

#CryptoMarketWatch

#CryptoMarketWatch

ETH4,81%

- Reward

- like

- Comment

- Repost

- Share

Denmark's Foreign Minister announced that they have rejected US President Donald Trump's request for negotiations regarding the takeover of Greenland.

#TariffTensionsHitCryptoMarket

#TariffTensionsHitCryptoMarket

- Reward

- like

- Comment

- Repost

- Share

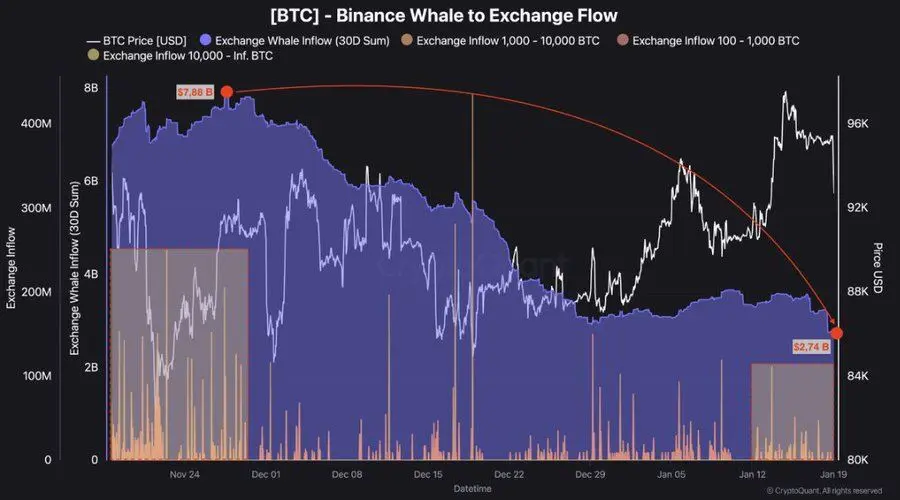

Whale selling pressure has sharply declined, with $BTC inflows to exchanges falling roughly 3x from late November levels, signaling large holders are no longer aggressively selling during the current consolidation phase.

#BTCMarketAnalysis

#BTCMarketAnalysis

BTC3,34%

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More154.27K Popularity

13.67K Popularity

394.19K Popularity

3.63K Popularity

16.29K Popularity

Pin