#BitcoinHitsBearMarketLow Bitcoin has once again fallen below the $72,000 support level, signaling a critical juncture for the crypto market. This breach is not just a technical event; it reflects heightened uncertainty among traders and investors, who are now questioning the sustainability of recent rallies. Volatility has spiked, and the sudden shift in sentiment underscores the fragility of market psychology. Every dip seems to trigger a wave of liquidations, particularly among leveraged traders, emphasizing that in highly leveraged environments, even small corrections can cascade into larger price swings.

From a technical standpoint, the $72,000 zone has historically served as a convergence point for multiple moving averages and a stabilization zone during prior pullbacks. Its failure has weakened short-term market structure and prompted a defensive reaction from participants. Liquidations of long positions have surged across major platforms, indicating that much of the current decline is driven by deleveraging rather than fundamental shifts in investor conviction. While this creates short-term pain, it also highlights the distinction between panic-driven selling and long-term distribution.

Market sentiment is currently polarized, with analysts divided over whether the recent decline represents a deep correction within a bull market or the start of a more prolonged downturn. Bearish perspectives focus on technical overextension, suggesting that unless Bitcoin quickly reclaims the $72,000–$72,500 range, deeper corrections to $70,000 or even $68,000 could occur. Optimistic analysts counter that this pullback aligns with historical patterns, where healthy adjustments of 20%-30% were common during prior bull phases, ultimately strengthening the long-term trend and setting the stage for renewed accumulation.

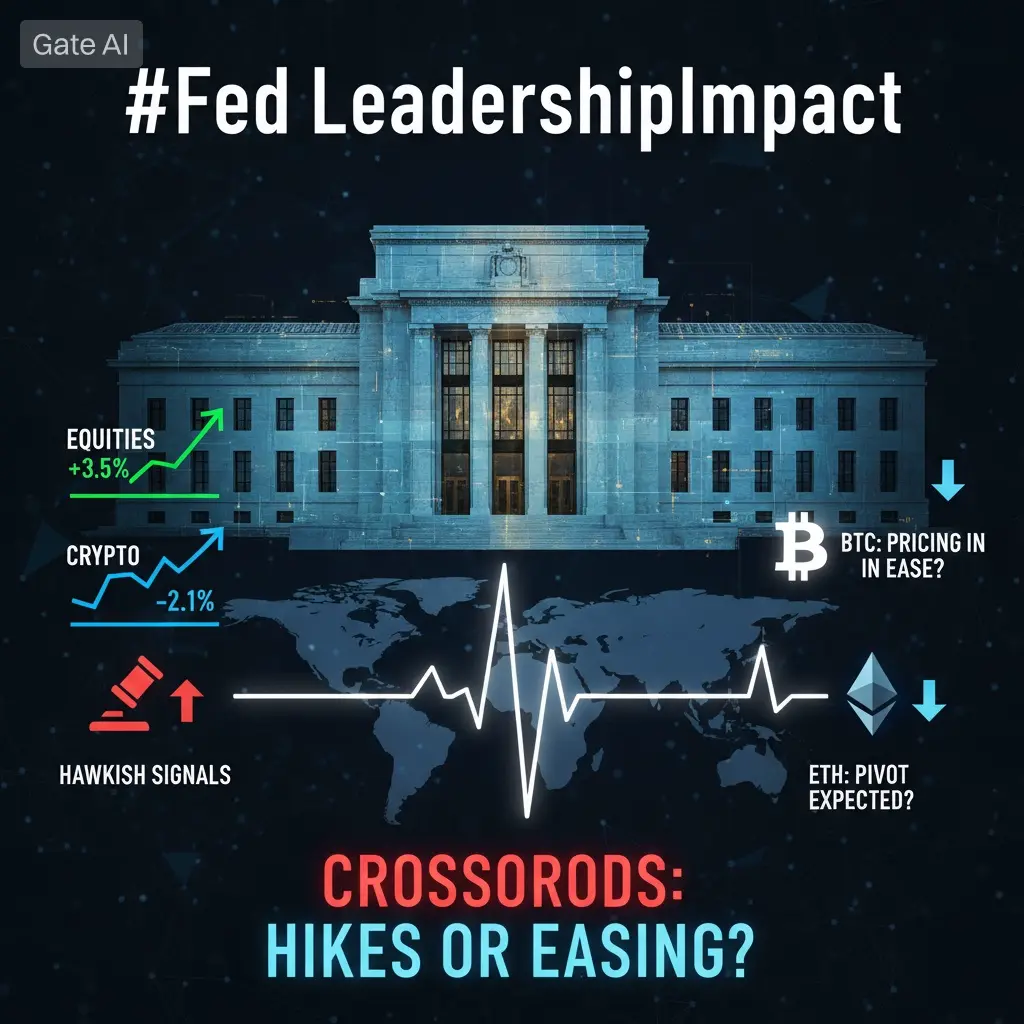

Several intertwined factors are influencing Bitcoin’s price action, creating a complex and dynamic market environment. Macroeconomic uncertainty remains prominent, with traders watching Federal Reserve policies, Treasury yields, and the dollar index closely. Any unexpected shift in interest rates or economic indicators could ripple through the crypto market, affecting risk appetite and liquidity availability. At the same time, regulatory developments continue to play a critical role, with potential new rules from both U.S. and European authorities impacting investor behavior and ETF activity.

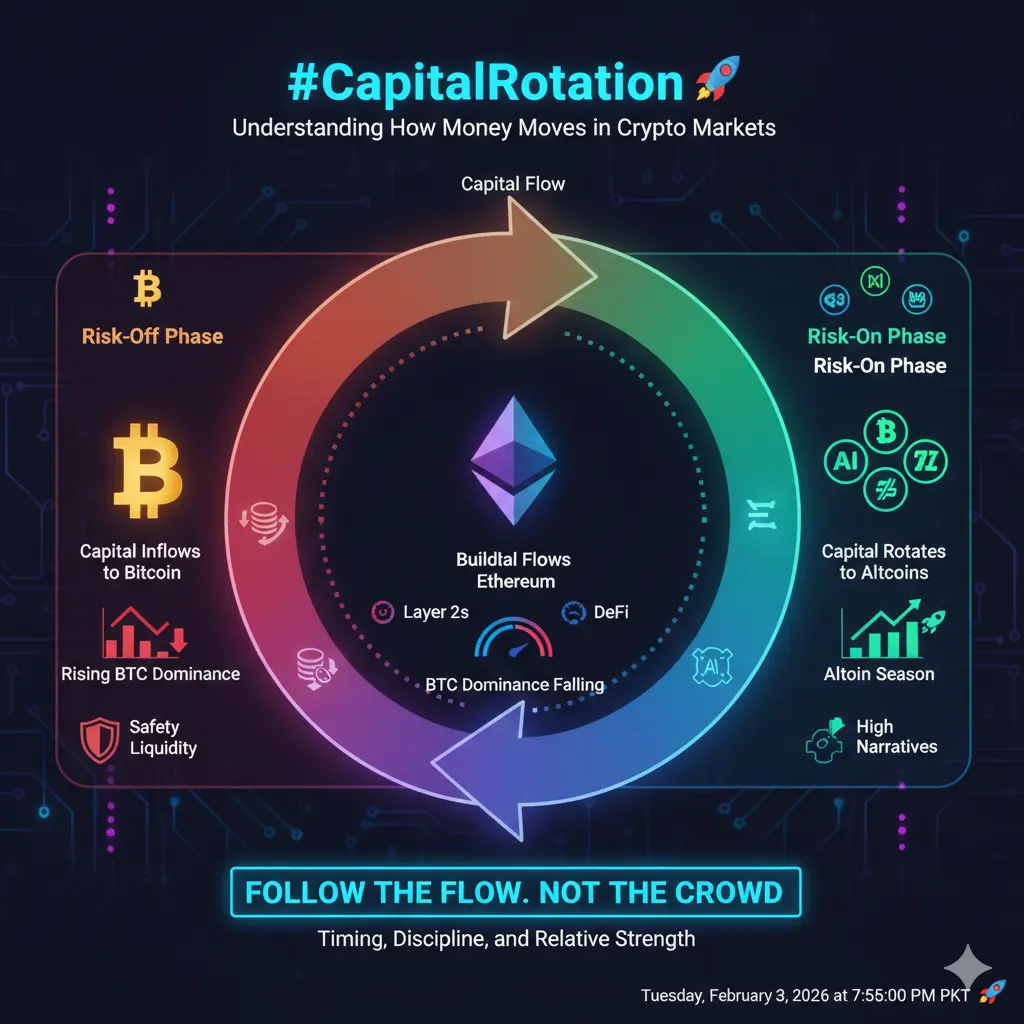

Capital flows provide another lens through which to assess market conditions. In recent weeks, net inflows into Bitcoin spot ETFs have slowed, occasionally turning negative, coinciding with price retracements. Meanwhile, the discount rate of certain large Bitcoin trusts has narrowed, suggesting that selling pressure is easing in some corners of the market. On-chain metrics, including exchange reserves, long-term holder activity, and large transaction frequency, indicate that a substantial portion of supply remains dormant, implying that foundational demand may remain intact despite short-term turbulence.

Technically, Bitcoin is at a decisive point. The $70,000–$72,000 range will likely dictate near-term market behavior. If support holds here, a consolidation phase could develop, creating the conditions for a technical rebound toward $74,000–$75,000. However, if the market fails to stabilize, deeper support zones around $65,000–$68,000, identified through Fibonacci retracement and historical trading activity, will become the next battleground. These zones have historically acted as accumulation points, suggesting that patient investors could use them as structured entry opportunities.

Three potential scenarios are emerging in the near term. The first is a rapid rebound, where Bitcoin regains $72,000 within 24–48 hours, signaling that the decline is primarily a short-term technical correction. The second scenario involves continued correction, where breaking below $70,000 triggers additional stop-loss selling and downward momentum toward $65,000–$68,000. The third scenario is an extended consolidation, with prices oscillating between $70,000–$72,000 as the market digests recent gains, maintaining high volatility but reducing the likelihood of a sharp, one-way move.

For long-term investors, this environment reinforces the importance of strategic patience. Phased accumulation near key support levels, rather than lump-sum investment, can reduce exposure to short-term swings and allow capital to be deployed efficiently as conditions evolve. Diversification across different crypto assets and even non-crypto instruments helps mitigate the impact of any single asset’s volatility on overall portfolio performance, balancing risk with potential reward.

Leverage management is particularly critical in periods of heightened volatility. High leverage amplifies gains but equally magnifies losses, and the current surge in liquidations underscores the dangers of overexposure. Traders and investors should focus on risk-adjusted entries, ensuring that exposure aligns with liquidity capacity and overall strategy. Avoiding emotional trades and maintaining clear thresholds for stop-loss and position sizing can preserve capital during turbulent phases.

Ultimately, the key to navigating this market lies in disciplined observation and selective action. Understanding how macro, technical, and on-chain factors interact allows investors to anticipate potential turning points and respond effectively without succumbing to panic. Whether Bitcoin stabilizes in the $70,000–$72,000 range, tests lower supports, or begins a new upward trajectory, the principles of patience, liquidity preservation, and evidence-based decision-making will continue to provide the strongest foundation for long-term success.

From a technical standpoint, the $72,000 zone has historically served as a convergence point for multiple moving averages and a stabilization zone during prior pullbacks. Its failure has weakened short-term market structure and prompted a defensive reaction from participants. Liquidations of long positions have surged across major platforms, indicating that much of the current decline is driven by deleveraging rather than fundamental shifts in investor conviction. While this creates short-term pain, it also highlights the distinction between panic-driven selling and long-term distribution.

Market sentiment is currently polarized, with analysts divided over whether the recent decline represents a deep correction within a bull market or the start of a more prolonged downturn. Bearish perspectives focus on technical overextension, suggesting that unless Bitcoin quickly reclaims the $72,000–$72,500 range, deeper corrections to $70,000 or even $68,000 could occur. Optimistic analysts counter that this pullback aligns with historical patterns, where healthy adjustments of 20%-30% were common during prior bull phases, ultimately strengthening the long-term trend and setting the stage for renewed accumulation.

Several intertwined factors are influencing Bitcoin’s price action, creating a complex and dynamic market environment. Macroeconomic uncertainty remains prominent, with traders watching Federal Reserve policies, Treasury yields, and the dollar index closely. Any unexpected shift in interest rates or economic indicators could ripple through the crypto market, affecting risk appetite and liquidity availability. At the same time, regulatory developments continue to play a critical role, with potential new rules from both U.S. and European authorities impacting investor behavior and ETF activity.

Capital flows provide another lens through which to assess market conditions. In recent weeks, net inflows into Bitcoin spot ETFs have slowed, occasionally turning negative, coinciding with price retracements. Meanwhile, the discount rate of certain large Bitcoin trusts has narrowed, suggesting that selling pressure is easing in some corners of the market. On-chain metrics, including exchange reserves, long-term holder activity, and large transaction frequency, indicate that a substantial portion of supply remains dormant, implying that foundational demand may remain intact despite short-term turbulence.

Technically, Bitcoin is at a decisive point. The $70,000–$72,000 range will likely dictate near-term market behavior. If support holds here, a consolidation phase could develop, creating the conditions for a technical rebound toward $74,000–$75,000. However, if the market fails to stabilize, deeper support zones around $65,000–$68,000, identified through Fibonacci retracement and historical trading activity, will become the next battleground. These zones have historically acted as accumulation points, suggesting that patient investors could use them as structured entry opportunities.

Three potential scenarios are emerging in the near term. The first is a rapid rebound, where Bitcoin regains $72,000 within 24–48 hours, signaling that the decline is primarily a short-term technical correction. The second scenario involves continued correction, where breaking below $70,000 triggers additional stop-loss selling and downward momentum toward $65,000–$68,000. The third scenario is an extended consolidation, with prices oscillating between $70,000–$72,000 as the market digests recent gains, maintaining high volatility but reducing the likelihood of a sharp, one-way move.

For long-term investors, this environment reinforces the importance of strategic patience. Phased accumulation near key support levels, rather than lump-sum investment, can reduce exposure to short-term swings and allow capital to be deployed efficiently as conditions evolve. Diversification across different crypto assets and even non-crypto instruments helps mitigate the impact of any single asset’s volatility on overall portfolio performance, balancing risk with potential reward.

Leverage management is particularly critical in periods of heightened volatility. High leverage amplifies gains but equally magnifies losses, and the current surge in liquidations underscores the dangers of overexposure. Traders and investors should focus on risk-adjusted entries, ensuring that exposure aligns with liquidity capacity and overall strategy. Avoiding emotional trades and maintaining clear thresholds for stop-loss and position sizing can preserve capital during turbulent phases.

Ultimately, the key to navigating this market lies in disciplined observation and selective action. Understanding how macro, technical, and on-chain factors interact allows investors to anticipate potential turning points and respond effectively without succumbing to panic. Whether Bitcoin stabilizes in the $70,000–$72,000 range, tests lower supports, or begins a new upward trajectory, the principles of patience, liquidity preservation, and evidence-based decision-making will continue to provide the strongest foundation for long-term success.