# الفائدة

5.41K

BasheerAlgundubi

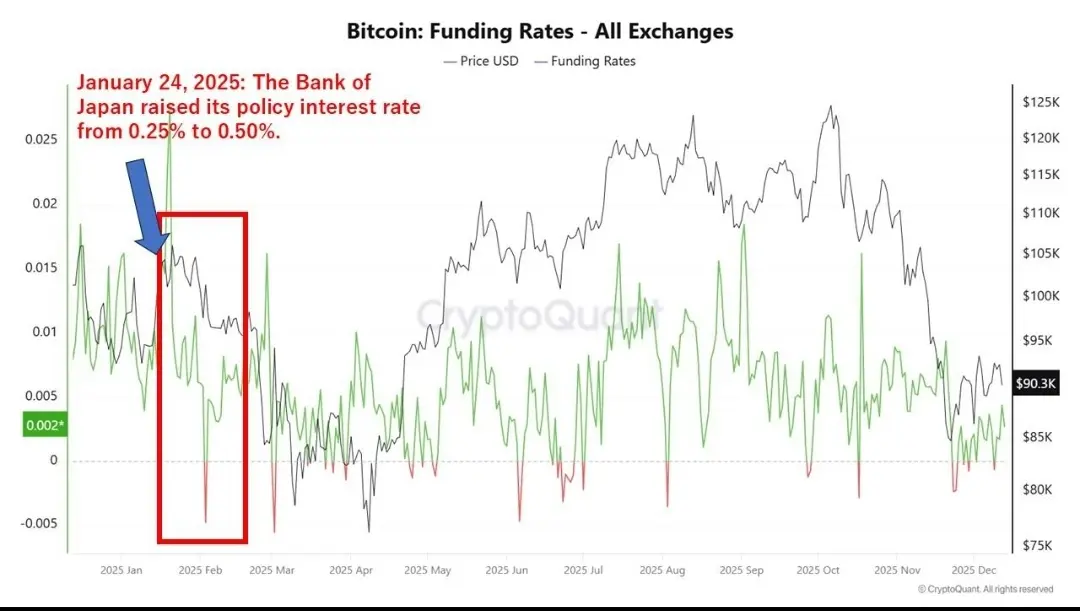

Bitcoin is already priced in with the Federal Reserve's rate hike!

Prices #البيتكوين indicate that the market has already adjusted to the Fed's expected rate increase on the 19th of the month.

• Selling pressure #الفائدة began before the official announcement.

• Trading inflows on platforms increased early, indicating that #Bitcoin are reducing risks in advance.

• Funding rates have already decreased, meaning that #المستثمرين are lowering leverage early.

• Unlike previous rate hikes, there is no sudden panic around the announcement.

• It has been expected that the Fed would shift toward a

View OriginalPrices #البيتكوين indicate that the market has already adjusted to the Fed's expected rate increase on the 19th of the month.

• Selling pressure #الفائدة began before the official announcement.

• Trading inflows on platforms increased early, indicating that #Bitcoin are reducing risks in advance.

• Funding rates have already decreased, meaning that #المستثمرين are lowering leverage early.

• Unlike previous rate hikes, there is no sudden panic around the announcement.

• It has been expected that the Fed would shift toward a

- Reward

- 4

- Comment

- Repost

- Share

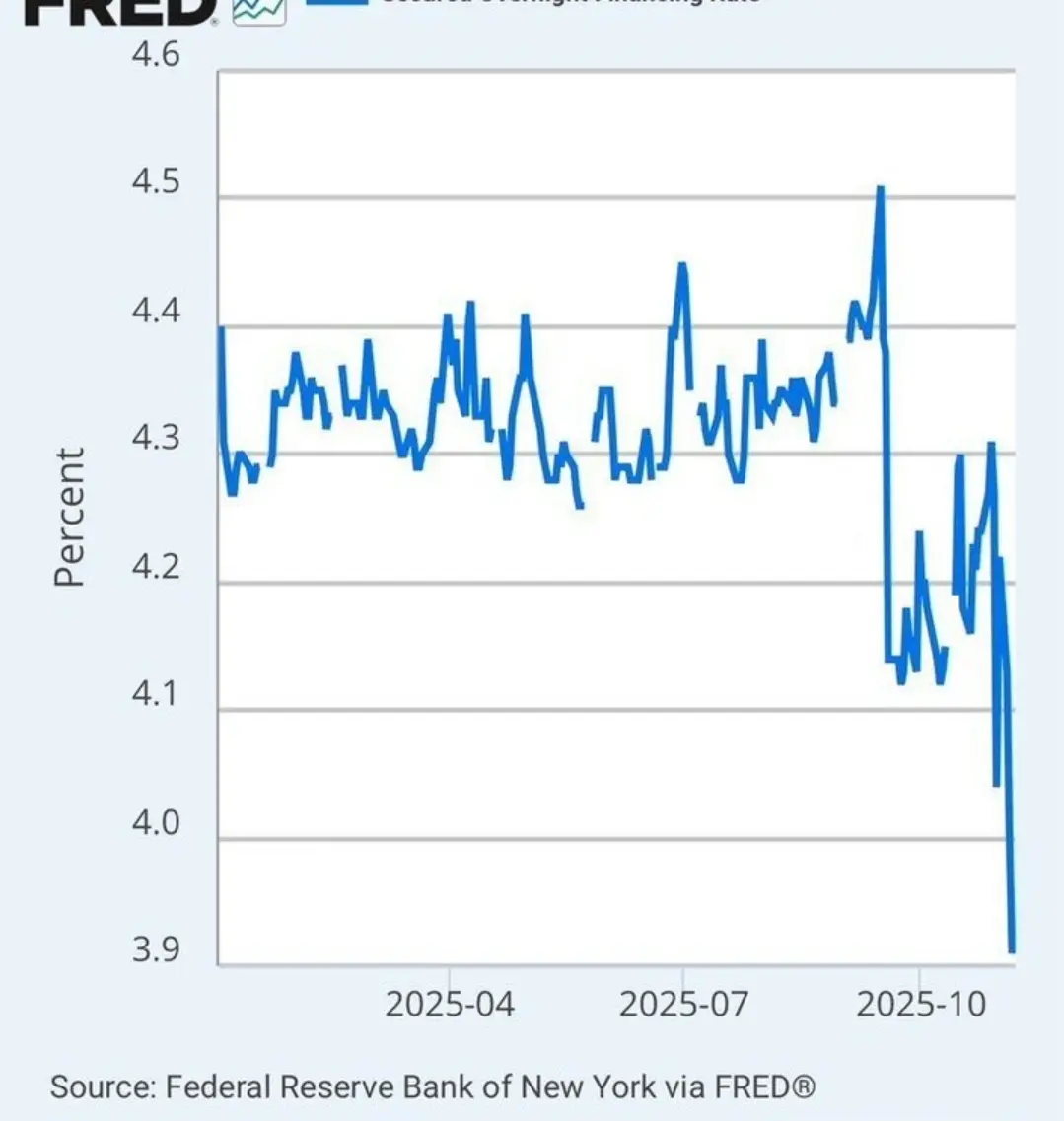

The price of #الفائدة on overnight secured financing (#SOFR ) is decreasing: low-cost borrowing in the future

When the interest rate on overnight secured financing (SOFR) decreases, large institutions can borrow overnight at a lower cost using Treasury bonds as collateral.

This often leads to rising asset prices and increased market activity. Digital assets and #اقتراض tend to benefit first.

Monitor liquidity, not headlines – the interest rate on overnight secured financing often leads the market by weeks.

According to the Federal Reserve Bank of New York, the interest rate on overnight sec

View OriginalWhen the interest rate on overnight secured financing (SOFR) decreases, large institutions can borrow overnight at a lower cost using Treasury bonds as collateral.

This often leads to rising asset prices and increased market activity. Digital assets and #اقتراض tend to benefit first.

Monitor liquidity, not headlines – the interest rate on overnight secured financing often leads the market by weeks.

According to the Federal Reserve Bank of New York, the interest rate on overnight sec

- Reward

- 9

- 4

- Repost

- Share

SCORPIONKING :

:

very very excellent 👍👍View More

In recent hours, the price of Bitcoin has dropped below 88,000, with analysts blaming the FOMC tensions.

#البيتكوين price fluctuated as the weekly trading candle closed.

The price of Bitcoin fell below $88,000 as volatility returned, with the #BTCUSDT /USD pair dropping by $2,000 in just two hours. This move ended a quiet weekend and opened the door for a new CME futures gap—a pattern that the market has consistently "filled" over the past six months, according to traders on platform X.

According to trader Kila, Monday sessions often set the week's trend. If the weekend doesn't produce a pric

View Original#البيتكوين price fluctuated as the weekly trading candle closed.

The price of Bitcoin fell below $88,000 as volatility returned, with the #BTCUSDT /USD pair dropping by $2,000 in just two hours. This move ended a quiet weekend and opened the door for a new CME futures gap—a pattern that the market has consistently "filled" over the past six months, according to traders on platform X.

According to trader Kila, Monday sessions often set the week's trend. If the weekend doesn't produce a pric

- Reward

- 7

- Comment

- Repost

- Share

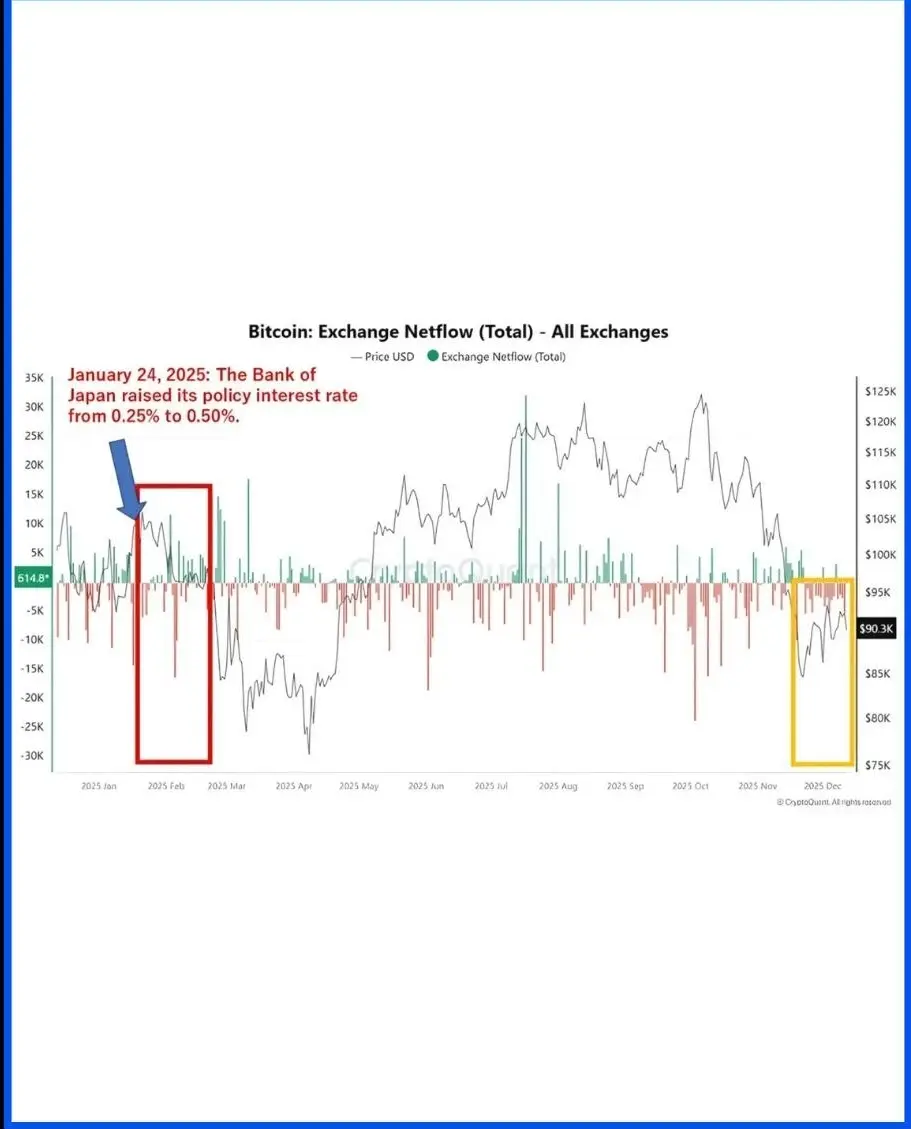

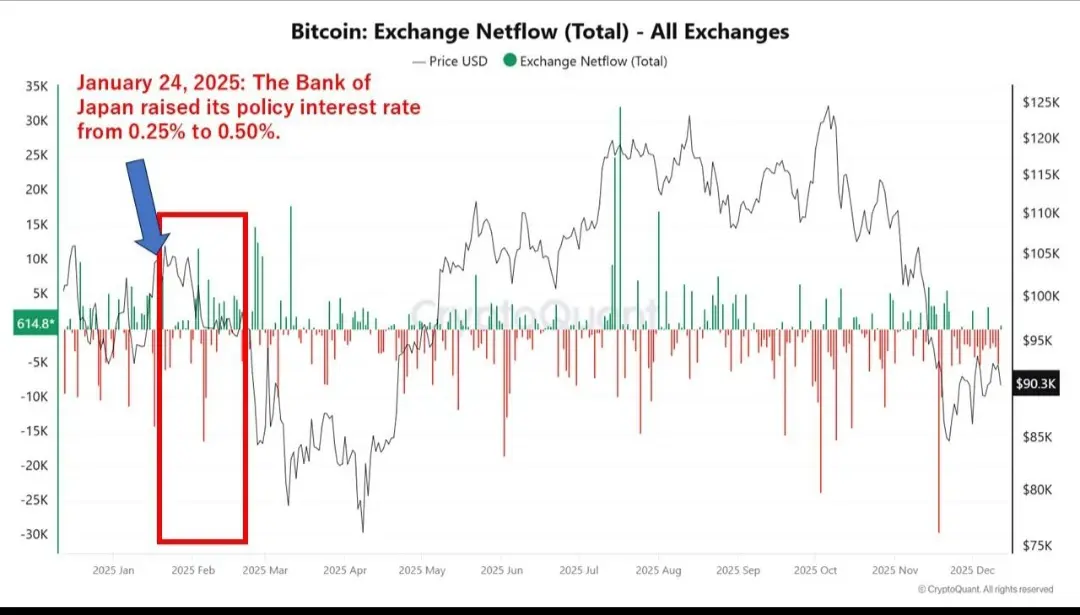

Why have the markets experienced volatility this week?

The volatility this week did not come out of nowhere.

Markets are reacting to expectations that the Bank of Japan will abandon its highly accommodative monetary policy, which poses a temporary obstacle to #البيتكوين .

We have seen this scenario before.

📅 January 24, 2025 — The Bank of Japan raised #الفائدة rates from 0.25% to 0.50% — what happened next?

- #Bitcoin was moved to trading platforms ( in preparation for risks )

- Funding rates ( decreased )

- The price dropped — but did not break its long-term structure

And now 👀 the same s

View OriginalThe volatility this week did not come out of nowhere.

Markets are reacting to expectations that the Bank of Japan will abandon its highly accommodative monetary policy, which poses a temporary obstacle to #البيتكوين .

We have seen this scenario before.

📅 January 24, 2025 — The Bank of Japan raised #الفائدة rates from 0.25% to 0.50% — what happened next?

- #Bitcoin was moved to trading platforms ( in preparation for risks )

- Funding rates ( decreased )

- The price dropped — but did not break its long-term structure

And now 👀 the same s

- Reward

- 2

- 1

- Repost

- Share

BasheerAlgundubi :

:

Wait and see cautiously 🔍#بيتكوين rally at Christmas: Watch the Fed 🎅

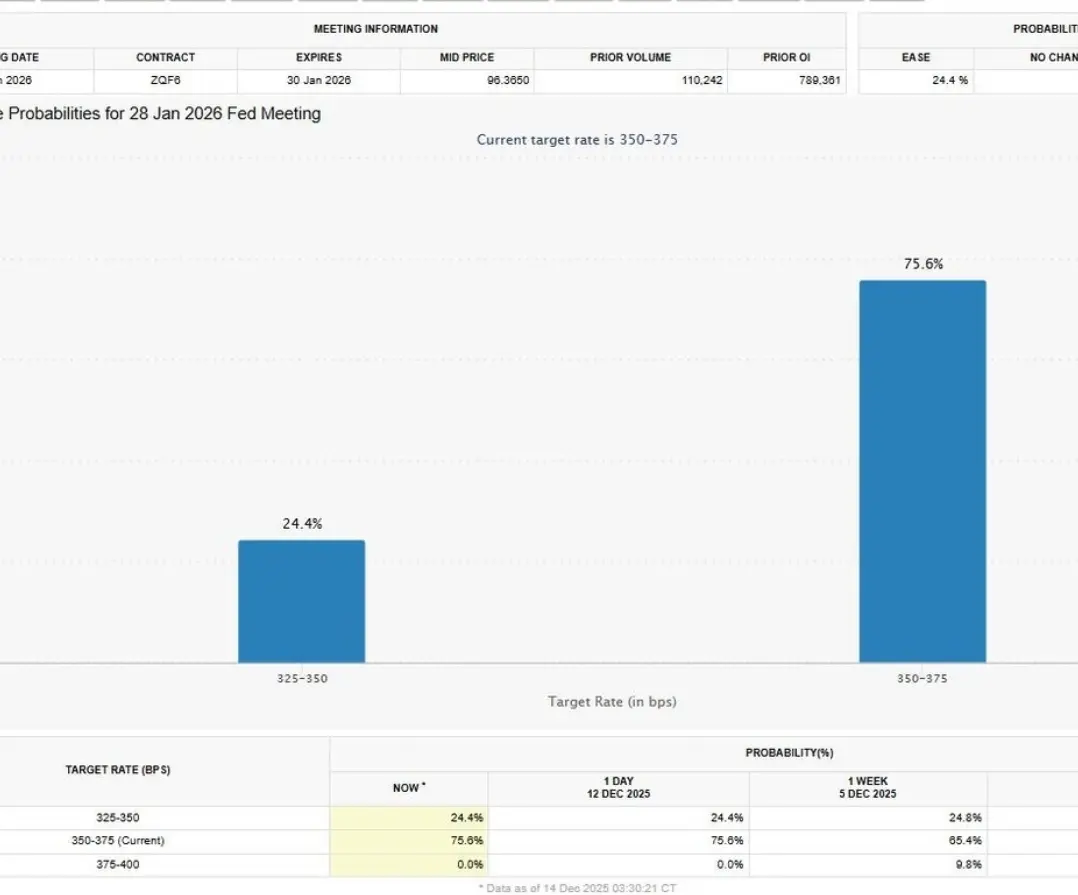

All eyes are on the Fed's decision. 90% odds of #الفائدة rate cuts and improved liquidity—two key drivers for a December recovery.

Risks remain: Any hawkish comments from Powell could limit upside potential.

A rate cut on December 10 as quantitative easing ends could unleash a Christmas rally and build momentum into 2026.

Support increases: Speculation that Kevin Hassett may lead the #الفيدرالي Reserve in 2026, signaling a more cautious shift.

#FOMCWatch #BTCVSGOLD

$BTC

$ETH

$GT

View OriginalAll eyes are on the Fed's decision. 90% odds of #الفائدة rate cuts and improved liquidity—two key drivers for a December recovery.

Risks remain: Any hawkish comments from Powell could limit upside potential.

A rate cut on December 10 as quantitative easing ends could unleash a Christmas rally and build momentum into 2026.

Support increases: Speculation that Kevin Hassett may lead the #الفيدرالي Reserve in 2026, signaling a more cautious shift.

#FOMCWatch #BTCVSGOLD

$BTC

$ETH

$GT

- Reward

- 1

- 1

- Repost

- Share

BasheerAlgundubi :

:

ترقب بحذر 🔍📌 #Bitcoin Drops below $90,000.. Will economic data restore momentum to the cryptocurrency market?

-#BTC Falls below the $90,000 level after weekend selling pressure, down about 29% from its all-time high of $127,000

-The "#XRP " token drops to $2, while #الإيثيريوم rises to $3,147 by 1.2%.

-Investors are watching US employment and inflation data this week, which could increase the chances of a #الفائدة rate cut in January and boost the recovery of the cryptocurrency market

-The markets are currently pricing in only a 27% chance of a quarter-point rate cut, making the impact of upcoming d

View Original-#BTC Falls below the $90,000 level after weekend selling pressure, down about 29% from its all-time high of $127,000

-The "#XRP " token drops to $2, while #الإيثيريوم rises to $3,147 by 1.2%.

-Investors are watching US employment and inflation data this week, which could increase the chances of a #الفائدة rate cut in January and boost the recovery of the cryptocurrency market

-The markets are currently pricing in only a 27% chance of a quarter-point rate cut, making the impact of upcoming d

- Reward

- 1

- 1

- Repost

- Share

BasheerAlgundubi :

:

Go full throttle 🚀The Federal Open Market Committee will make a decision #تذكير regarding a rate cut #الفيدرالية today at 2:00 PM Eastern Time.

The market expects an 88% probability of a 25 basis point interest rate cut.

At 2:30 PM Eastern Time, Powell's press conference will begin.

If Powell hints at quantitative easing and further rate cuts, markets will see a sharp rise.

#الفائدة #FOMCWatch

#FederalReserve $BTC

$ETH

$SOL

View OriginalThe market expects an 88% probability of a 25 basis point interest rate cut.

At 2:30 PM Eastern Time, Powell's press conference will begin.

If Powell hints at quantitative easing and further rate cuts, markets will see a sharp rise.

#الفائدة #FOMCWatch

#FederalReserve $BTC

$ETH

$SOL

- Reward

- 2

- 1

- Repost

- Share

LittleLittleLittleCalami :

:

Is this a signal to take off?$5 trillion in debt, and still rising; is #البيتكوين a safe haven?

Consumer debt in the United States has risen to $5.08 trillion; of which $1.32 trillion is in credit cards, and $3.77 trillion in auto and student loans.

Since 2020, Americans have added nearly $1 trillion in new debt, while credit card interest rates have remained around 23%, even after #الفائدة Federal rate cuts.

Inflation continues to rise, and debt keeps piling up.

Source: Kobe, issiL, etter

#Bitcoin currency is still emerging as a hedge against the collapse of the monetary system. As Young Hoon Kim (the person with the

View OriginalConsumer debt in the United States has risen to $5.08 trillion; of which $1.32 trillion is in credit cards, and $3.77 trillion in auto and student loans.

Since 2020, Americans have added nearly $1 trillion in new debt, while credit card interest rates have remained around 23%, even after #الفائدة Federal rate cuts.

Inflation continues to rise, and debt keeps piling up.

Source: Kobe, issiL, etter

#Bitcoin currency is still emerging as a hedge against the collapse of the monetary system. As Young Hoon Kim (the person with the

- Reward

- 1

- Comment

- Repost

- Share

Key US Data This Week, including the #المستهلك Price Index, may determine the trajectory of cryptocurrencies 👀

US #الوظائف data and a drop in the Consumer Price Index next week; these are the same figures that influence the Federal Reserve's rate cuts, liquidity, and cryptocurrency prices.

📅 Key Data #الفيدرالي 8:30 AM Eastern Time(:

• Employment Report: Tuesday, December 16

• Consumer Price Index Inflation: Thursday, December 18

Positive or negative economic data could change the likelihood of a quick rate cut.

📉 Negative Data )Drop (, Weak Labor Market#التضخم ← Higher chances of rate c

View OriginalUS #الوظائف data and a drop in the Consumer Price Index next week; these are the same figures that influence the Federal Reserve's rate cuts, liquidity, and cryptocurrency prices.

📅 Key Data #الفيدرالي 8:30 AM Eastern Time(:

• Employment Report: Tuesday, December 16

• Consumer Price Index Inflation: Thursday, December 18

Positive or negative economic data could change the likelihood of a quick rate cut.

📉 Negative Data )Drop (, Weak Labor Market#التضخم ← Higher chances of rate c

- Reward

- 1

- 1

- Repost

- Share

BasheerAlgundubi :

:

Key US data this week, including the Consumer Price Index, could set the course for cryptocurrencies 👀All eyes are on the #الفائدة US decision tonight, along with the press conference that may reveal the outline of the upcoming phase. Markets are prepared for any change in #الفيدرالي 's tone… A decisive night for gold and the dollar.

#FOMCWatch

#CPIWatch

$SUI

$ADA

$LTC

View Original#FOMCWatch

#CPIWatch

$SUI

$ADA

$LTC

- Reward

- 2

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

12.16K Popularity

22.9K Popularity

16.48K Popularity

7.8K Popularity

99.9K Popularity

8.04K Popularity

2.79K Popularity

3.86K Popularity

90.68K Popularity

37.36K Popularity

108.21K Popularity

793.08K Popularity

223.53K Popularity

4.51K Popularity

238.99K Popularity

News

View MoreBABY (Babylon) increased by 15.01% in the last 24 hours

1 m

ZKP (zkPass) increased by 63.21% in 24 hours, currently trading at $0.20

6 m

Solana Mobile announces that the native token SKR will be launched on January 21

8 m

Kalshi CEO: The Venezuela insider event mainly involves unregulated offshore prediction platforms. Kalshi strictly prohibits insider trading.

11 m

Solana Mobile: SKR tokens will be launched on January 21

11 m

Pin