# CapitalRotation

2.17K

Trading patterns are shifting during the pullback. Where do you see capital leaning right now?

Korean_Girl

#CapitalRotation

📊 Crypto Market Capital Rotation: Total Market, Bitcoin, and Sector Shifts (With Price Reference)

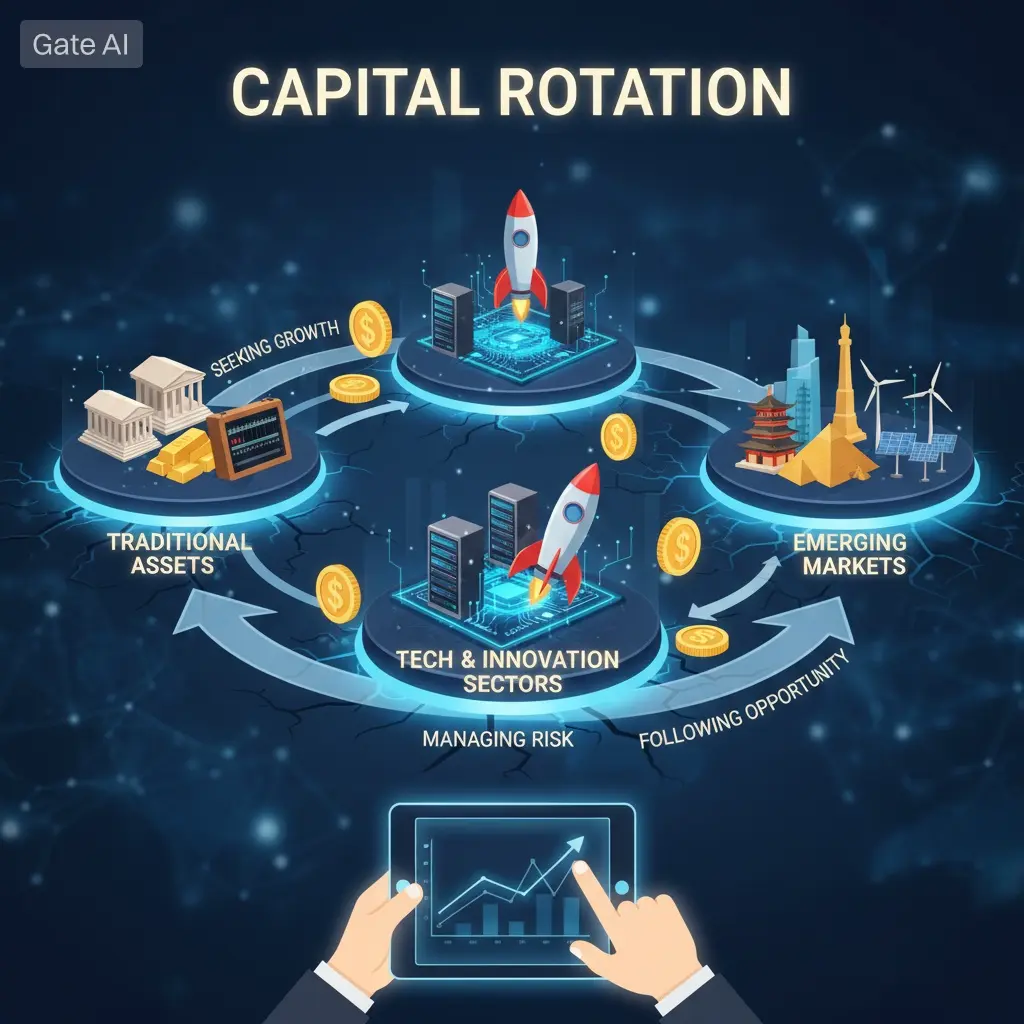

Capital rotation is one of the most powerful forces shaping crypto markets — it’s the movement of capital between Bitcoin, altcoins, stablecoins, and emerging sectors.

🧠 1. What Is Capital Rotation?

Capital rotation refers to the redistribution of capital from one part of the market to another — not just random price movement, but money shifting from one asset category into another based on risk appetite, performance, sentiment, technical signals, or macro catalysts.

In crypto

📊 Crypto Market Capital Rotation: Total Market, Bitcoin, and Sector Shifts (With Price Reference)

Capital rotation is one of the most powerful forces shaping crypto markets — it’s the movement of capital between Bitcoin, altcoins, stablecoins, and emerging sectors.

🧠 1. What Is Capital Rotation?

Capital rotation refers to the redistribution of capital from one part of the market to another — not just random price movement, but money shifting from one asset category into another based on risk appetite, performance, sentiment, technical signals, or macro catalysts.

In crypto

- Reward

- 2

- 1

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊#CapitalRotation

📊 Crypto Market Capital Rotation: Total Market, Bitcoin, and Sector Shifts (With Price Reference)

Capital rotation is one of the most powerful forces shaping crypto markets — it’s the movement of capital between Bitcoin, altcoins, stablecoins, and emerging sectors.

🧠 1. What Is Capital Rotation?

Capital rotation refers to the redistribution of capital from one part of the market to another — not just random price movement, but money shifting from one asset category into another based on risk appetite, performance, sentiment, technical signals, or macro catalysts.

In crypto

📊 Crypto Market Capital Rotation: Total Market, Bitcoin, and Sector Shifts (With Price Reference)

Capital rotation is one of the most powerful forces shaping crypto markets — it’s the movement of capital between Bitcoin, altcoins, stablecoins, and emerging sectors.

🧠 1. What Is Capital Rotation?

Capital rotation refers to the redistribution of capital from one part of the market to another — not just random price movement, but money shifting from one asset category into another based on risk appetite, performance, sentiment, technical signals, or macro catalysts.

In crypto

- Reward

- 8

- 10

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

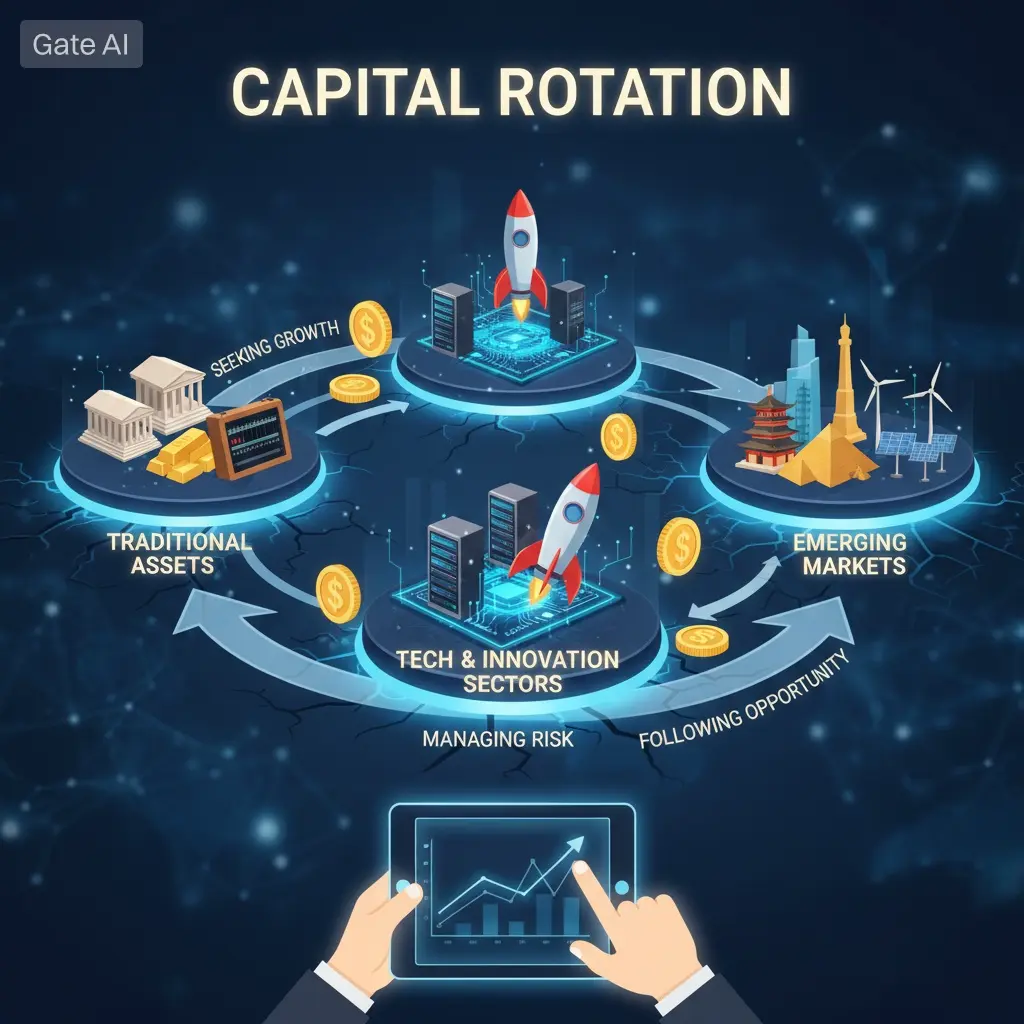

#CapitalRotation captures the flow of investor funds across different crypto assets, reflecting shifts in market sentiment, risk appetite, and sector preference. This phenomenon occurs when capital moves from one cryptocurrency or asset class to another, often in search of higher returns, diversification, or perceived safety. In early February 2026, the crypto market has been witnessing notable capital rotation from Bitcoin (BTC) into Ethereum (ETH) and several high-potential altcoins like Cardano (ADA) and Solana (SOL). Bitcoin, trading in a consolidation range of $75,000–$78,000, has seen re

- Reward

- 2

- Comment

- Repost

- Share

#CapitalRotation captures the flow of investor funds across different crypto assets, reflecting shifts in market sentiment, risk appetite, and sector preference. This phenomenon occurs when capital moves from one cryptocurrency or asset class to another, often in search of higher returns, diversification, or perceived safety. In early February 2026, the crypto market has been witnessing notable capital rotation from Bitcoin (BTC) into Ethereum (ETH) and several high-potential altcoins like Cardano (ADA) and Solana (SOL). Bitcoin, trading in a consolidation range of $75,000–$78,000, has seen re

- Reward

- 6

- 8

- Repost

- Share

HighAmbition :

:

1000x VIbes 🤑View More

#CapitalRotation

Capital rotation is becoming one of the most defining forces in the current crypto market, placing firmly in focus today. Rather than moving as a single unified wave, capital is now shifting selectively between assets, sectors, and narratives. This behavior typically emerges during periods of uncertainty or transition, where investors seek relative strength instead of broad exposure. As overall market momentum cools, the flow of capital offers valuable clues about where confidence is building and which areas are temporarily being left behind.

From a market structure standpoin

Capital rotation is becoming one of the most defining forces in the current crypto market, placing firmly in focus today. Rather than moving as a single unified wave, capital is now shifting selectively between assets, sectors, and narratives. This behavior typically emerges during periods of uncertainty or transition, where investors seek relative strength instead of broad exposure. As overall market momentum cools, the flow of capital offers valuable clues about where confidence is building and which areas are temporarily being left behind.

From a market structure standpoin

BTC-0,39%

- Reward

- 3

- 7

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#CapitalRotation 📉 Market Update: Shifting Patterns During the Pullback

The market is showing a subtle but important rotation as the recent pullback unfolds. Trading patterns are no longer uniform — capital is leaning in different directions based on risk appetite, structural opportunity, and relative strength.

Key Observations:

Altcoin Divergence: Not all altcoins are moving in sync. While some are correcting sharply, others are holding key support zones or showing resilience. Selective exposure matters more than broad bets.

Bitcoin & Major Assets: BTC is consolidating around key levels. Tra

The market is showing a subtle but important rotation as the recent pullback unfolds. Trading patterns are no longer uniform — capital is leaning in different directions based on risk appetite, structural opportunity, and relative strength.

Key Observations:

Altcoin Divergence: Not all altcoins are moving in sync. While some are correcting sharply, others are holding key support zones or showing resilience. Selective exposure matters more than broad bets.

Bitcoin & Major Assets: BTC is consolidating around key levels. Tra

BTC-0,39%

- Reward

- 2

- 1

- Repost

- Share

Yusfirah :

:

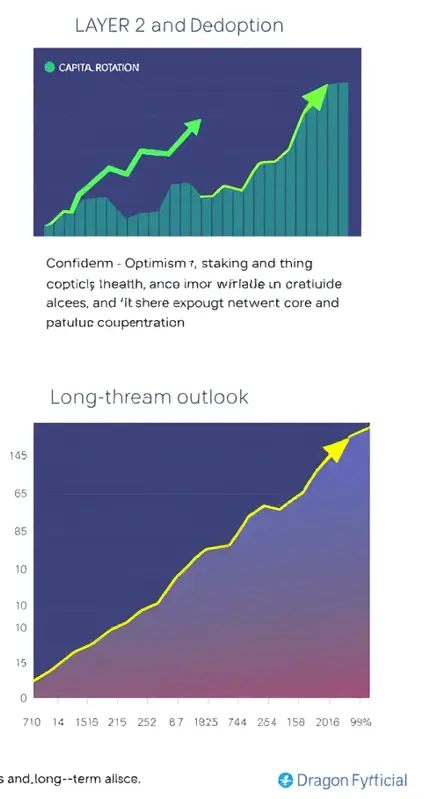

2026 GOGOGO 👊⚡ Trading Patterns Shifting During Pullback – Dragon Fly Official

Current Market Snapshot:

Markets are experiencing a pullback, with ETH and major altcoins showing choppy price action.

Trading patterns are shifting as capital rotates between assets, sectors, and risk profiles.

📉 Dragon Fly Official Analysis: Price vs Capital Flow

Price Signals (Dragon Fly Official):

Pullback is causing short-term indecision; price is testing key support zones.

Volatility is rising, creating opportunities for attentive traders.

Capital Flow & Fundamentals (Dragon Fly Official):

Capital rotation is visible: som

Current Market Snapshot:

Markets are experiencing a pullback, with ETH and major altcoins showing choppy price action.

Trading patterns are shifting as capital rotates between assets, sectors, and risk profiles.

📉 Dragon Fly Official Analysis: Price vs Capital Flow

Price Signals (Dragon Fly Official):

Pullback is causing short-term indecision; price is testing key support zones.

Volatility is rising, creating opportunities for attentive traders.

Capital Flow & Fundamentals (Dragon Fly Official):

Capital rotation is visible: som

- Reward

- 8

- 7

- Repost

- Share

DragonFlyOfficial :

:

“Markets are shifting during this pullback — where do you see capital leaning right now? I’m watching ETH and Layer-2s closely for emerging leaders. Share your perspective! 🔥View More

#CapitalRotation

Capital rotation is the movement of liquidity from one sector of the crypto market to another. Currently, we are seeing a three-stage shift that is putting unique pressure on the market:

1. The Flight to "Quality" Yield

As global interest rates stabilize in early 2026, capital is rotating out of high-risk, low-utility "meme" coins and back into Yield-Bearing Assets. Because Ethereum offers native staking rewards (projected to be more stable following the Glamsterdam upgrade), institutional desks are rotating their stablecoin reserves back into ETH to capture the 3-4% "real" y

Capital rotation is the movement of liquidity from one sector of the crypto market to another. Currently, we are seeing a three-stage shift that is putting unique pressure on the market:

1. The Flight to "Quality" Yield

As global interest rates stabilize in early 2026, capital is rotating out of high-risk, low-utility "meme" coins and back into Yield-Bearing Assets. Because Ethereum offers native staking rewards (projected to be more stable following the Glamsterdam upgrade), institutional desks are rotating their stablecoin reserves back into ETH to capture the 3-4% "real" y

- Reward

- 5

- 5

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#CapitalRotation Shifting Flows Across Crypto Markets

Market dynamics this February are highlighting a clear theme: capital rotation. Investors and traders are increasingly reallocating positions across Bitcoin, Ethereum, and major altcoins such as XRP, DOGE, and SUI, seeking relative strength, tactical opportunities, and improved risk-adjusted returns. Understanding these flows is critical, as rotation often precedes larger trends and signals potential shifts in market leadership.

Bitcoin as the Core Anchor

BTC continues to act as the primary reserve asset and risk anchor for the crypto mark

Market dynamics this February are highlighting a clear theme: capital rotation. Investors and traders are increasingly reallocating positions across Bitcoin, Ethereum, and major altcoins such as XRP, DOGE, and SUI, seeking relative strength, tactical opportunities, and improved risk-adjusted returns. Understanding these flows is critical, as rotation often precedes larger trends and signals potential shifts in market leadership.

Bitcoin as the Core Anchor

BTC continues to act as the primary reserve asset and risk anchor for the crypto mark

- Reward

- 6

- 4

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

# CapitalRotation

🔄 Capital

Rotation: Where is the Money Flowing?

As the market cools off, smart money is on the move.

Trading patterns are clearly shifting, and the current "pullback" is

revealing where investors feel most safe—or where they see the next bargain. 💸

The big question is: Where do you see capital

leaning right now?

👇 Let us know

your take:

🛡️ Stablecoins:

Rotating to USDT/USDC to wait it out? 🪙 Bitcoin:

Swinging back to BTC as the relative safe haven? 📈 Specific

Narratives: Moving capital into resilient sectors (e.g., AI, RWA)? 🏦

TradFi: Jumping ship to Gold or Stocks

🔄 Capital

Rotation: Where is the Money Flowing?

As the market cools off, smart money is on the move.

Trading patterns are clearly shifting, and the current "pullback" is

revealing where investors feel most safe—or where they see the next bargain. 💸

The big question is: Where do you see capital

leaning right now?

👇 Let us know

your take:

🛡️ Stablecoins:

Rotating to USDT/USDC to wait it out? 🪙 Bitcoin:

Swinging back to BTC as the relative safe haven? 📈 Specific

Narratives: Moving capital into resilient sectors (e.g., AI, RWA)? 🏦

TradFi: Jumping ship to Gold or Stocks

BTC-0,39%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

378.84K Popularity

7.45K Popularity

7.3K Popularity

4.28K Popularity

2.83K Popularity

4.81K Popularity

2.8K Popularity

3.24K Popularity

2.17K Popularity

23 Popularity

54.45K Popularity

72.75K Popularity

20.38K Popularity

26.61K Popularity

219.71K Popularity

News

View MoreKorean regulatory agency expands AI system to track cryptocurrency manipulation activities

34 m

Bloomberg: SpaceX is in advanced talks to merge with xAI, and the merger announcement could be made as early as this week.

37 m

Opinion: The crypto bear market cycle is expected to reverse by 2026, with Bitcoin potentially bottoming out around $60,000.

47 m

Michael Saylor: Strategy has accumulated a total of 713,502 BTC, with an average purchase price of approximately $76,052.

50 m

Spot gold prices briefly surged past $4,800 per ounce, breaking through the short-term resistance level.

1 h

Pin