# What’sNextforBitcoin?

13.56K

Peacefulheart

#What’sNextforBitcoin? Mid-February 2026 Market Outlook (Feb 15 Update) 📊

Bitcoin has continued its rebound from the $65K dip, solidifying above the $70,000 psychological barrier. The past 48–72 hours have seen a dramatic shift in market sentiment—from “Extreme Fear” to Aggressive Accumulation—as macro signals, on-chain flows, and institutional activity align in favor of BTC.

📈 The Bullish Momentum

Several factors are driving the upside:

Macro Tailwinds:

US Core CPI hit a 4-year low of 2.5%, reinforcing hopes of a March Fed rate cut. Lower rates traditionally fuel crypto rallies by reducing

Bitcoin has continued its rebound from the $65K dip, solidifying above the $70,000 psychological barrier. The past 48–72 hours have seen a dramatic shift in market sentiment—from “Extreme Fear” to Aggressive Accumulation—as macro signals, on-chain flows, and institutional activity align in favor of BTC.

📈 The Bullish Momentum

Several factors are driving the upside:

Macro Tailwinds:

US Core CPI hit a 4-year low of 2.5%, reinforcing hopes of a March Fed rate cut. Lower rates traditionally fuel crypto rallies by reducing

- Reward

- 2

- 2

- Repost

- Share

Lock_433 :

:

LFG 🔥View More

Reset or Re-Accumulation? The 2026 Inflection Point

Bitcoin is hovering in the $66,000–$70,000 range in mid-2026, stabilizing after the sharp correction from the $126,000 peak seen in October 2025.

This is no longer a simple pullback.

It’s a structural test.

And unlike previous cycles, this one is not primarily about halving mechanics.

It’s about liquidity and institutional capital flows.

1️⃣ The Post-Halving Reality: Supply Shock Is Marginal

Following the 2024 halving, daily new issuance dropped to roughly 450 BTC.

Mathematically, the supply shock effect is now limited.

Price discovery is inc

Bitcoin is hovering in the $66,000–$70,000 range in mid-2026, stabilizing after the sharp correction from the $126,000 peak seen in October 2025.

This is no longer a simple pullback.

It’s a structural test.

And unlike previous cycles, this one is not primarily about halving mechanics.

It’s about liquidity and institutional capital flows.

1️⃣ The Post-Halving Reality: Supply Shock Is Marginal

Following the 2024 halving, daily new issuance dropped to roughly 450 BTC.

Mathematically, the supply shock effect is now limited.

Price discovery is inc

BTC0,23%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- 1

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

The屯hexagram indicates a chance for growth; don't be impatient during sideways trading. Only after sixty thousand units should you start building your position.🚀 #What’sNextforBitcoin? (Feb 15, 2026 Update)

Bitcoin has staged a dramatic comeback, reclaiming the $70,000 psychological barrier after a brief but intense dip to $65,000. The market sentiment has shifted from "Extreme Fear" to "Aggressive Accumulation."

📈 The Bull Case:

Macro Tailwind: With US Core CPI hitting a 4-year low (2.5%), the market is now pricing in a 40% chance of a Fed rate cut in March. Lower rates traditionally fuel crypto bull runs.

Short Squeeze: Over $365M in liquidations hit the market in the last 48 hours as bears were caught off guard by the $70k breakout.

Resistance

Bitcoin has staged a dramatic comeback, reclaiming the $70,000 psychological barrier after a brief but intense dip to $65,000. The market sentiment has shifted from "Extreme Fear" to "Aggressive Accumulation."

📈 The Bull Case:

Macro Tailwind: With US Core CPI hitting a 4-year low (2.5%), the market is now pricing in a 40% chance of a Fed rate cut in March. Lower rates traditionally fuel crypto bull runs.

Short Squeeze: Over $365M in liquidations hit the market in the last 48 hours as bears were caught off guard by the $70k breakout.

Resistance

BTC0,23%

- Reward

- 1

- 1

- Repost

- Share

Crypto_Exper :

:

follow me brother I will follow back we should support each other 🥰✅#What’sNextforBitcoin?

As of today (February 15, 2026), Bitcoin is trading around $69,000–$71,000 USD, reflecting ongoing volatility after recent swings between roughly $65,000 and $74,000. Its price has pulled back significantly from the all-time highs above $120,000 seen last year and remains well below that peak, but it continues to attract attention from traders and investors reacting to market sentiment and broader economic conditions. This level indicates that Bitcoin is still a major global digital asset with a market capitalization in the trillions, yet it faces both bullish hopes and

As of today (February 15, 2026), Bitcoin is trading around $69,000–$71,000 USD, reflecting ongoing volatility after recent swings between roughly $65,000 and $74,000. Its price has pulled back significantly from the all-time highs above $120,000 seen last year and remains well below that peak, but it continues to attract attention from traders and investors reacting to market sentiment and broader economic conditions. This level indicates that Bitcoin is still a major global digital asset with a market capitalization in the trillions, yet it faces both bullish hopes and

BTC0,23%

- Reward

- 4

- 3

- Repost

- Share

Ryakpanda :

:

Wishing you great wealth in the Year of the Horse 🐴View More

#What’sNextforBitcoin?

#What’s Next for Bitcoin? – Full Detailed Analysis in 5 Topics

1️⃣ Current Market Trend of Bitcoin

Bitcoin remains the world’s largest and most dominant cryptocurrency. Its price moves in cycles — bullish (uptrend) and bearish (downtrend).

🔹 What is happening now?

Market volatility is still high.

Institutional investors are active.

Price reacts strongly to global news and economic data.

🔹 Short-Term Outlook:

Possible consolidation (sideways movement).

Breakout depends on volume and global liquidity.

🔹 Long-Term Outlook:

Historically, Bitcoin follows a 4-year cycle li

#What’s Next for Bitcoin? – Full Detailed Analysis in 5 Topics

1️⃣ Current Market Trend of Bitcoin

Bitcoin remains the world’s largest and most dominant cryptocurrency. Its price moves in cycles — bullish (uptrend) and bearish (downtrend).

🔹 What is happening now?

Market volatility is still high.

Institutional investors are active.

Price reacts strongly to global news and economic data.

🔹 Short-Term Outlook:

Possible consolidation (sideways movement).

Breakout depends on volume and global liquidity.

🔹 Long-Term Outlook:

Historically, Bitcoin follows a 4-year cycle li

BTC0,23%

- Reward

- 2

- 3

- Repost

- Share

AltafTrader :

:

LFG 🔥View More

🚀 #What’sNextforBitcoin? (Feb 15, 2026 Update)

Bitcoin has staged a dramatic comeback, reclaiming the $70,000 psychological barrier after a brief but intense dip to $65,000. The market sentiment has shifted from "Extreme Fear" to "Aggressive Accumulation."

📈 The Bull Case:

Macro Tailwind: With US Core CPI hitting a 4-year low (2.5%), the market is now pricing in a 40% chance of a Fed rate cut in March. Lower rates traditionally fuel crypto bull runs.

Short Squeeze: Over $365M in liquidations hit the market in the last 48 hours as bears were caught off guard by the $70k breakout.

Resistance

Bitcoin has staged a dramatic comeback, reclaiming the $70,000 psychological barrier after a brief but intense dip to $65,000. The market sentiment has shifted from "Extreme Fear" to "Aggressive Accumulation."

📈 The Bull Case:

Macro Tailwind: With US Core CPI hitting a 4-year low (2.5%), the market is now pricing in a 40% chance of a Fed rate cut in March. Lower rates traditionally fuel crypto bull runs.

Short Squeeze: Over $365M in liquidations hit the market in the last 48 hours as bears were caught off guard by the $70k breakout.

Resistance

BTC0,23%

- Reward

- like

- Comment

- Repost

- Share

#What’sNextforBitcoin? 🚀

As the crypto market moves into a new phase of maturity, one big question dominates discussions across trading floors, online forums, and institutional boardrooms alike: What’s next for Bitcoin? After years of volatility, explosive growth, corrections, and renewed optimism, Bitcoin continues to stand at the center of the global digital asset revolution.

Bitcoin has already proven its resilience. From surviving multiple bear markets to facing regulatory scrutiny worldwide, it has consistently rebounded stronger. Historically, Bitcoin moves in cycles—periods of rapid ex

As the crypto market moves into a new phase of maturity, one big question dominates discussions across trading floors, online forums, and institutional boardrooms alike: What’s next for Bitcoin? After years of volatility, explosive growth, corrections, and renewed optimism, Bitcoin continues to stand at the center of the global digital asset revolution.

Bitcoin has already proven its resilience. From surviving multiple bear markets to facing regulatory scrutiny worldwide, it has consistently rebounded stronger. Historically, Bitcoin moves in cycles—periods of rapid ex

BTC0,23%

- Reward

- like

- Comment

- Repost

- Share

#What’sNextforBitcoin? 🚀 #What’sNextforBitcoin? (Feb 15 Update)

Bitcoin has successfully reclaimed the $70,000 level today, surging as high as $70,434! The market is finally breathing a sigh of relief after a "brutal" stretch of liquidations.

📊 The Current Setup:

Price Check: BTC is trading around $70,200, up 2% in the last 24 hours.

The "CPI" Fuel: The latest US inflation data (2.4% vs 2.5% expected) acted as a rocket fuel, reviving hopes for a Federal Reserve rate cut as early as April.

Sentiment Shift: We have moved away from the "Extreme Fear" lows of 5/100 seen earlier this month. Inves

Bitcoin has successfully reclaimed the $70,000 level today, surging as high as $70,434! The market is finally breathing a sigh of relief after a "brutal" stretch of liquidations.

📊 The Current Setup:

Price Check: BTC is trading around $70,200, up 2% in the last 24 hours.

The "CPI" Fuel: The latest US inflation data (2.4% vs 2.5% expected) acted as a rocket fuel, reviving hopes for a Federal Reserve rate cut as early as April.

Sentiment Shift: We have moved away from the "Extreme Fear" lows of 5/100 seen earlier this month. Inves

BTC0,23%

- Reward

- 5

- 7

- Repost

- Share

AYATTAC :

:

LFG 🔥View More

#What’sNextforBitcoin?

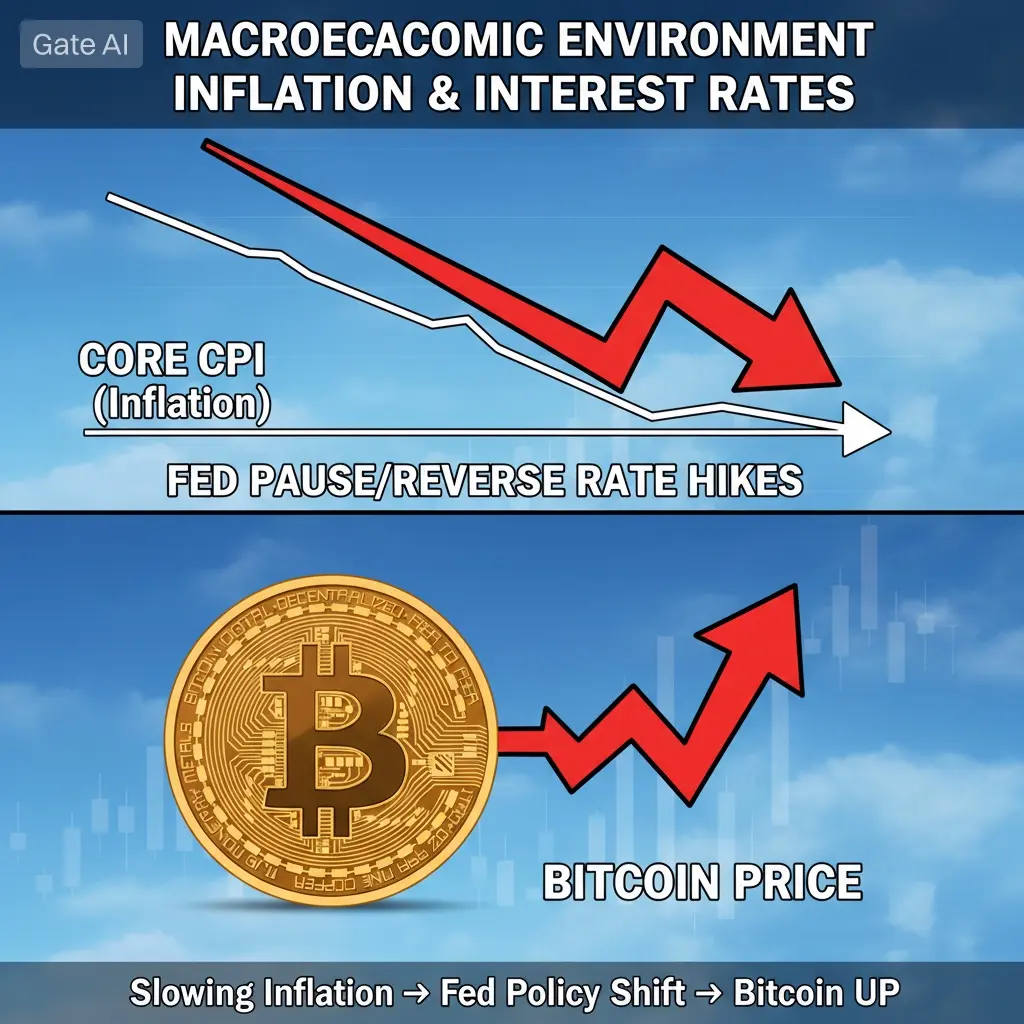

1️⃣ Macroeconomic Environment

Bitcoin is highly sensitive to liquidity conditions. When inflation slows — such as with recent declines in Core CPI — it can influence the policy direction of the Federal Reserve.

If inflation continues to moderate:

Interest rate hike cycles may pause or reverse

Liquidity conditions could gradually improve

Risk assets, including Bitcoin, may benefit

Historically, Bitcoin performs strongly during periods of:

Monetary easing

Expanding liquidity

Weakening U.S. dollar trends

However, if economic growth weakens sharply, volatility may increase

1️⃣ Macroeconomic Environment

Bitcoin is highly sensitive to liquidity conditions. When inflation slows — such as with recent declines in Core CPI — it can influence the policy direction of the Federal Reserve.

If inflation continues to moderate:

Interest rate hike cycles may pause or reverse

Liquidity conditions could gradually improve

Risk assets, including Bitcoin, may benefit

Historically, Bitcoin performs strongly during periods of:

Monetary easing

Expanding liquidity

Weakening U.S. dollar trends

However, if economic growth weakens sharply, volatility may increase

BTC0,23%

- Reward

- 8

- 11

- Repost

- Share

repanzal :

:

1000x VIbes 🤑View More

#What’sNextforBitcoin? Market Outlook & Momentum Check – 2026 Update

Bitcoin has climbed back above $69K following softer U.S. CPI data that eased inflation concerns. This recovery has renewed bullish sentiment — but the key question remains: can BTC sustain this move and break into a new expansion phase, or is more consolidation ahead?

📊 Current Market Pulse

At present, Bitcoin is showing resilience, but remains technically cautious:

BTC trading in the $66K–$70K range

Strong support near $65K

Key resistance at $68K–$70K

Volatility remains elevated amid mixed macro signals

➡ In summary: Bitco

Bitcoin has climbed back above $69K following softer U.S. CPI data that eased inflation concerns. This recovery has renewed bullish sentiment — but the key question remains: can BTC sustain this move and break into a new expansion phase, or is more consolidation ahead?

📊 Current Market Pulse

At present, Bitcoin is showing resilience, but remains technically cautious:

BTC trading in the $66K–$70K range

Strong support near $65K

Key resistance at $68K–$70K

Volatility remains elevated amid mixed macro signals

➡ In summary: Bitco

BTC0,23%

- Reward

- 1

- 1

- Repost

- Share

Nazdej :

:

To The Moon 🌕Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

104.45K Popularity

14.14K Popularity

13.56K Popularity

59.15K Popularity

6.71K Popularity

264.83K Popularity

275.26K Popularity

18.61K Popularity

7.62K Popularity

6.83K Popularity

6.75K Popularity

6.68K Popularity

6.04K Popularity

34.65K Popularity

News

View MoreFidelity Analyst: Crypto Bear Market Bottom May Have Formed, Expecting a New Round of Expansion

1 m

Obama Responds for the First Time to Trump's Prank Video: The "Sense of Shame" and "Courtesy" That Once Restraint American Officials Have Completely Disappeared

11 m

Morgan Stanley is recruiting blockchain and tokenization engineers, working with Ethereum, Polygon, and other blockchains.

16 m

Fast-food chain Steak 'n Shake will pay bonuses to hourly workers in the form of Bitcoin

17 m

Data: 179 BTC transferred from an anonymous address, then routed through a relay before being sent to another anonymous address

19 m

Pin