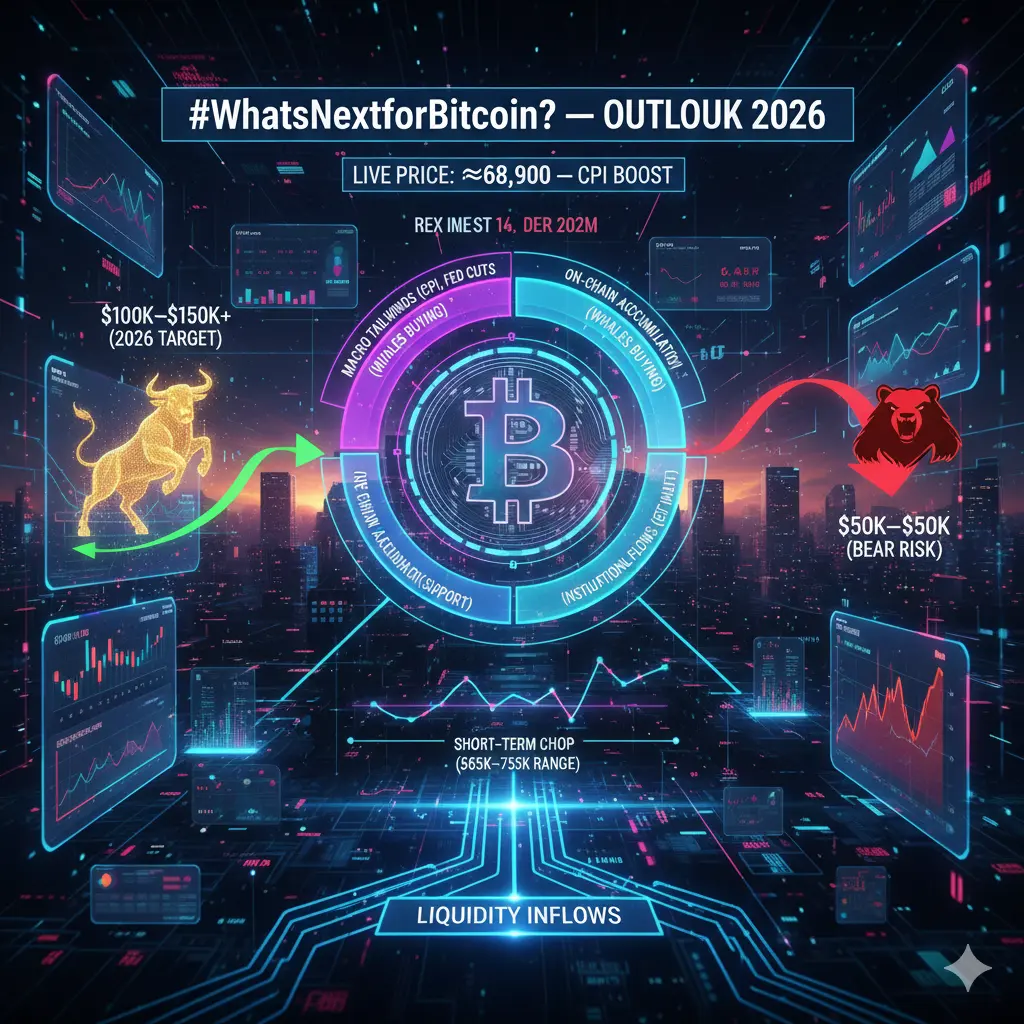

#What’sNextforBitcoin?

Bitcoin (BTC) is currently trading around $68,900–$69,000 (spot ~$68,864–$68,971, futures ~$68,980). After a sharp 40–50% correction from 2025 peaks (above $100k), BTC is showing signs of renewed bullish momentum, climbing +3–5% in recent sessions thanks to easing inflation and the US Core CPI hitting a multi-year low of 2.5%.

1️⃣ Current Market Snapshot & Price Action

Live Price: ~$68,900–$69,000

Recent Lows: $65,800–$66,200 (Feb 12–13), showing strong support at $65k–$67k.

Resistance Levels: $70,000 (psychological), $72,000–$72,500 (Fibonacci 61.8%), $74,000–$75,000 (previous consolidation highs).

Support Levels: $65,000–$67,000 (strong buyer zone; break risks $60k–$63k).

Volume & Liquidity: Spike post-CPI; high futures open interest; stablecoin inflows show active participation.

BTC has bounced from prior lows, testing key resistance. The $70k zone is a psychological barrier, while $65k–$67k is critical support where accumulation is likely. Volume trends confirm active trader involvement and liquidity for continued movement.

2️⃣ Technical Structure & Indicators

Trend: Medium-term bullish — 50-day MA above 200-day MA; short-term is range-bound after recent correction.

RSI: ~68–70 → slightly overbought, suggesting potential consolidation without extreme reversal.

MACD: Bullish crossover indicates upward momentum; watch for divergence in case rally fades.

Fibonacci Retracement: BTC holding 38.2–50% retracement zones from prior swing; maintaining structure signals stability.

The technical setup shows BTC is in a cautiously bullish zone. Breaking $70k signals continuation to higher resistance, while failing could trigger retesting support.

3️⃣ Macro Drivers & Correlations

US Core CPI: 2.5% YoY → Fed expected to cut rates mid-2026. Lower borrowing costs = more liquidity flows into BTC.

USD: Slight weakening → BTC cheaper for global buyers; often inversely correlated.

Bond Yields: Dipping → reduces opportunity cost for non-yielding BTC vs. cash/bonds.

Risk Appetite: Dovish Fed vibes push markets into “risk-on” mode → BTC, ETH, and equities benefit.

Risks: Geopolitics, energy shocks, or sticky jobs data could trigger temporary risk-off.

The macro backdrop is BTC-friendly. Lower rates, weaker USD, and easing inflation create a positive environment for BTC demand and liquidity.

4️⃣ On-Chain Metrics & Network Health

Active Addresses: Rising → indicates growing adoption.

Transaction Volume: Net outflows from exchanges → long-term holding trend.

Whale Behavior: Large wallets accumulating (1,000–100,000 BTC added) → hidden support $67k–$68k.

Exchange Flows: Net outflows dominate → reduced selling pressure, stronger price support.

Hashrate: Stable/rising → network secure, miner confidence intact.

On-chain signals confirm accumulation and network health. Large holders and LTHs are supporting BTC near $67k–$68k, giving confidence to medium-term bulls.

5️⃣ Sentiment Analysis & Investor Behavior

Fear & Greed Index: Shifting from “Extreme Fear” toward neutral/greed.

Long-Term Holders: Accumulating → strong conviction in medium-term upside.

Short-Term Traders: Exploit volatility; FOMO may trigger breakout if $70k holds.

Market Psychology: Post-correction relief + easing inflation → “buy the dip” mindset strengthening.

Investor psychology is cautiously optimistic. Relief rallies, macro tailwinds, and accumulation by LTHs create a favorable sentiment environment for BTC.

6️⃣ Institutional Flows & Global Influence

ETFs/Funds: Rebound inflows as macro is favorable → institutions see BTC as digital gold in low-rate world.

Corporate & Strategic Buyers: Accumulation continues (e.g., MicroStrategy-style) → long-term support.

Retail Influence: Weaker USD and lower borrowing costs stimulate buying globally.

Exchange Dynamics: High-liquidity platforms amplify price efficiency and volume.

Institutions and strategic buyers are providing tailwinds. Global retail buying in USD-weak regions adds upward pressure.

7️⃣ Altcoin & Broader Market Correlation

Ethereum (ETH): ~$2,050, potential $2,200+ in risk-on flows.

Major Alts: SOL, BNB, XRP follow BTC momentum.

Insight: BTC leads the market; altseason potential arises if BTC stabilizes and liquidity flows.

BTC’s movement sets the tone for top altcoins. A stabilized BTC rally often spreads to ETH and other major coins.

8️⃣ Historical Patterns & Cycle Context

Macro Reactions: BTC rallies on disinflation + easing rate expectations

Cycle Insight: Post-2024 halving → steady growth, less explosive than prior cycles, but institutional smoothing is visible.

Support/Resistance Patterns: $65k–$67k repeatedly tested; relief rallies historically last 3–6 months if macro supportive.

Explanation: Past behavior suggests BTC could sustain higher consolidation before next leg, assuming macro tailwinds continue.

9️⃣ Price Projections & Scenarios

Horizon

Target

Key Levels

Notes

Short-Term (1–4 weeks)

$69k–$70k

Support $65k–$67k

Possible minor pullbacks before next leg

Medium-Term (2–6 months)

$72k–$75k+

Resistance $72k–$75k

Supported by Fed cuts, institutional inflows

Bear/Risk

$60k–$63k

Support $60k–$63k

Geopolitical or energy shocks; macro disruptions

BTC is positioned to test $70k, with medium-term bullish potential to $72k–$75k. Risk factors could temporarily drag it toward $60k–$63k.

🔟 Strategic Trading Insights & Takeaways

Risk Management: Stop-losses near $65k–$67k; avoid excessive leverage.

Trading Strategy: Accumulate dips, trade $65k–$75k range; blend short-term tactical moves with long-term holding.

Macro Monitoring: CPI, PCE, Fed minutes, ETF flows, and whale activity guide strategy.

Position Discipline: Small, measured positions preferred due to volatility.

Bottom Line:

Bitcoin, currently at $68,900–$69,000, sits at a pivotal zone. Macro tailwinds (cooling inflation, potential Fed cuts), on-chain accumulation, and technical momentum favor medium-term upside toward $70k–$75k+, but short-term volatility, support at $65k–$67k, and external risks require disciplined trading and risk management.

Bitcoin (BTC) is currently trading around $68,900–$69,000 (spot ~$68,864–$68,971, futures ~$68,980). After a sharp 40–50% correction from 2025 peaks (above $100k), BTC is showing signs of renewed bullish momentum, climbing +3–5% in recent sessions thanks to easing inflation and the US Core CPI hitting a multi-year low of 2.5%.

1️⃣ Current Market Snapshot & Price Action

Live Price: ~$68,900–$69,000

Recent Lows: $65,800–$66,200 (Feb 12–13), showing strong support at $65k–$67k.

Resistance Levels: $70,000 (psychological), $72,000–$72,500 (Fibonacci 61.8%), $74,000–$75,000 (previous consolidation highs).

Support Levels: $65,000–$67,000 (strong buyer zone; break risks $60k–$63k).

Volume & Liquidity: Spike post-CPI; high futures open interest; stablecoin inflows show active participation.

BTC has bounced from prior lows, testing key resistance. The $70k zone is a psychological barrier, while $65k–$67k is critical support where accumulation is likely. Volume trends confirm active trader involvement and liquidity for continued movement.

2️⃣ Technical Structure & Indicators

Trend: Medium-term bullish — 50-day MA above 200-day MA; short-term is range-bound after recent correction.

RSI: ~68–70 → slightly overbought, suggesting potential consolidation without extreme reversal.

MACD: Bullish crossover indicates upward momentum; watch for divergence in case rally fades.

Fibonacci Retracement: BTC holding 38.2–50% retracement zones from prior swing; maintaining structure signals stability.

The technical setup shows BTC is in a cautiously bullish zone. Breaking $70k signals continuation to higher resistance, while failing could trigger retesting support.

3️⃣ Macro Drivers & Correlations

US Core CPI: 2.5% YoY → Fed expected to cut rates mid-2026. Lower borrowing costs = more liquidity flows into BTC.

USD: Slight weakening → BTC cheaper for global buyers; often inversely correlated.

Bond Yields: Dipping → reduces opportunity cost for non-yielding BTC vs. cash/bonds.

Risk Appetite: Dovish Fed vibes push markets into “risk-on” mode → BTC, ETH, and equities benefit.

Risks: Geopolitics, energy shocks, or sticky jobs data could trigger temporary risk-off.

The macro backdrop is BTC-friendly. Lower rates, weaker USD, and easing inflation create a positive environment for BTC demand and liquidity.

4️⃣ On-Chain Metrics & Network Health

Active Addresses: Rising → indicates growing adoption.

Transaction Volume: Net outflows from exchanges → long-term holding trend.

Whale Behavior: Large wallets accumulating (1,000–100,000 BTC added) → hidden support $67k–$68k.

Exchange Flows: Net outflows dominate → reduced selling pressure, stronger price support.

Hashrate: Stable/rising → network secure, miner confidence intact.

On-chain signals confirm accumulation and network health. Large holders and LTHs are supporting BTC near $67k–$68k, giving confidence to medium-term bulls.

5️⃣ Sentiment Analysis & Investor Behavior

Fear & Greed Index: Shifting from “Extreme Fear” toward neutral/greed.

Long-Term Holders: Accumulating → strong conviction in medium-term upside.

Short-Term Traders: Exploit volatility; FOMO may trigger breakout if $70k holds.

Market Psychology: Post-correction relief + easing inflation → “buy the dip” mindset strengthening.

Investor psychology is cautiously optimistic. Relief rallies, macro tailwinds, and accumulation by LTHs create a favorable sentiment environment for BTC.

6️⃣ Institutional Flows & Global Influence

ETFs/Funds: Rebound inflows as macro is favorable → institutions see BTC as digital gold in low-rate world.

Corporate & Strategic Buyers: Accumulation continues (e.g., MicroStrategy-style) → long-term support.

Retail Influence: Weaker USD and lower borrowing costs stimulate buying globally.

Exchange Dynamics: High-liquidity platforms amplify price efficiency and volume.

Institutions and strategic buyers are providing tailwinds. Global retail buying in USD-weak regions adds upward pressure.

7️⃣ Altcoin & Broader Market Correlation

Ethereum (ETH): ~$2,050, potential $2,200+ in risk-on flows.

Major Alts: SOL, BNB, XRP follow BTC momentum.

Insight: BTC leads the market; altseason potential arises if BTC stabilizes and liquidity flows.

BTC’s movement sets the tone for top altcoins. A stabilized BTC rally often spreads to ETH and other major coins.

8️⃣ Historical Patterns & Cycle Context

Macro Reactions: BTC rallies on disinflation + easing rate expectations

Cycle Insight: Post-2024 halving → steady growth, less explosive than prior cycles, but institutional smoothing is visible.

Support/Resistance Patterns: $65k–$67k repeatedly tested; relief rallies historically last 3–6 months if macro supportive.

Explanation: Past behavior suggests BTC could sustain higher consolidation before next leg, assuming macro tailwinds continue.

9️⃣ Price Projections & Scenarios

Horizon

Target

Key Levels

Notes

Short-Term (1–4 weeks)

$69k–$70k

Support $65k–$67k

Possible minor pullbacks before next leg

Medium-Term (2–6 months)

$72k–$75k+

Resistance $72k–$75k

Supported by Fed cuts, institutional inflows

Bear/Risk

$60k–$63k

Support $60k–$63k

Geopolitical or energy shocks; macro disruptions

BTC is positioned to test $70k, with medium-term bullish potential to $72k–$75k. Risk factors could temporarily drag it toward $60k–$63k.

🔟 Strategic Trading Insights & Takeaways

Risk Management: Stop-losses near $65k–$67k; avoid excessive leverage.

Trading Strategy: Accumulate dips, trade $65k–$75k range; blend short-term tactical moves with long-term holding.

Macro Monitoring: CPI, PCE, Fed minutes, ETF flows, and whale activity guide strategy.

Position Discipline: Small, measured positions preferred due to volatility.

Bottom Line:

Bitcoin, currently at $68,900–$69,000, sits at a pivotal zone. Macro tailwinds (cooling inflation, potential Fed cuts), on-chain accumulation, and technical momentum favor medium-term upside toward $70k–$75k+, but short-term volatility, support at $65k–$67k, and external risks require disciplined trading and risk management.