# YiLihuaExitsPositions

2.43K

HighAmbition

#YiLihuaExitsPositions

#YiLihuaExitsPositions 🚨

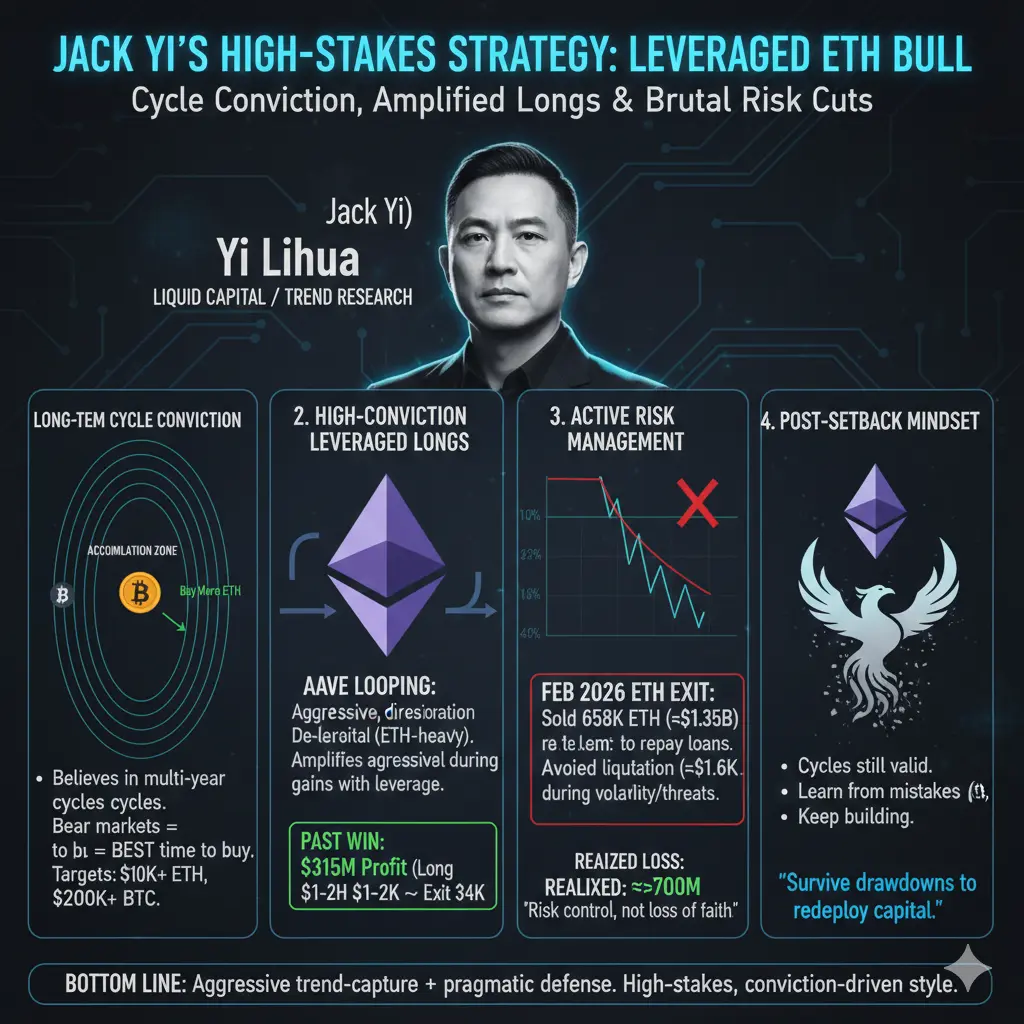

Yi Lihua (Jack Yi), founder of Trend Research and former LD Capital, has fully exited his massive Ethereum (ETH) positions — a move watched closely in crypto circles. Here’s what happened in simple terms:

1️⃣ What “Exiting Positions” Means

Selling or closing your trade to lock in profits or cut losses.

Yi’s team had a leveraged long on ETH (~658K ETH, $2B+ value).

Exit = swapped ETH → USDT, repaid loans, sold almost everything.

2️⃣ Why He Exited

ETH price crashed from ~$3,386 → ~$1,750–$1,820.

Leverage risk: potential forced liquidation.

Tactic

#YiLihuaExitsPositions 🚨

Yi Lihua (Jack Yi), founder of Trend Research and former LD Capital, has fully exited his massive Ethereum (ETH) positions — a move watched closely in crypto circles. Here’s what happened in simple terms:

1️⃣ What “Exiting Positions” Means

Selling or closing your trade to lock in profits or cut losses.

Yi’s team had a leveraged long on ETH (~658K ETH, $2B+ value).

Exit = swapped ETH → USDT, repaid loans, sold almost everything.

2️⃣ Why He Exited

ETH price crashed from ~$3,386 → ~$1,750–$1,820.

Leverage risk: potential forced liquidation.

Tactic

- Reward

- 8

- 13

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

2026 Go Go Go 👊View More

# YiLihuaExitsPositions

The crypto market is once again proving that even the biggest investors must adapt quickly. Recent

reports show that renowned crypto investor Yi

Lihua, founder of Liquid Capital, exited his position in the Aster

project after triggering a stop-loss due to governance concerns — specifically,

the team was unable to contact the project’s founder.

⚠️ Why This Matters:

Large investors rarely abandon positions without strong reasons. Governance

risk — not just price — can be a major red flag in Web3 projects.

💡 Strategic Shift:

Following the exit, Yi signaled a stronger fo

The crypto market is once again proving that even the biggest investors must adapt quickly. Recent

reports show that renowned crypto investor Yi

Lihua, founder of Liquid Capital, exited his position in the Aster

project after triggering a stop-loss due to governance concerns — specifically,

the team was unable to contact the project’s founder.

⚠️ Why This Matters:

Large investors rarely abandon positions without strong reasons. Governance

risk — not just price — can be a major red flag in Web3 projects.

💡 Strategic Shift:

Following the exit, Yi signaled a stronger fo

- Reward

- like

- Comment

- Repost

- Share

#YiLihuaExitsPositions

The recent exit of Yi Lihua from significant cryptocurrency positions has created ripples throughout the market, emphasizing the influence of major institutional flows on price behavior and market sentiment. Large-scale exits from prominent investors serve as both a direct source of selling pressure and an indirect psychological signal for retail and professional participants alike. In this case, Bitcoin and other major assets reacted with immediate volatility, reflecting a combination of forced liquidations, short-term panic selling, and reactive buying from opportunis

The recent exit of Yi Lihua from significant cryptocurrency positions has created ripples throughout the market, emphasizing the influence of major institutional flows on price behavior and market sentiment. Large-scale exits from prominent investors serve as both a direct source of selling pressure and an indirect psychological signal for retail and professional participants alike. In this case, Bitcoin and other major assets reacted with immediate volatility, reflecting a combination of forced liquidations, short-term panic selling, and reactive buying from opportunis

BTC1,29%

- Reward

- 5

- 6

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

New Year Wealth Explosion 🤑View More

# YiLihuaExitsPositions

The crypto market is once again proving that even the biggest investors must adapt quickly. Recent

reports show that renowned crypto investor Yi

Lihua, founder of Liquid Capital, exited his position in the Aster

project after triggering a stop-loss due to governance concerns — specifically,

the team was unable to contact the project’s founder.

⚠️ Why This Matters:

Large investors rarely abandon positions without strong reasons. Governance

risk — not just price — can be a major red flag in Web3 projects.

💡 Strategic Shift:

Following the exit, Yi signaled a stronger fo

The crypto market is once again proving that even the biggest investors must adapt quickly. Recent

reports show that renowned crypto investor Yi

Lihua, founder of Liquid Capital, exited his position in the Aster

project after triggering a stop-loss due to governance concerns — specifically,

the team was unable to contact the project’s founder.

⚠️ Why This Matters:

Large investors rarely abandon positions without strong reasons. Governance

risk — not just price — can be a major red flag in Web3 projects.

💡 Strategic Shift:

Following the exit, Yi signaled a stronger fo

- Reward

- 1

- Comment

- Repost

- Share

⚠️ #YiLihuaExitsPositions

Breaking: Yi Lihua has reportedly exited some of their positions, sparking market attention. Traders are now watching BTC and other major coins closely for potential volatility.

🔍 Market Insight:

Sudden exits from large holders can cause short-term price fluctuations.

Watch key support and resistance levels to gauge market reaction.

Risk management is essential during periods of high activity from whales.

💡 Tip: Stay alert, avoid panic selling, and focus on strategic entry points.

#YiLihuaExitsPositions #CryptoNews #BTC #Bitcoin #Gateio

Breaking: Yi Lihua has reportedly exited some of their positions, sparking market attention. Traders are now watching BTC and other major coins closely for potential volatility.

🔍 Market Insight:

Sudden exits from large holders can cause short-term price fluctuations.

Watch key support and resistance levels to gauge market reaction.

Risk management is essential during periods of high activity from whales.

💡 Tip: Stay alert, avoid panic selling, and focus on strategic entry points.

#YiLihuaExitsPositions #CryptoNews #BTC #Bitcoin #Gateio

BTC1,29%

- Reward

- 4

- 9

- Repost

- Share

MrKing :

:

1000x VIbes 🤑View More

#YiLihuaExitsPositions

News of Yi Lihua exiting positions has quickly circulated across crypto circles, triggering a familiar wave of speculation, caution, and narrative-driven reactions. Whenever a well-known market participant adjusts or closes positions, the market rarely stays neutral. Some interpret it as a warning sign, others see it as routine portfolio management. The truth, as always, lies somewhere in between and understanding context matters far more than reacting to headlines.

At this stage of the cycle, exits from prominent figures often reflect risk management rather than outri

News of Yi Lihua exiting positions has quickly circulated across crypto circles, triggering a familiar wave of speculation, caution, and narrative-driven reactions. Whenever a well-known market participant adjusts or closes positions, the market rarely stays neutral. Some interpret it as a warning sign, others see it as routine portfolio management. The truth, as always, lies somewhere in between and understanding context matters far more than reacting to headlines.

At this stage of the cycle, exits from prominent figures often reflect risk management rather than outri

- Reward

- 2

- 3

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

Day 14 · Build Your "Asset Filter": Lock in Three Key Signals Among Thousands of Coins

Good morning, focused hunters.

This is #币圈100天成长计划 Day 14/100.

🌊 The market every day produces countless new codes, narratives, and hot topics. Chasing every "possibility" will quickly dilute your energy and capital.

The real dilemma is often not "having no options," but having too many.

What you need is not just research ability, but a **ruthless filtering system** that can eliminate 99% of the noise before it even reaches your radar.

💎 Today's Build: Three-Layer Funnel Filtering Method

From now on, any

Good morning, focused hunters.

This is #币圈100天成长计划 Day 14/100.

🌊 The market every day produces countless new codes, narratives, and hot topics. Chasing every "possibility" will quickly dilute your energy and capital.

The real dilemma is often not "having no options," but having too many.

What you need is not just research ability, but a **ruthless filtering system** that can eliminate 99% of the noise before it even reaches your radar.

💎 Today's Build: Three-Layer Funnel Filtering Method

From now on, any

BTC1,29%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

12:00 First Analysis: Yesterday, Bitcoin and ETH spot minute charts experienced abnormal fluctuations, possibly caused by a liquidation event of a market-making bot.

BlockBeats reports that on February 9, Wintermute founder Evgeny Gaevoy analyzed the abnormal volatility in Bitcoin and ETH spot 1-minute charts on the early morning of February 8. He stated that it was very likely due to a market-making bot experiencing a liquidation, with losses possibly reaching tens of millions of dollars. The abnormal fluctuations were caused by losses from the bot, not malicious actions by market makers, a

BlockBeats reports that on February 9, Wintermute founder Evgeny Gaevoy analyzed the abnormal volatility in Bitcoin and ETH spot 1-minute charts on the early morning of February 8. He stated that it was very likely due to a market-making bot experiencing a liquidation, with losses possibly reaching tens of millions of dollars. The abnormal fluctuations were caused by losses from the bot, not malicious actions by market makers, a

ETH-0,54%

- Reward

- like

- Comment

- Repost

- Share

$BTC $SOL $BNB

It has dropped, interested ones! Currently, you can continue building your position and extend the timeline! We're considering the rise and fall, right? Keep adding to your spot holdings! Prioritize stability. #易理华割肉清仓 , look at the big players who have already fully sold off; will it still drop? No worries, if it drops, I'll come back to call the shots! Spot trading will eventually be profitable, no need to worry 👌🏻OCS12VQA

View OriginalIt has dropped, interested ones! Currently, you can continue building your position and extend the timeline! We're considering the rise and fall, right? Keep adding to your spot holdings! Prioritize stability. #易理华割肉清仓 , look at the big players who have already fully sold off; will it still drop? No worries, if it drops, I'll come back to call the shots! Spot trading will eventually be profitable, no need to worry 👌🏻OCS12VQA

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

178.65K Popularity

39.18K Popularity

2.43K Popularity

12.87K Popularity

3.79K Popularity

1.78K Popularity

1.51K Popularity

225 Popularity

1.52K Popularity

804 Popularity

609 Popularity

574 Popularity

70.56K Popularity

17.03K Popularity

36.93K Popularity

News

View MoreStory Lianchuang Defends Token Unlock Delay, Says the Project Needs "More Time"

4 m

OSL HK becomes Hong Kong's first exchange to list RLUSD

12 m

Tether is aggressively buying gold: $23 billion in reserves ranks in the top 30 globally, outpacing many central banks.

27 m

Elon Musk once again unveils the "Moon City" blueprint: SpaceX aims to build a self-sustaining base within 10 years

32 m

AINFT user base has exceeded 19,000 and continues to grow steadily.

34 m

Pin