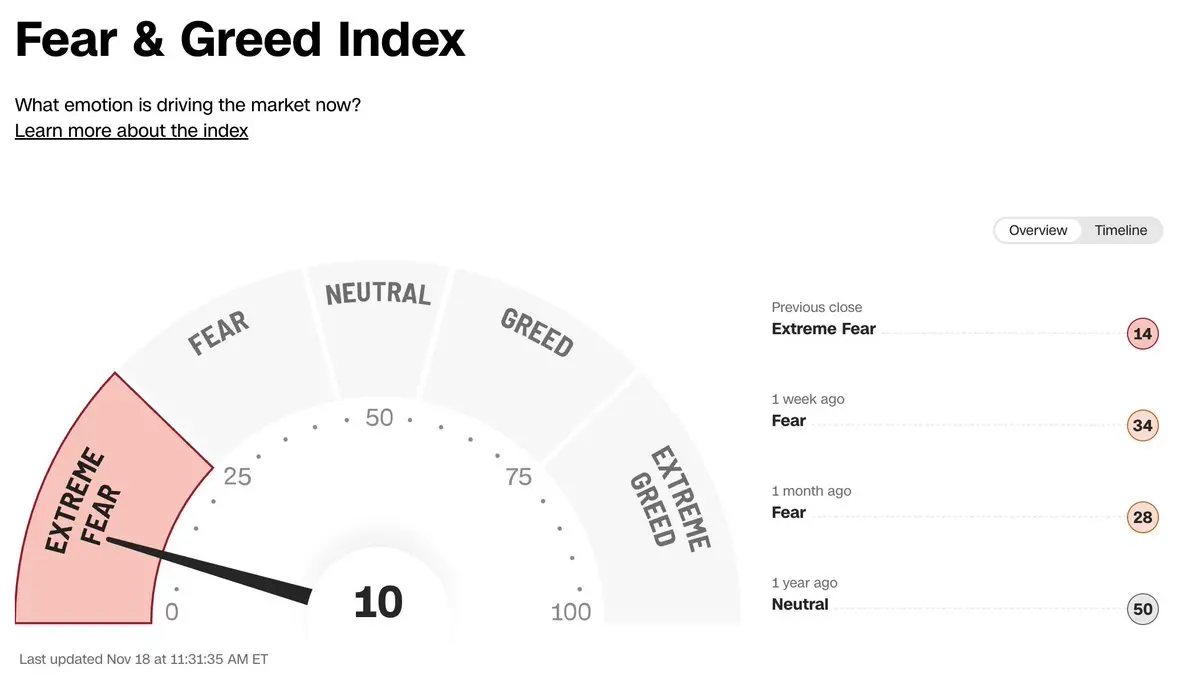

別人恐懼,我貪婪,合理倉位管理的優勢來了

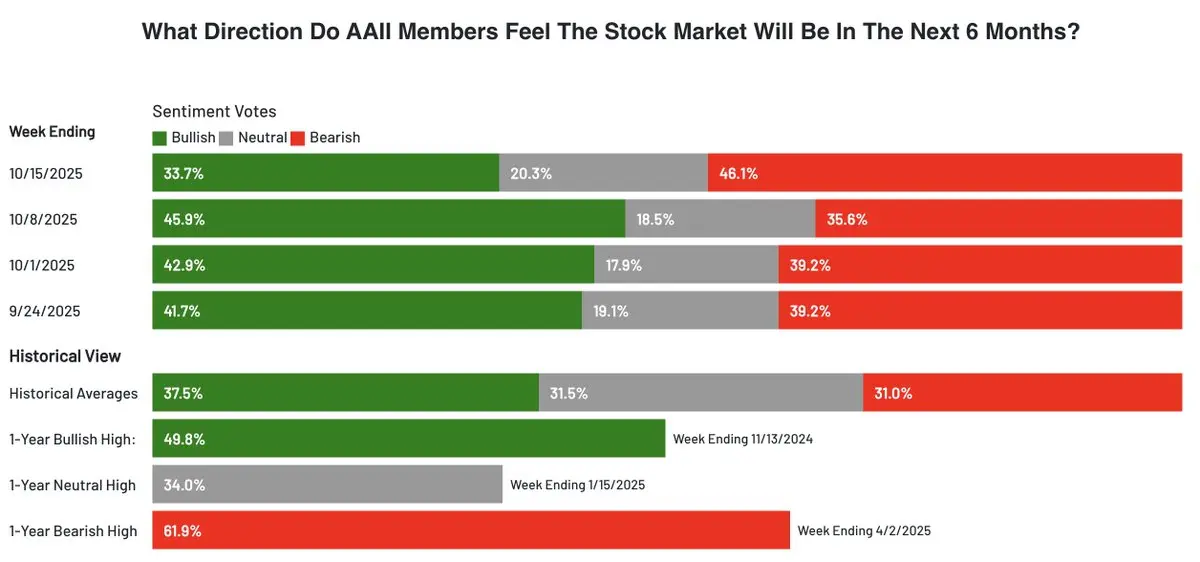

優質美股,雙十一打折,可以隨便挑選;

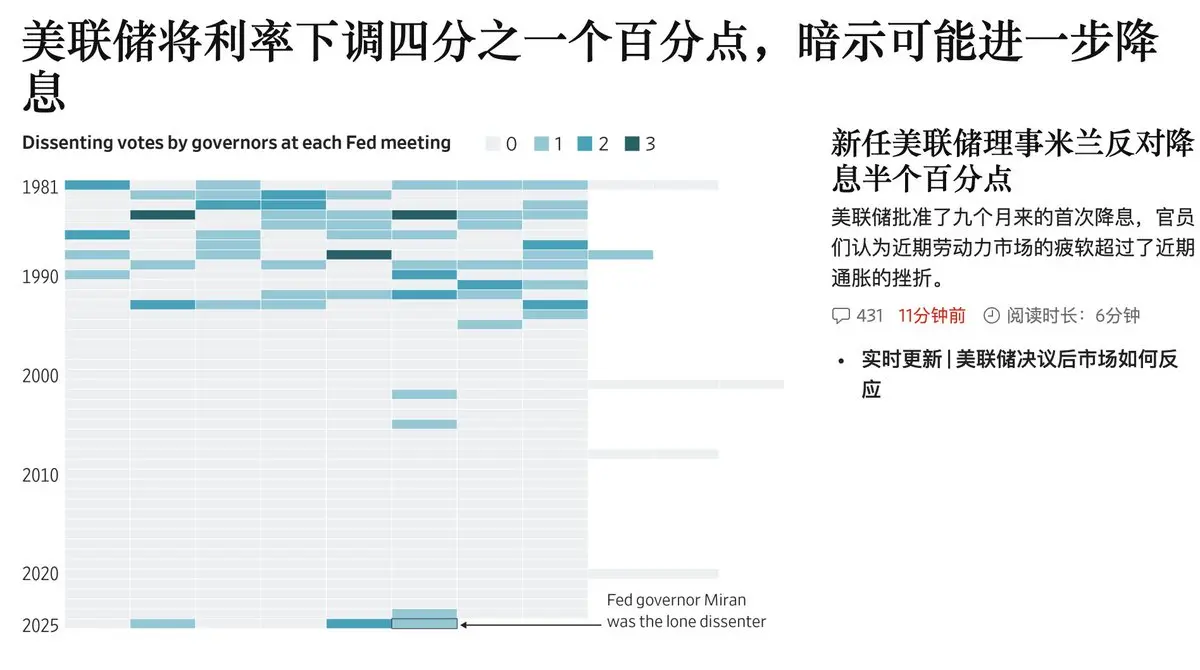

AI是美國的國運所在,你說川普救不救?

加倉了 $NVDA 184.5, $TSLA 398, $TSM 280;

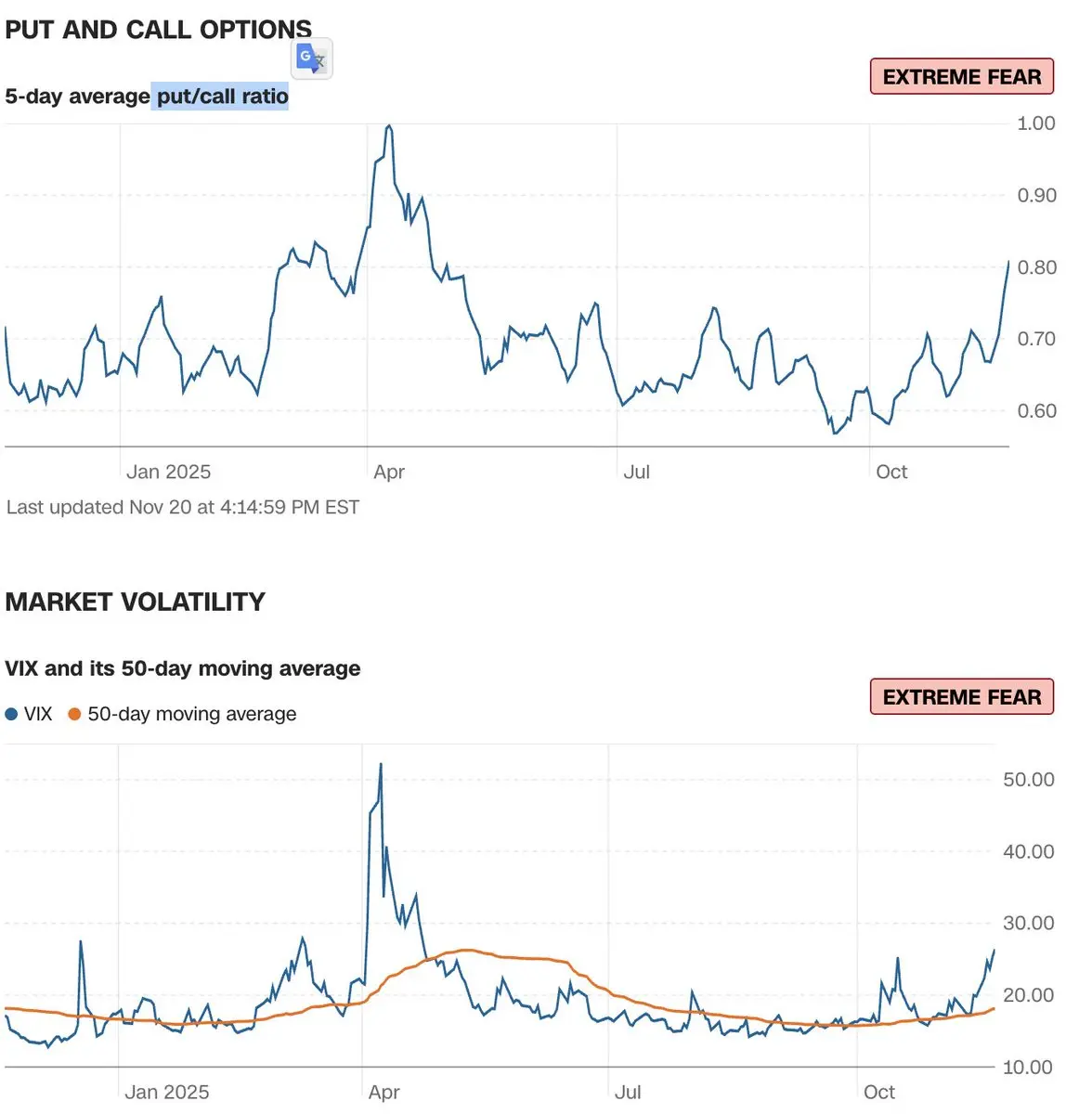

VIX目前21.3,確保自己VIX到30時,還有倉位可以加。

When others are fearful, I’m greedy — this is where position management shows its advantage.

High-quality stocks are on discount sale — take your pick.

AI represents America’s national destiny — do you think Trump will let it fail?

Just added positions in $NVDA at 184.5, $TSLA at 398, and $TSM at 280.

With the VIX at 21.3 right now, make sure you still have room to add more when it hits 30.

查看原文優質美股,雙十一打折,可以隨便挑選;

AI是美國的國運所在,你說川普救不救?

加倉了 $NVDA 184.5, $TSLA 398, $TSM 280;

VIX目前21.3,確保自己VIX到30時,還有倉位可以加。

When others are fearful, I’m greedy — this is where position management shows its advantage.

High-quality stocks are on discount sale — take your pick.

AI represents America’s national destiny — do you think Trump will let it fail?

Just added positions in $NVDA at 184.5, $TSLA at 398, and $TSM at 280.

With the VIX at 21.3 right now, make sure you still have room to add more when it hits 30.